By: Dounya Hamdan

dounya.hamdan@thinklogicly.com

Clients want to trust that you are the most qualified person to manage their finances and expect a high level of satisfaction with your performance as their financial advisor.

This raises the question: What are clients truly seeking in a financial advisor?

With financial advisors facing growing pressure to effectively convey and showcase their worth in the relationship with their clients, it’s become increasingly important to demonstrate their value to clients in today’s market.

The below are important factors advisors should take into consideration:

- The availability of a wide range of online financial tools and the introduction of ‘finfluencers’ has made it possible for individuals to handle their own financial matters with greater ease, leading some clients to question the necessity of hiring a professional advisor.

- The use of technology in the financial industry is rapidly evolving, and advisors who are able to utilize technology to improve the efficiency and effectiveness of their services may be more attractive to clients.

- Clients’ expectations and needs are constantly changing, and advisors who are able to anticipate and meet these changing needs may be more successful in retaining and attracting business.

- Economic and market conditions can significantly impact financial planning and decision-making, and advisors who are able to navigate these challenges and provide valuable guidance to clients may be more successful in the long term.

Client priorities and concerns can vary widely, depending on many factors, such as age, retirement goals and personal values, to name a few.

And so, advisors who are able to truly listen to and understand their clients’ needs are more likely to be successful in providing valuable and relevant advice.

In today’s volatile market and rapidly changing technological environment, how can advisors effectively demonstrate their value to clients in order to build strong and lasting relationships?

Key #1: The More You Know

The better you know your clients, the better you can help them reach their end goal. Simple enough, right?

By gaining a deeper understanding of your clients’ goals, concerns, and priorities, you can better tailor your advice and recommendations to meet their specific needs. This can help to build trust and strengthen the client-advisor relationship, leading to increased loyalty and retention, and potentially servicing their family members, including their children.

Here are a few questions that advisors may consider asking their clients:

- What are your personal values and how do they impact your financial decisions?

- What are your non-financial goals (e.g. career, family, travel, etc.) and how do they relate to your financial planning?

- What are your expectations for our relationship and how can I best support you in achieving your goals?

- What are your concerns or fears about your financial future?

Generally, conversations with your clients will surround the topic of money. But one question that may help you go beyond their financial goals is asking them what they value more than money itself.

This can open the doors to better understanding the bigger picture for your clients.

With the rise of robo-advisors and self-directed investing options, advisors can differentiate themselves by establishing genuine empathy and connection with their clients. Investing time and effort in understanding your clients can pay significant dividends for your practice in the long term.

Key #2: One Step at a Time

Financial planning can be a complex and overwhelming process for clients, as it involves making important decisions about saving, investing, and managing money.

One way that financial advisors can help their clients to feel more comfortable and in control is by breaking long-term goals into shorter segments or phases. This will help clients to feel more confident and capable of making progress towards their financial objectives.

For clients who come with their own values system and who support certain causes, advisors can assist in having these beliefs reflected in their investment strategies.

For instance, as more investors become interested in ESG investing, financial advisors may receive more requests from clients to incorporate ESG considerations into their investment portfolios.

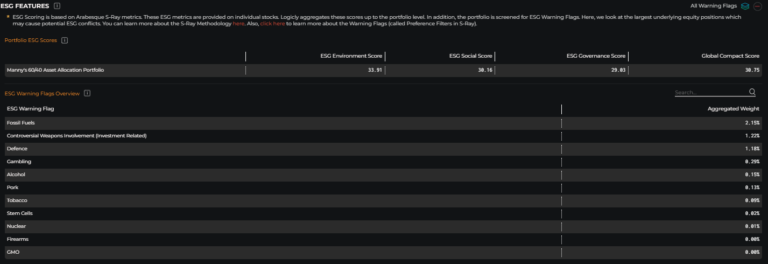

LOGICLY’s Portfolio Analysis tool helps advisors create customized simulations for clients across a broad array of portfolio characteristics.

The tool equips advisors with an ESG screening and scoring system that can shed light on exposures to ESG Warning Flags such as Fossil Fuels, Tobacco, Defense Industries, and more.

It is also evident that depending upon which age bracket your clients fall into, their financial goals may vary:

- Gen Z: accomplishing short-term objectives (such as paying off college loans) while seeking out multiple income opportunities

- Millennial: owning a home may be a significant financial goal, and saving for a down payment and securing a mortgage may be a top priority.

- Gen X: may be facing a range of concerns, including worries about the stock market, family expenses and uncertainty about how much they need to save for retirement

- Baby Boomer: retirement is a top concern and having enough money saved for accumulating debt or expenses

By staying attuned to your clients’ priorities, you can position yourself as their trusted adviser for the long term.

Key #3: The Intersection of Compliance and the Client Experience

We’ve established that advisors play a crucial role in helping clients navigate the complex world of financial planning and investment management. However, in order to be successful, they must also navigate the ever-changing regulatory landscape.

Balancing compliance and the client experience can be a challenging task, but there are various steps advisors can take to ensure a positive experience for clients while still being compliant.

One of the most important steps advisors can take is to be transparent about their investment strategies with the client’s best interest in mind. With the advancement of today’s technology, advisors can use data and deeper analytics to improve the client experience by identifying areas where investment improvements can be made.

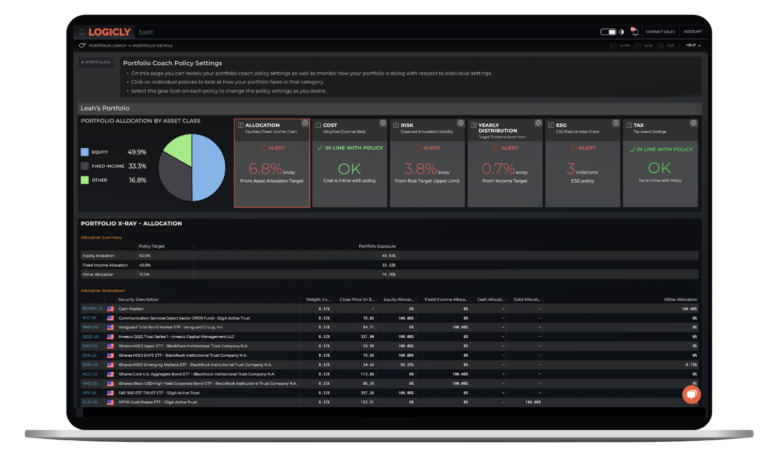

For instance, you can connect your client’s portfolio(s) to LOGICLY and receive real-time policy alerts, rebalancing notifications, as well as potential trade ideas to improve cost, performance, lower risk and monitor your client’s tax liability. With the addition of generating an audit trail on every decision made for your client’s portfolio(s).

Within the platform, advisors will find the current holdings across all households and portfolios that are being monitored by Portfolio Coach.

Once inside the portfolio, you will see the current asset allocation in pie chart form on the left side. In addition to the allocation chart, you are met with the Investment Policy Statement (IPS) settings that dictate the alerts and warnings generated by Portfolio Coach.

Here you are able to adjust IPS settings for the respective portfolio and also monitor how the portfolio is doing relative to its individual settings.

With these solutions, advisors can better stick to their fiduciary duties, and always put the client’s needs ahead of their firm’s wants and interests.

Key #4: Checking Your Client’s Blind Spots

By adopting today’s technology, financial advisors can enhance their existing processes and services, allowing them to do more for their clients by doing less, and streamlining their workload.

By leveraging technology, advisors can expand the scope of their services and offer clients a diverse range of investment opportunities and financial planning services, including tax planning, estate planning and risk management.

Technology allows advisors to gain deeper insights into clients’ financial behaviors and make data-driven recommendations. It also helps them stay current with market trends and strategies, providing clients with relevant and timely advice.

LOGICLY serves as a comprehensive solution by supporting advisors at every stage of the process while they support their clients.

Typically, investors may only seek their advisor’s assistance with tax-efficient investing strategies or general tax help during tax season.

However, with the use of LOGICLY, advisors can continuously incorporate potential tax impacts into their clients’ financial planning and take advantage of tax loss harvesting opportunities all year round, providing a more in-depth and proactive approach to portfolio management.

Tools like this, allow for advisors to identify and address any potential blind spots in their clients’ investments, and create a dynamic financial plan that can be regularly reviewed and adjusted as needed.

Key #5: Open Door Policy

At the core, clients hire and retain financial advisors to achieve their financial goals and aspirations. Clients want an advisor who can comfortably position them to succeed in meeting these long-term targets.

It is crucial for advisors to consistently evaluate and align their services with their clients’ investment priorities and to better ease any doubts or fears they may have.

With reasonable fears, such as having enough retirement savings to get through higher inflation and a potential recession, clients need to believe that their advisor is the best person to help them through it.

Advisors can help by offering an open door policy where clients can reflect on past financial failures or stressors, while also planning for both upside and downside portfolio scenarios.

Above all, clients appreciate an advisor who takes the time to understand their needs, to simplify and provide a more holistic view of their financial picture.

Focus on what matters to your clients. While you’re focused on helping your clients, we at LOGICLY can stay focused on helping you.

Enjoy reading this article? Other content you may find interesting:

- Getting paid…in Bitcoin?

- Deflation: A Different Kind of Deflate-gate

- A Friend Request from Your Advisor

- Cryptocurrency and the Rise of Custodied Assets

- The Future is Here: How Thematics is Disrupting Investing

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

To connect about media inquiries or to discuss the article, please email Dounya at: dounya.hamdan@thinklogicly.com