Build and Manage Portfolios

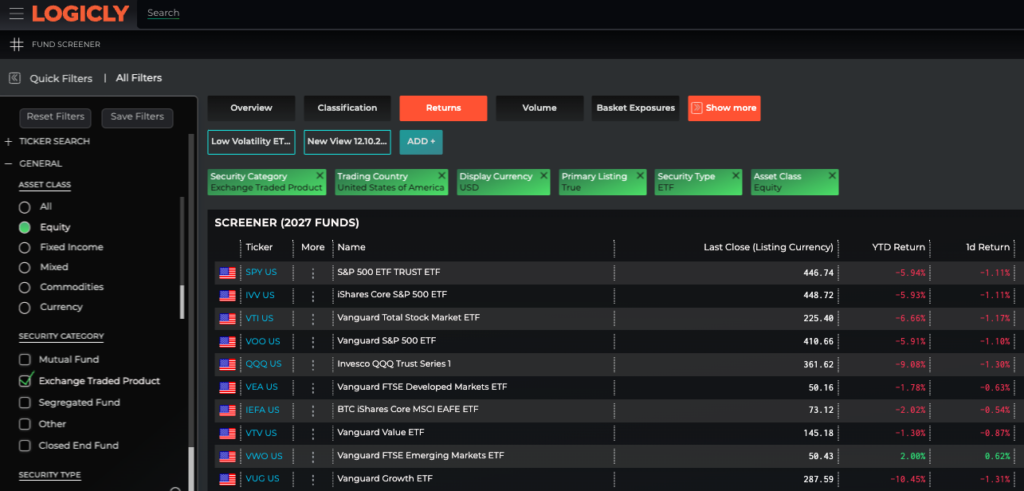

Good portfolio construction starts with good investment screening.

With a few clicks, you can quickly filter the complete universe of global ETFs and mutual funds to find the most suitable ideas for your clients. LOGICLY puts you in the Portfolio Manager’s chair with our easy-to-use Fund Screener tools.

Advisors like you can access our industry-leading ETF and fund screening tools, and actionable institutional-caliber data, research and analytics. Using LOGICLY significantly reduces time spent on finding new investment ideas for clients.

Time = money.

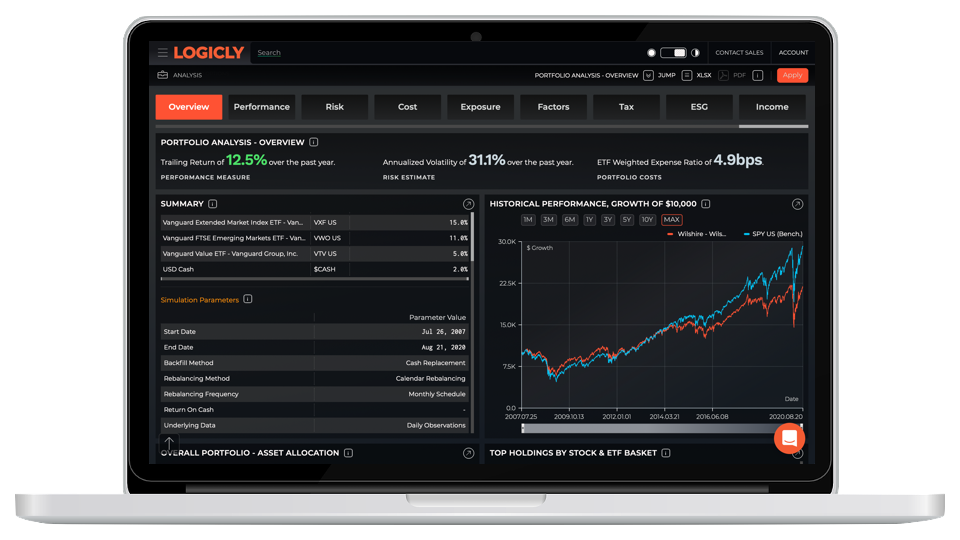

And continues with rigorous analysis.

Once you’ve narrowed down a list of choices for your clients, it’s time to analyze key portfolio metrics like performance, risk, costs, factors, and ESG further homes in on the most suitable choices for clients.

Portfolio Analysis from LOGICLY streamlines portfolio construction by giving you point-and-click access to institutional-caliber analytics. Improve investment decision-making with clients by perform a wide array of analysis, including:

- Risk metrics (Marginal Contribution to Risk)

- Performance Attribution

- ESG (Environmental, Social, Governance)

- Efficient Frontier for portfolio optimization

- Income analysis for dividends and interest yields

- Tax smart trading and rebalancing

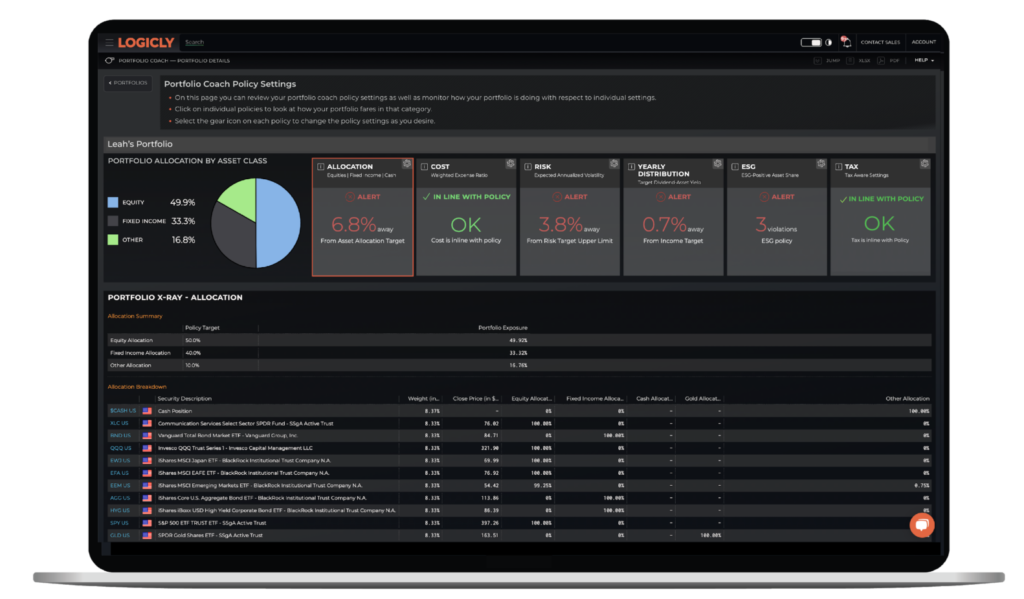

AI for advisors. Beat the bots and add value.

Finding and implementing portfolios for clients is just the starting point. The real value is how you guide clients through up and down markets and ensure their portfolios to stay on track with their IPS.

Portfolio Coach from LOGICLY simplifies, streamlines, and automates portfolio management. It’s a personal AI for each household you advise that also captures details and notes of conversations and decisions. With Portfolio Coach, you can do more, faster.

- Real-time monitoring and alerting that increases client touchpoints

- Custom benchmarking and direct indexing

- Portfolio alerts for ESG and more

- Tax-smart portfolio rebalancing

- Active trade ideas

- Link IPS to client accounts at custodian