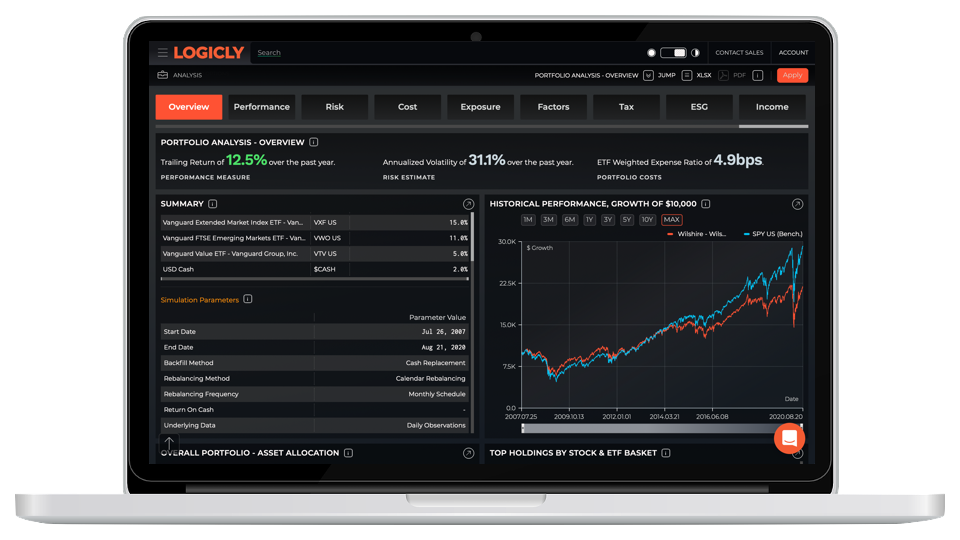

CORE - Portfolio Analysis

Better analysis. Better investment decisions.

Behind every investment decision should be thorough research and analysis. Reviewing portfolio metrics like performance, risk, costs, factors, ESG is important in understanding if an investment is suitable for a client.

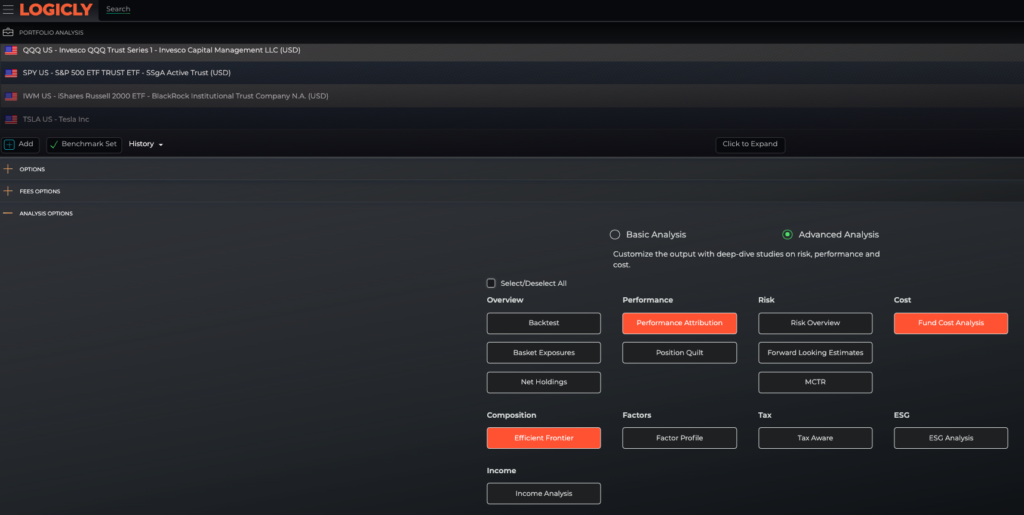

LOGICLY CORE – Portfolio Analysis gives you institutional-caliber analytics and the ability to create customized simulations for clients across a broad array of portfolio characteristics. You can use trading history, rebalancing, return on cash, and even use fee overlays to represent portfolio outcomes inclusive of your fees.

Fast, deep-dive analytics to power investment strategies and selection.

Lift the hood on a fund’s marketing materials to see what’s really happening. CORE – Portfolio Analysis from LOGICLY puts at your fingertips investment data and analytics that was once only available to institutions. We level the playing field by giving you access to analysis including:

- Performance Attribution

- Risk metrics and MCTR

- ESG

- Efficient Frontier to optimize portfolios

- Tax awareness for tax-sensitive adjustments

- Income, dividend and interest yields

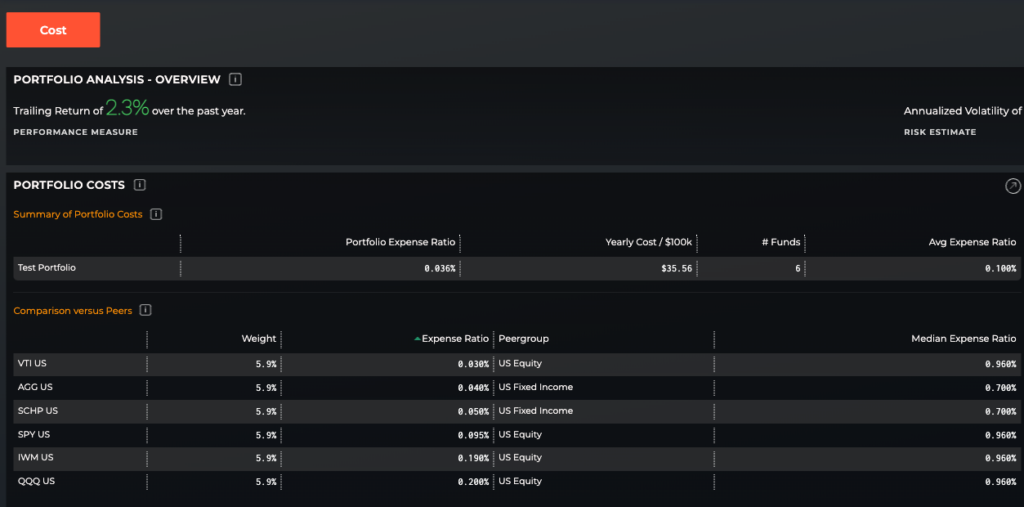

Pay the right price.

Fees are just as important a consideration as returns when choosing investments. Fund fees can quietly erode performance. Analyzing a portfolio to identify funds with higher costs, and potential replacement options, gives you a competitive advantage.

And sometimes, the cheapest option isn’t the best choice for a client. With CORE – Portfolio Analysis, you can quickly analyze current fund holdings and costs, and compare against potential replacement funds to guide clients in making the most suitable decision.