By: Dounya Hamdan

dounya.hamdan@thinklogicly.com

Financial planning is not a one-size-fits-all solution, and understanding your audience is key. A closer look reveals a demographic full of potential yet often overlooked: women investors.

With distinctive financial circumstances and goals, they present a unique landscape for growth and innovation in the financial advisory realm.

Women investors face specific challenges and opportunities that are pivotal to their financial future. By addressing these, financial advisors can better tailor their services and engage their female clients effectively, bridging the current investment gap and leveraging women’s strengths and aspirations.

This article dives into three integral aspects of women and financial planning, aiming to help financial advisors engage more effectively with this valuable demographic and, in the process, empower them to take charge of their financial destinies.

Igniting Confidence: Women and Financial Empowerment

Understanding the landscape of women in finance presents some surprising insights. According to BNY Mellon’s study, 1 in 10 women believe they don’t have a solid understanding of investing. Confidence is also low, with only 28% of women feeling sure about investing their funds.

Adding to the conundrum, the majority of asset managers seem to be focusing on the male demographic, with a whopping 86% targeting male customers. In fact, most U.S. financial advisors are male — just 35% were women in 2022, according to the Bureau of Labor Statistics.

Another perception barrier lies in income expectations. On average, women globally feel the necessity to earn $4,092 a month before they can contemplate investments, according to BNY Mellon.

This perceived threshold is even higher for U.S. women, who believe, on average, that a monthly income exceeding $6,000 – amounting to over $72,000 annually – is a prerequisite to investing.

However, financial advisors have an opportunity to dispel these misconceptions and ignite confidence among women investors.

Reflective questions for advisors to consider:

- How are you actively challenging the traditional male-focused investment industry narrative to better include women?

- Are you educating your female clients on risk awareness and giving them the necessary tools to make informed decisions?

- How can you make investing more accessible to those who may not have a high disposable income? How are you communicating the potential of small, regular investments?

By turning the dial to foster a more inclusive investment environment, advisors can ensure that finance is no longer a men’s club but a sphere where women can participate actively and confidently.

Bridging the Investment Gap

According to BNY Mellon’s survey, there would be an additional $3.22 trillion in global assets under management if women invested at the same rate as men.

Surprisingly, women are only half as likely to invest their money as men, and a staggering 70% have never met with a financial advisor. However, when women do invest, they often outperform their male counterparts by 40 basis points, as highlighted by a 2021 Fidelity Investments study.

Put these strategies into play as a financial advisor:

Promote Financial Literacy: Actively engage in educating your female clients about financial planning and investing. Host seminars or workshops focusing on the fundamentals of investing. Take it a step further by partnering with local community organizations to reach a broader audience of women.

Show Empathy and Understanding: Understand and empathize with the unique financial challenges faced by women. Tailor your advice to their specific circumstances, whether they are single, married, divorced, widowed, have children, or are caring for aging parents.

Leverage Technology: Offer user-friendly digital tools that can assist women in tracking their investment goals, understanding their portfolios, and learning more about different investment options.

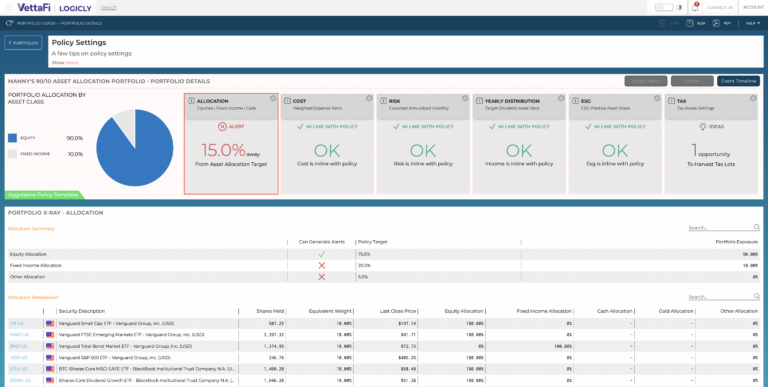

An example is LOGICLY’s Portfolio Coach, with its 24/7 monitoring capabilities, it allows for constant oversight of investment performance. It delivers comprehensive portfolio analysis, helping to ensure alignment with client goals and risk tolerance.

LOGICLY‘s detailed yet straightforward insights can enhance women’s understanding of their investments, fostering greater confidence and engagement in their financial futures.

Engage deeper with female clients by posing these questions:

- Are there any specific financial concerns or challenges you are currently facing that we should address?

- How comfortable are you with your current understanding of financial planning and investing?

- What kind of support or resources would you find most helpful in improving your financial literacy?

- Do you have any specific expectations or preferences when it comes to communication or the way we work together?

By taking these actions and asking these questions, financial advisors can better connect with their female clients, address their unique needs, and help them realize their financial potential.

Painting the Future: Women and Their Financial Legacy

Legacy planning for women investors is a multifaceted concept; it’s about leaving an imprint that aligns with their goals, values, societal impact, and personal objectives. These range from backing the next generation’s professional pursuits to significant philanthropic commitments.

A recent RBC survey revealed generational differences in how women perceive their legacy. More young women feel an obligation to pass on wealth to the next generation (65% vs. 55%) and make a broader societal impact (65% vs. 52%) than older women.

Women are increasingly controlling larger shares of wealth, requiring careful orchestration of their legacy strategy portfolios. This involves prudent investing to safeguard and grow their wealth across generations, as well as establishing plans for a smooth transfer of wealth.

Here are several impactful strategies to better assist female clients:

Align Goals and Values: Understand the values and social impact goals of your female clients. Shape their investment strategies in a way that aligns with their desire to leave a legacy.

Encourage Philanthropic Investing: Promote impact investing and charitable giving strategies that can help women fulfill their vision of societal contribution.

Initiate Succession Conversations: Early and frequent discussions about succession planning can ensure a smooth transition of wealth, aligned with their objectives and time frames.

Incorporate Legacy Planning in Regular Reviews: Regularly review and adjust the legacy strategy to accommodate changes in the client’s life and objectives.

In this evolving landscape, advisors who can adeptly navigate these facets will not only strengthen their relationships with female clients but also unlock a new realm of financial planning.

Enjoy reading this article? Other content you may find interesting:

- 5 Ways to Implement ESG Investing into Your Practice

- The 5 Keys to a Successful Advisor-Client Relationship

- Get Prepared for Reg BI Enforcement in 2023

- Cryptocurrency and the Rise of Custodied Assets

- The Future is Here: How Thematics is Disrupting Investing

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

To connect about media inquiries or to discuss the article, please email Dounya at: dounya.hamdan@thinklogicly.com