By – Steve Sullivan, Head of Marketing, Senior Writer/Editor steve.sullivan@thinklogicly.com

By – Steve Sullivan, Head of Marketing, Senior Writer/Editor steve.sullivan@thinklogicly.com

In our first piece in the ongoing LOGICLY Tax Aware Strategies series, we talked about the powerful LOGICLY Tax App available in our Core subscription level. This is the second article in the series, where we jump into tax loss harvesting.

Generating money from losing positions doesn’t require wizard-level sorcery. Using tax loss harvesting can offer a magical ability to protect future gains by realizing current losses.

Origin story of tax loss harvesting

A brief historical perspective on taxes, realizing gains, and the wash sale rule, to better understand where we are today.

On November 23, 1921, the Revenue Act of 1921 became law.

Among other updates, numerous tax codes were repealed or adjusted. Notably absent in this Act was the concept of wash sale rules. This gap allowed investors, who were well aware of tax code provisions that enabled them to recognize losses and/or push gains into the future, to take advantage of the tax code. Even more aggressive, some investors exploited this loophole in the tax code by selling investments at a loss for tax purposes and then immediately repurchasing the same investment.

Congress clamped down on this abuse by enacting “wash sale” rules as part of the Revenue Act of 1921. Over the years, various iterations of the wash sale rule have expanded to include other abuses, like selling investments for a loss and repurchasing in an IRA.

Thanks to Congressional action, one of Wall Street’s best kept secrets (turning losses into gains via tax loss harvesting) is an accepted practice. And one that financial advisors should be using throughout the year, especially in turbulent markets like the first half of 2022.

Taking losses can be tough for clients

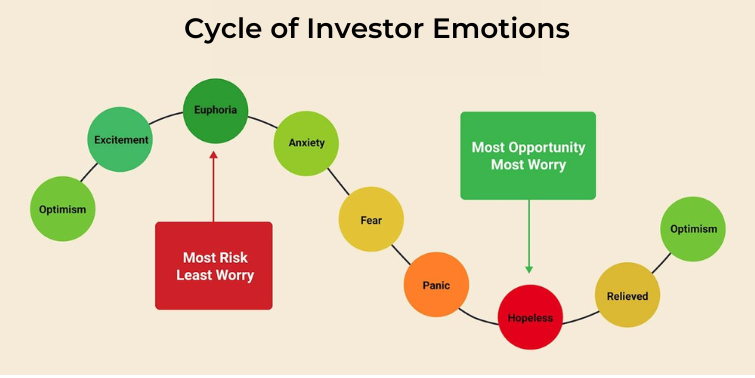

It’s hard to admit to being wrong. Most clients (and advisors) don’t like talking about losing money. When it comes to tax loss harvesting, it’s challenging to investors as it requires them to acknowledge an investment loss.

Wall Street professionals tend to remove emotion from the decision-making process, as seen in the oft-repeated trading mantra:

“Cut losers short, let winners run.”

Clients often do the opposite, unknowingly following an accepted psychological theory known as the “disposition effect”, which looks like:

“Sell winners. Let losers run.”

It doesn’t take a PhD or CFA to understand that this strategy will lead to less-than-desired outcomes for investors. Guiding clients in overcoming these built-in emotional barriers puts advisors in a trusted advocate position, far more so than avoiding the conversation.

Overcoming the bias against taking losses

Wall Street pros take the emotion and guesswork out of investing. Systems and processes provide tight guardrails for opening and closing of positions.

Part of the client bias against tax loss harvesting is rooted firmly in the idea of “losses”, as noted above. To counter this entrenched view, advisors can shift the focus from a negative (losses) to a more positive concept (“tax alpha” or “tax assets”).

Both carry a similar meaning, though the industry tends to view tax alpha as the result of tax assets. That is, using tax loss harvesting (tax assets) to increase/maximize after-tax wealth. For clients, after-tax wealth is what really matters.

Another way to overcome this bias, before it even arises, is with a well-crafted Investment Policy Statement (IPS). This documents not just a client’s investment strategy, but also guides responses to various life situations and market events.

Why advisors and clients should welcome tax loss harvesting

For advisors, it’s relatively simple.

According to various industry experts, tax loss harvesting strategies produce a tax alpha (given long and short-term capital gains rates of 15% and 35%, respectively) of approximately 1.10%. Even when applying the wash sale rule, tax alpha sits around 0.85%.

With fee compression constricting margins of advisor businesses, providing a service that boosts a client’s after-tax wealth by 0.85% or greater is a way advisors can showcase value to clients. It also lessens the sting from any single losing position in favor of the overall, long-term strategy and focus on life/financial goals.

For clients, it’s also somewhat simple.

Why pay more in taxes than necessary? No one likes to pay taxes, certainly not more than needed. With tax loss harvesting, clients can realize a loss now, and defer taxes until a later point in time, while staying invested in relatively similar securities.

It’s not just IF, it’s also WHEN, to do tax loss harvesting

It may or may not come as a surprise, but December has historically been one of the worst months to harvest losses. Why so?

According to research by Paul Unchalipongse, CFA at Columbia Threadneedle, nearly 75% of the time, in December, the market experiences a positive return. Further, historically, December also has the lowest standard deviation of monthly returns.

December performance aside, other considerations abound. The first half of 2022 serves as a cautionary tale for advisors and clients waiting for year-end. With the market down 15%+, there are opportunities across the board to take losses and reinvest proceeds in similar securities that allow clients to avoid running afoul of wash sale rules.

Taking losses throughout the year gives clients an opportunity to stay invested in similar securities that align with their specific IPS. For example, taking a loss on a position in June frees up proceeds to invest in a similar security in June. This creates a “tax asset” now, while any upside may be a potential taxable vent at some point in the future. Tax assets offset tax liabilities, thereby improving a client’s tax efficiency.

Putting it together

Two topics that make clients cringe: losses and taxes. By using one of Wall Street’s best kept secrets, tax loss harvesting, advisors can take the sting out of both.

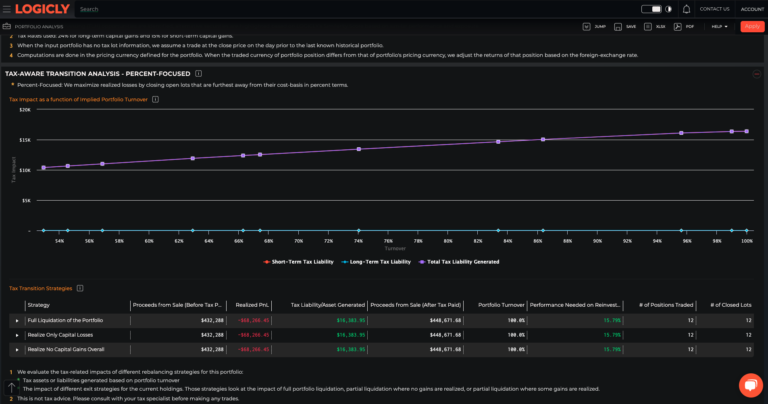

And when it comes to complex and complicated concepts like tax alpha and tax loss harvesting, technology should play a central role. LOGICLY gives advisors the much-needed tax information to facilitate conversations with clients including:

- Review tax considerations at a tax-lot level

- Evaluate and compare the impact of the exit strategy

- View the tax-related impact of transitioning out of the current portfolio

- Generate proposals for new and existing clients

Keep an eye out for other topics in our multi-part LOGICLY Tax Aware Strategies series:

- Read the first article in the series: Use the Tax App to Increase Tax Efficiency

- What being tax aware means and how it improves client relationships

- Comparing exit strategies to increase after-tax wealth

- Choosing optimal exit scenarios to free-up cash and stay invested

- Showing your value by generating proposals that highlight tax transition benefits

- Using technology to build effective talking points with clients

Do more for clients. Click here to bring Tax Aware Strategies to your business today!

To connect about media inquiries or to discuss the article, please email me at: steve.sullivan@thinklogicly.com.