-By Steve Sullivan, Head of Marketing & Head Writer

-By Steve Sullivan, Head of Marketing & Head Writer

steve.sullivan@thinklogicly.com

Sports and crypto

In 2019, Russel Okung, an offensive lineman for the Carolina Panthers in the NFL, famously tweeted, “Pay me in Bitcoin”. Okung wanted the Panthers to pay half of his $13m salary in Bitcoin. Several months later, he followed up his original tweet with another saying “Paid in Bitcoin”. An early adopter, at least in pro sports, Okung was one of the first, but certainly not the last of a parade of professional athletes getting paid in Bitcoin or another form of cryptocurrency.

The trend has accelerated, with high profile athletes like Aaron Rodgers, Lionel Messi, Odell Beckham, Jr., Saquon Barkely, and Trevor Lawrence, among others requesting at least part of their comp (endorsements or salary) in Bitcoin, Ethereum, or another coin. Presumably, while each athlete has their own motivation for receiving crypto as comp, there is likely a percentage of that decision that is rooted in speculation.

Another, Landon Cassill, a NASCAR driver, has a deal to receive his entire salary in Bitcoin and Litecoin from Voyager, the crypto exchange that recently filed for bankruptcy. Cassill once mined Bitcoin in his basement, so it’s not all that surprising that he chose crypto for his form of compensation.

Still others, like Ifunanyachi Achara, a Nigerian-born soccer player who plays for Toronto FC in the Major Soccer League, have non-investing motivations. Achara takes half of his salary in Bitcoin. Doing so offered Achara a way to send his family money should they need to quickly relocate to get away from violence.

Most recently, Brazilian UFC fighter Luana Pinheiro became the first female sportswoman in Latin America to receive her entire salary in Bitcoin.

Choking out inflation

Referencing her decision, Pinheiro highlights a key position of crypto proponents: hedging against inflation. For her, like many crypto participants, Bitcoin acts as a hedge against inflation since it has continued an uptrend despite corrections along the way. This, compared to the erosion of purchasing power of fiat currencies like the Brazilian Real (BRL) or the US Dollar, is attractive.

Pinheiro’s crypto views relative to inflation were shaped by Brazil’s long-standing inflationary environment. She was born in Brazil in 1994, around the time the Real was introduced and pegged 1:1 to the US Dollar at the time. The currency exchange rate is now 5:1, that is, 5 BRL for every dollar. To Pinheiro, “Bitcoin is for that, to protect against inflation.”

Bitcoin’s status as an inflation hedge is a white-hot debate. On the one hand, Bitcoin advocates tout the crypto’s scarcity in arguing that this would protect its value during times of rising inflation. Countering this is the view, noted by Bank of America, that Bitcoin trades in sync with the stock market, making it a risk asset, not an inflation hedge. Landing somewhere in the middle are observers who note that, since Bitcoin is decentralized and not tied to any central bank, it could become a good inflation hedge over time. Even so, recent speculation and market volatility (see “Crypto Winter”) in Bitcoin and other cryptos shakes the long-held belief of crypto’s ability to weather an inflationary environment.

Bitcoin, the ultimate FOMO

There’s no shortage of opinions on both sides of the issue, clouding the ability to Bitcoin to build broader appeal, particularly with financial advisors and the clients they serve. Most advisors have clients in, or approaching, the retirement phase of their financial plan. Clients in this stage of their lives face different challenges than those still in peak earning years.

Retirees have demographics characteristics which might make them less subject to concerns about rising inflation. Typically, this client segment is likely to own their house free of debt. As such, retirees are not usually exposed to rising rental/housing costs and don’t carry a debt burden that becomes more more expensive in a rising rate environment. Not working means that retirees do not have job-related commuting costs. For retirees, the biggest potential roadblock would be carrying insufficient investments, like fixed income for throwing off enough yield to overcome the inflation-driven erosion of purchasing power. Instead of investing in TIPS (Treasury Inflation Protected Securities), U.S. Government bonds that move in lockstep with inflation, some retirees may be tempted to invest in Bitcoin as an inflation hedge.

Clients in their peak earnings, or wealth accumulation years, view crypto through a different lens: speculation. Sensational stories of literal overnight millionaires flood social media, leading to FOMO, which makes any advisor cringe. For every story like this, there are far more people who have lost most, if not all, of an investment in a crypto with risk that would make a casino blush. That said, for more mainstream crypto assets like Bitcoin, many investors want to include crypto in their portfolios for primarily growth, with inflation concerns a secondary consideration.

The financial advisory community, which has been slow to embrace Bitcoin as a viable financial instrument, is moving toward a more accepting posture. More and more firms and advisors are allowing for greater customization of the traditional asset allocation model to include a crypto sleeve as part of the investment strategy conversation. With a growing crypto awareness fueling increasingly inquisitive clients, providing comprehensive planning and investment solutions that include crypto is table stakes. Crypto allocations often range between 1-5% of a client’s portfolio to cushion against crypto winter fallout.

Choose your (crypto) investment theme

Theme-driven investing connects a client’s values with investments. A quick look at many self-directed investment providers shows how prominent this has become. Charles Schwab, one of LOGICLY’s integration partners, offers investing in themes like Big Data, AI, Cyber Security, Renewables, the SpaceEconomy, and many others. Adding to this, Schwab now offers a crypto-related ETF, the Schwab Crypto Thematic ETF (trading under ticker “STCE”).

Thematic funds (including both ETFs and mutual funds) look at particular sectors and make bets on macro trends within those sectors over a given period of time. Recent thematic funds have focused on investing in areas such as cannabis, cloud computing, EV, and clean energy.

Some clients may have a strong belief in solar energy or cannabis. Instead of merely investing in a S&P 500 ETF or fund, advisors can focus in on this belief and customize the client’s portfolio to include ETFs or funds with exposure to solar and cannabis names. Other clients may want to avoid specific themes, like fossil fuels, tobacco, and alcohol names. Thematic investing opens the door to a wide range of choices for clients who like to match their capital to their values.

Crypto is one such theme. Clients can invest directly in Bitcoin or other cryptos through a crypto exchange like Coinbase. Crypto-based ETFs give advisors and clients access to crypto allocations without the need for digital wallets or cold storage of direct crypto investments. Some funds invest in a range of cryptos, while others invest primarily in Bitcoin. Sourcing and managing an allocation to crypto that aligns with the context of the client’s IPS puts the advisor and client on the same page. The question then is: how to find crypto-based ETFs?

The answer: LOGICLY.

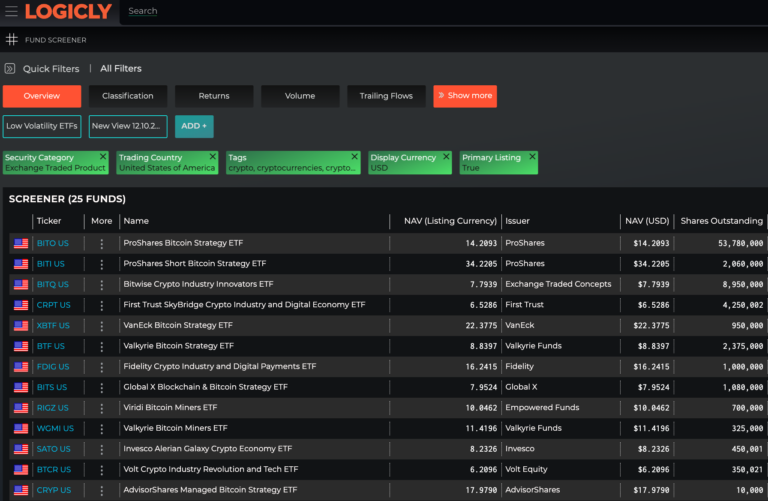

Finding crypto-based ETFs is easy with LOGICLY. Using lightning-fast, powerful screening technology puts crypto ETFs right at the advisor’s fingertips. Dive deep to see underlying characteristics to inform client conversations. With better insights come better decisions. And when it comes to crypto allocations, having a clear understanding can make the difference between a satisfied, informed client and a litigious one.

Below is a view inside the LOGICLY Fund Screener, showing a list of crypto-related ETFs in the US. By expanding the search to include all global funds, the list grows to more 130 ETFs.

See other useful content for advisors including:

- Harley Davidson, Sustainability, and ESG

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

- The Appeal of Thematic Investing

- Using the LOGICLY Tax App to Increase Tax Alpha & Efficiency

- How to Win More Business with the Efficient Frontier

To connect about media inquiries or to chat about the article, please email me at: steve.sullivan@thinklogicly.com.