By: Dounya Hamdan

dounya.hamdan@thinklogicly.com

Tax season can be a dreaded time of year for many individuals. The thought of sifting through paperwork, gathering documents, and filling out forms can be overwhelming and stressful.

However, as a financial advisor, you have the opportunity to alleviate some of your clients’ anxieties by providing them with the knowledge and tools to stay organized and prepared.

By implementing effective tax planning strategies, you can help your clients maximize their tax benefits and minimize their tax burdens, ensuring a smoother route to achieving their financial goals.

This article outlines five key strategies that you can use to help your clients stay organized during tax season and take control of their finances. From encouraging them to gather all necessary documents to educating them on the latest tax laws and regulations, these strategies will enable you to add value to your clients beyond just compliance.

Key Strategies for Mastering Tax Season

Setting the Foundation for a Stress-Free Tax Season

As a financial advisor, it’s crucial to emphasize to your clients the importance of starting early and staying organized when it comes to tax season. By encouraging your clients to gather all necessary documents as soon as they become available, you can help them avoid the rush and stress that often comes with last-minute scrambling.

One effective way to help your clients stay organized is to recommend a designated folder or online storage system to keep all their tax documents in one place, including W-2s, 1099s, and any other important receipts.

In addition, you can help your clients understand which documents are necessary for their specific tax situation. For example, if they have recently purchased a home or started a business, they may need additional documents to file their taxes.

By having everything organized and easily accessible, clients can save time and avoid the frustration of searching for missing documents.

Maximizing Tax Savings through Portfolio Review

It’s essential to help your clients identify potential tax saving opportunities, and reviewing their portfolios is a key strategy in achieving this. By regularly reviewing their portfolios, you can identify areas where they may be able to take advantage of tax deductions and minimize their taxable income.

One area where advisors can help clients maximize tax deductions is through retirement accounts such as 401(k)s and IRAs. You can work with your clients to ensure they are contributing the maximum amount allowed each year and taking advantage of any employer matching programs.

Advisors can also help clients evaluate which type of retirement account is best for their specific situation, whether it be a traditional or Roth IRA, for example. By maximizing contributions and taking advantage of tax benefits, clients can potentially save thousands of dollars in taxes over time.

Moreover, advisors can help clients identify potential tax losses within their investment portfolios. LOGICLY gives advisors much-needed tax information to facilitate conversations with clients, including:

- Reviewing tax considerations at a tax-lot level

- Evaluating and comparing the impact of the exit strategy

- View the tax-related impact of transitioning out of the current portfolio

- Generating proposals for new and existing clients

Advisors may find themselves asking, “How do we transition from the client’s current allocation to the proposed allocation?”

Our Tax-Aware Intelligence solutions enable advisors to take a more active approach in tax-efficient investing by providing access to tax-aware strategies right at their fingertips. By building an analytics framework for tax considerations, advisors get the right degree of involvement with their clients’ portfolios.

With a complete picture of tax-related impacts associated with possible portfolio transitions, the Tax Loss Prospector tool analyzes portfolios to surface TLH opportunities. Advisors are then provided with securities to consider for suitable alternatives for a swap trade.

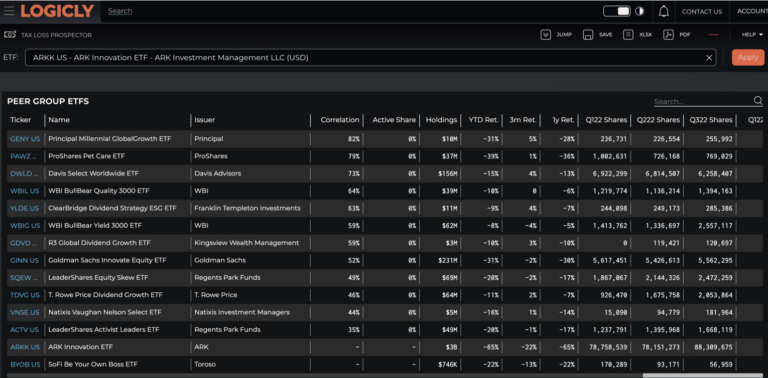

Below is an example of the tool in action: ETFs that are classified in the same Peer Group as ARK Innovation ETF (Ticker: ARKK). Sorted by Correlation.

Furthermore, our LOGICLY TAX App can help advisors identify TLH opportunities within a single portfolio or group of portfolios. And not wait until the end of the year to do so.

This is a key update that enables users to:

Review tax considerations at a tax-lot level

- Identify lots to trade depending on tax position by getting a complete picture of the tax lots: age, status, trade price and unrealized gains or losses

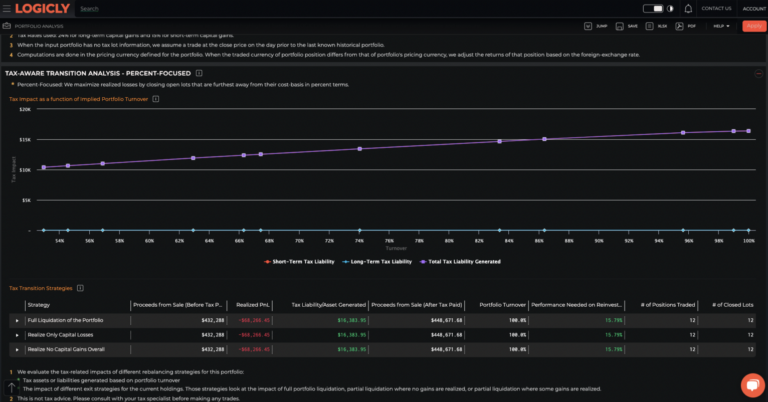

Evaluate and compare the impact of the exit strategy used

- Decision to follow a “percent-focused” (deviation from cost basis) or “notional-focused” exit strategy can have a great impact on after-tax returns for the portfolio

Highlight tax-related impact of transitioning out of the current portfolio. Examples of notable scenarios include:

- Realize ONLY capital losses

- Realize NO capital gains overall

- 5% decrease needed to offset tax liability

- 10% decrease needed to offset tax liability

- Full liquidation of portfolio

Generate proposals for new and prospective clients

- Evaluate current portfolios for tax loss harvesting opportunities

- Show tax transition value of moving to proposed portfolios

When being tax-smart, investors can protect future gains by locking in current losses.

Aligning Tax Strategies with Financial Goals

Effective communication with clients is critical for a successful tax season. As financial advisors, it’s important to regularly review a client’s financial goals, both present and future, to ensure that their tax strategies align with their overall financial plan.

Tax planning should be an ongoing process that occurs throughout the year, not just at year-end.

It’s important to communicate regularly with your clients and keep them informed of any changes to tax laws or regulations that may impact their financial plan. This can include discussing potential tax implications of significant life events, such as buying a new home or starting a business as mentioned earlier.

Furthermore, reviewing client goals regularly can help you identify any changes in their financial situation that may impact their tax strategy. For example, if a client experiences a significant increase in income or inheritance, their tax strategy may need to be adjusted to account for these changes.

Needless to say, effective communication and reviewing client goals regularly, go hand in hand, and are essential for a successful tax season. By taking the time to understand your client’s financial situation and long-term objectives, you can provide personalized tax recommendations and guidance to help them achieve financial success.

Streamlining Tax Season with Automation

An effective strategy to streamline your client’s tax season is by automating their investment process.

LOGICLY is able to help in this area by seamlessly integrating our platform into your practice. This helps advisors to focus on more critical tasks and provide better service to their clients.

Portfolio Coach simplifies the day-to-day workload of advisors by keeping client portfolios aligned with a policy and generating automatic alerts for dozens of important portfolio measurements. It ensures portfolios are optimized through rebalances while taking full advantage of lower-cost funds, tax-alpha opportunities, higher-yielding stocks, ESG metrics, and much more.

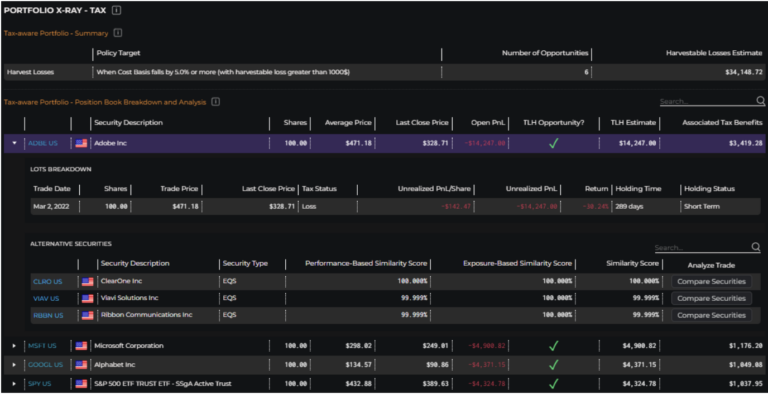

The tool also provides advisors with the ability to dictate the parameters controlling how tax-efficient strategies are identified and applied to their client’s given portfolio. It provides an in-depth analysis for each holding within the portfolio. If an opportunity is available, there will be a check mark under ‘TLH Opportunity?’.

For those holdings, advisors are given a comprehensive breakdown and a list of recommended alternative securities that can help to secure the associated tax advantage. This can help advisors avoid costly mistakes on behalf of their clients and make adjustments to their investment strategy as needed.

Navigating the Changing Tax Landscapes

Staying current with the latest tax laws and regulations is crucial for both advisors and clients. Tax laws are subject to frequent changes, and failure to comply with them can result in costly penalties that can significantly impact clients’ financial plans.

By leveraging their knowledge of the latest regulations, advisors can help their clients optimize their tax strategies and take advantage of potential tax-saving opportunities.

Here are a few questions advisors should consider when working with clients during tax season:

- What are the most important tax law changes that may affect my clients’ finances, and how can we stay on top of them?

- How can we adjust my clients’ financial plans or business strategies in response to the new tax law changes?

- What are some tax-saving or tax-planning opportunities that we can explore for my clients? Are there any potential risks or downsides to consider?

- How can I add value beyond just compliance by proactively advising my clients on the tax law changes and their implications for their finances or business?

LOGICLY offers advisors automated solutions that ensure their clients comply with the latest tax laws and regulations, minimizing the risks associated with non-compliance. Our tools provide peace of mind to both advisors and clients by offering an audit trail for every decision made in their portfolio.

Additionally, advisors can pinpoint these decisions to specific policy suggestions from the Portfolio Coach with the help of our tools.

Ultimately, tax planning is a crucial component of providing comprehensive financial advice to clients. By identifying opportunities to minimize taxes, advisors can help their clients maximize their after-tax returns and achieve their financial goals more efficiently.

However, as mentioned previously, tax planning is not a one-time event but an ongoing process that requires collaboration and communication between the advisor and the client.

By staying proactive and informed about changes to the tax laws and the client’s circumstances, advisors can add significant value to their clients’ financial lives and help them achieve long-term success.

Enjoy reading this article? Other content you may find interesting:

- 5 Ways to Implement ESG Investing into Your Practice

- The 5 Keys to a Successful Advisor-Client Relationship

- Get Prepared for Reg BI Enforcement in 2023

- Cryptocurrency and the Rise of Custodied Assets

- The Future is Here: How Thematics is Disrupting Investing

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

To connect about media inquiries or to discuss the article, please email Dounya at: dounya.hamdan@thinklogicly.com