By: Andrew Unthank

“Price is what you pay. Value is what you get.” – Warren Buffet

As the second half of 2023 is underway, we are having quite the year in the market across the board. Remarkably, the first half of the year has seen steady growth across various indexes: the S&P 500 has risen by 16.89% YTD, the Nasdaq has increased by 42.28% YTD, the Dow Jones has improved by 4.11% YTD, and the traditional 60/40 asset allocation portfolio has made gains of 11% YTD.

Much of this growth can be attributed to solid equity returns, while fixed income is showing modest positive performance at this halfway point.

This year’s market performance has surprised many in the financial services industry. A fair number of investors had anticipated a recession in 2023 after a difficult 2022 for the financial markets and had positioned themselves accordingly.

The reasoning behind these predictions was not unfounded, with geopolitical events like Russia’s invasion of Ukraine, central banks worldwide raising interest rates to control inflation, and political turmoil such as the crisis in the UK Government leading to instability in the GILT Market.

However, in the face of these challenges, the market has shown resilience, with a performance that has defied these early predictions.

The M&A Balancing Act

Despite the roller coaster ride that marked 2022, the market has displayed remarkable tenacity. This tenacity has triggered a strong bounce-back in asset valuations from the end of 2022 through to the current point of July 2023. The swift revival in asset valuations has necessitated abrupt strategy shifts by many investment firms and managers, who found their market positions misaligned.

Simultaneously, numerous investment firms, particularly in the RIA and wealth management sectors, are engaged in M&A activities. These firms are striving to identify valuable opportunities that align with their unique circumstances.

This task is further complicated by managing portfolio rebalances that may be misaligned with the market at a time when there is intense competition to sell firms to the highest bidder and maximize the value of the assets on their balance sheets.

This balancing act can prove challenging, especially when assets within an investment firm’s portfolio may be deemed overvalued by the potential acquirer. Firms looking to acquire are focused on securing favorable deals and avoiding overpayment for assets.

RIA M&A in the Face of ‘Irrational Exuberance’

Given the swift surge in interest rates, it’s understandable that firms on the acquisition trail are becoming increasingly discerning about the assets and businesses they choose to acquire. Yet, within the arena of financial market valuations, assets can occasionally be subject to what might be termed irrational exuberance, and the RIA M&A market has indeed shown signs of this in recent years.

As Fidelity recently highlighted, while valuations in RIA M&A transactions may be leveling off, the pace of acquisitions shows no signs of decelerating.

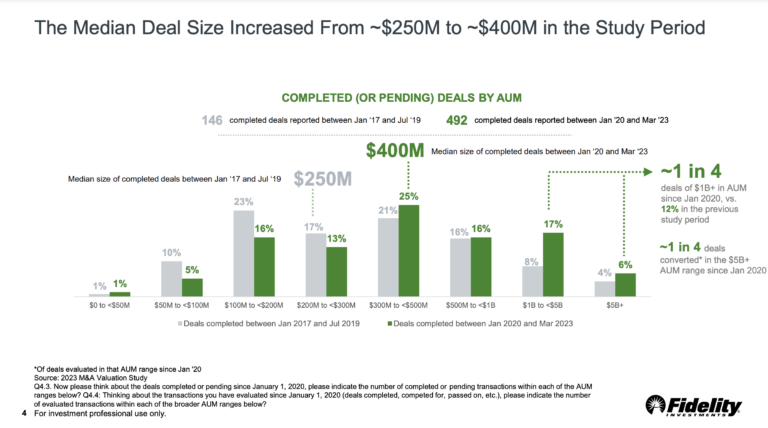

According to Fidelity’s report, there has been a significant increase in the median size of RIA M&A deals. Comparing the period between January 2020 and March 2023 to the pre-pandemic era (January 2017 to July 2019), the median size has risen from $250 million to $400 million. During the pre-pandemic period, the average size of RIA M&A deals averaged at $250 million.

Interestingly, we can see that from January 2020 to March 2023, 64% of the finalized deals had an AUM exceeding $400 million, with 23% of these deals surpassing $1 billion in AUM. This underscores a clear trend of diminishing M&A opportunities for RIA firms managing AUM below $300 million, while at the same time, deals are increasing for those managing assets above $300 million.

When this reduction in deal volume for small to mid-sized RIAs is paired with heightened market volatility, which in turn affects portfolio asset valuations, it creates a challenging scenario. This could potentially lead to a decline, or in the worst-case scenario, the disappearance of smaller to medium-sized RIA firms.

Top of the Pyramid: The ‘Haves and Have-Nots’ of the RIA Landscape

A recent article from RIA Intel, echoing sentiments from Fidelity’s report, highlighted that there’s a significant concentration at the top of the RIA AUM pyramid. An astonishing 88.1% of investment advisors operate on a smaller scale, employing 50 or fewer employees and operating from only one or two offices.

However, it’s the largest firms that command the majority of the wealth. The article quotes John Furey, Managing Partner of Advisor Growth Strategies, saying that the industry has, in broad terms, split into “haves and have-nots.” Furey also emphasizes the necessity for smaller, growth-oriented firms to implement practical measures to stay competitive and foster continuous growth.

Key M&A Trends in 2023: Selectivity, Speed, and Collaboration

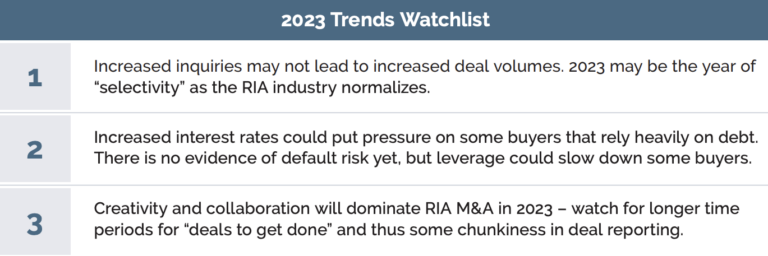

In the 2023 report from Advisor Growth Strategies, it is noted that there are three critical aspects that both buyers and sellers should consider during negotiations.

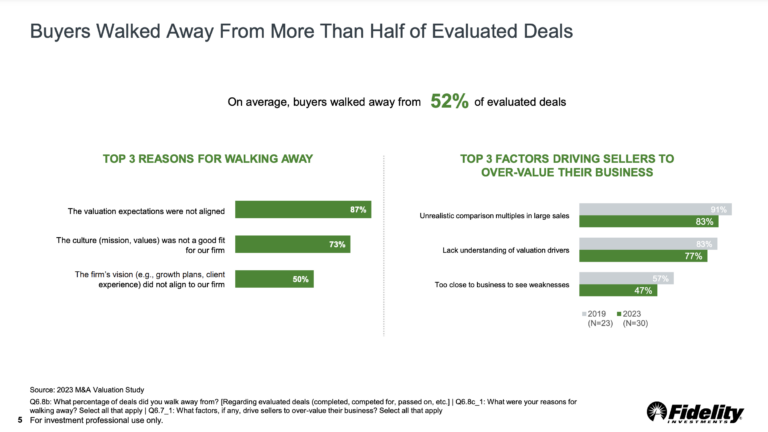

The first trend highlighted is that 2023 is leaning towards more selective acquisitions compared to previous years. This is supported by data from Fidelity’s M&A Valuations Study conducted in June of this year, which reveals that buyers demonstrated a willingness to withdraw from transactions with inflated valuation prices 52% of the time.

The second theme in the report addresses how rising interest rates have the potential to hinder deal transactions. Interestingly, Fidelity’s data suggests that despite heightened market volatility since March 2020, the average time to finalize a deal has actually shortened.

In this environment of expedited M&A transactions and higher interest rates, due diligence becomes critical for acquiring firms. It is imperative to ensure that their goals and values are in sync with those of the firms they are acquiring.

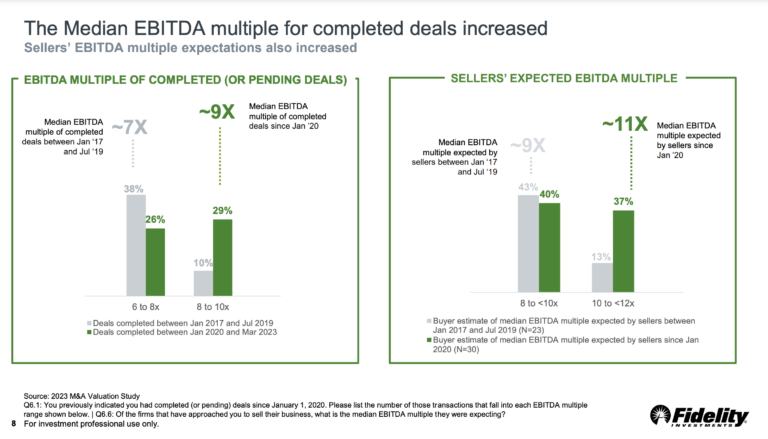

The third theme underscores the necessity for innovation and cooperation between buyers and sellers to successfully finalize deals. As collaboration continues to shape RIA M&A activity, it’s worth noting that the median EBITDA multiple has seen an upward trend since the dawn of the 2020 decade.

The average EBITDA multiple on completed deals has escalated to 9x, while sellers are setting their sights on a multiple of 11x EBITDA during the same period.

Laura Delaney, Vice President of Practice Management and Consulting at Fidelity, recently pointed out that while the price has surged by two turns, or 200%, the multiples for high-quality firms are beginning to level off.

Delaney also highlights that not all firms are evaluated in the same way. Those RIA firms facing potential challenges, such as the absence of a leadership succession plan, lack of a robust management team, or over-reliance on a single large client, tend to attract lower offers.

This is logical, considering that, as per Fidelity, a deficiency in succession planning accounts for 40% of the factors spurring seller interest in the M&A space.

Shaping the Future: The Importance of Value over Cost in the RIA Space

Regardless of whether an RIA firm is considering selling or making acquisitions, understanding the landscape and the underlying dynamics is crucial. Such knowledge equips firms to seize opportunities as they arise and ensures that they act appropriately to provide and receive the right value.

Here at LOGICLY, we believe in changing the conversation from the cost of advice to the value of advice. We acknowledge that consolidation within the RIA space isn’t just continuing; it’s accelerating. This is supported by the fact that over 76% of average selling firms have an owner aged 57 or older.

This underlines the reality that, regardless of your firm’s current stage, assets are in motion. If you’re not in a position to acquire new assets and grow your business, enhancing its value, there could well be someone else—or another firm—that sees your business as an asset they’d like to acquire, provided the price is right.

Enjoy reading this article? Other content you may find interesting:

- How to Navigate the Complexities of Tax Loss Harvesting

- 5 Must Know Strategies for Mastering Tax Season

- Solving the Challenges of Regulatory Compliance for Advisors

- ETFs and Volatile Markets

- 5 Ways to Implement ESG Investing into Your Practice

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

To connect about media inquiries or to discuss the article, please email Andrew Unthank at: andrew.unthank@thinklogicly.com

Think LOGICLY.