By: Andrew Unthank

Alpha, the much-discussed and sought-after investment metric, seems to be the primary focus of the financial world. But is the concept of alpha as straightforward as it appears, or does it encompass multiple dimensions?

In the past, quantifying alpha was relatively simple: did your fund outperform the benchmark? For both advisors and fund managers, providing alpha was equated with how well their portfolios or models outperformed their respective benchmarks for clients, whether through proper ETF or mutual fund selection, appropriate allocation based on specific model parameters, or customized solutions.

At first glance, delivering alpha to clients may seem like a straightforward task for fund managers and advisors, enabling them to consistently generate healthy risk-adjusted returns. However, in the era of low interest rates, achieving this has proven to be increasingly challenging. This has led financial professionals to broaden their understanding of how to provide alpha to clients.

The evolving perspective reveals that alpha encompasses more than merely outperforming the market; it involves a multifaceted approach to generating value for clients.

In Pursuit of Alpha During the Passive Revolution

Since the 2008 financial crisis and the subsequent rise of quantitative easing by central banks worldwide, the pursuit of alpha has become increasingly challenging for fund managers. The flood of investor dollars into index ETFs, which experienced exponential growth in the ensuing years, left many active managers struggling to keep up as assets shifted toward passive strategies.

This migration of assets not only impacted active managers but also affected advisors who relied on these strategies. Consequently, they witnessed outflows from their client base as customers sought new advisory firms.

Perhaps both groups could have curbed the outflows had they adopted a more holistic approach to providing alpha. In addition to their quantitative focus on beating the benchmark, incorporating more relationship-oriented services during tumultuous market periods might have better served them and their clients. Although we cannot know for certain, we can learn from others’ missteps to avoid repeating the same mistakes.

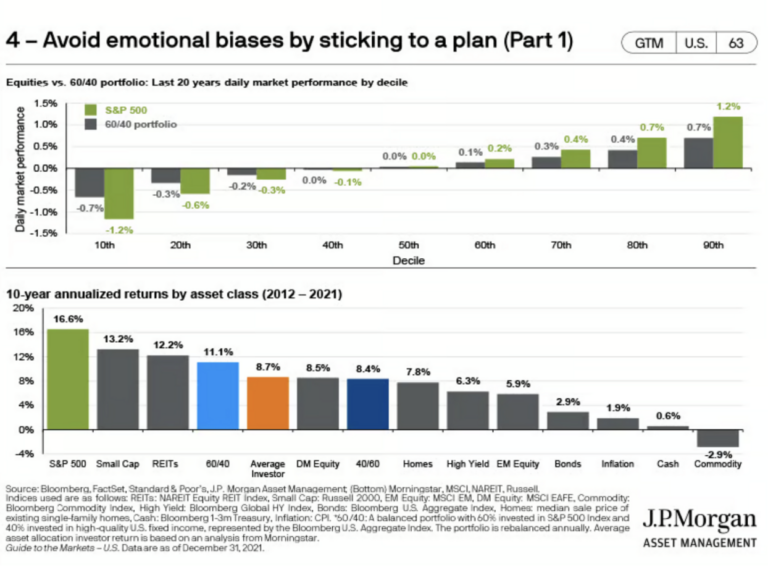

The landscape of uncertainty has only intensified since the 2008 financial crisis, with events such as the Euro-debt crisis, the Greek debt crisis, and the United States-China trade war. Advisors have had to adapt by offering additional value to clients in order to prevent them from succumbing to emotions that drive counterproductive investment behavior, such as buying high and selling low.

By guiding clients to adhere to the principles of successful long-term investing, advisors can help them navigate the choppy waters of global market uncertainty.

Embracing Change and Unquantifiable Value

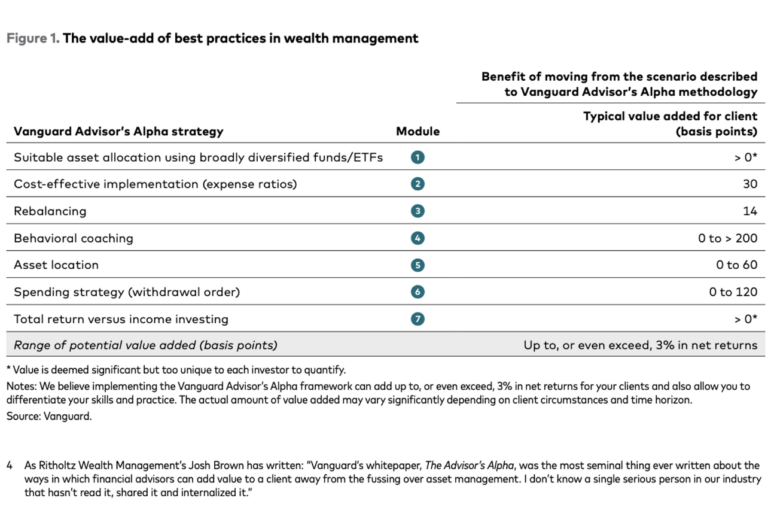

Vanguard’s August 2022 white paper, “Putting a value on your value: Quantifying Advisor Alpha,” asserts that amid today’s market changes and uncertainties, the value proposition of advisors has never been higher.

By implementing additional strategic business practices, advisors can significantly broaden their alpha quantification and provide extra value to clients and their practices.

The white paper warns against defining an advisor’s value-add solely as an annualized number, as this oversimplification overlooks the unquantifiable alpha that advisors bring to their practices and clients.

This unique alpha helps clients navigate periods of market distress and uncertainty while fostering a comprehensive understanding of each client’s portfolio and personal needs. Vanguard’s Advisor’s Alpha framework (Figure 1) suggests that advisors can potentially add up to, or even exceed, 3% in net returns by employing this framework.

The white paper clarifies that it doesn’t cover every avenue for adding value and emphasizes the non-universal nature of advisory alpha levers. The described framework can serve as the foundation for constructing Advisor Alpha.

Examining Vanguard’s seven-module framework, we can see that adding structure where applicable can greatly benefit advisory firms and enhance clients’ experiences throughout the relationship.

At LOGICLY, we are committed to helping financial service professionals, particularly advisors, change the conversation with their clients to provide the unquantifiable alpha that transcends percentages.

Implementing a strategic framework similar to Vanguard’s Advisor Alpha Strategy or a comparable approach, combined with innovative FinTech solutions, can create powerful synergies that deliver more than just portfolio performance compared to a set benchmark.

On the Frontline of Market Turbulence

The ultimate goal for financial professionals is to guide their clients toward their financial objectives within the agreed-upon timeframe, all while steering through the ever-changing landscape of financial market uncertainties.

As market and global uncertainties escalate, many clients prioritize wealth preservation. Adopting a workflow that accounts for these concerns will be the key to distinguishing successful financial professionals from the rest.

A prime example of the unpredictable nature of financial markets is the COVID-19 outbreak in March 2020, which brought the world to a standstill. In response, central banks worldwide rapidly infused trillions of dollars into the markets to avert a global financial catastrophe.

This massive liquidity injection fueled one of the quickest and largest bull cycles in history, followed by an inflation spike initially dubbed “transitory” by several members of the Federal Reserve Board in the United States.

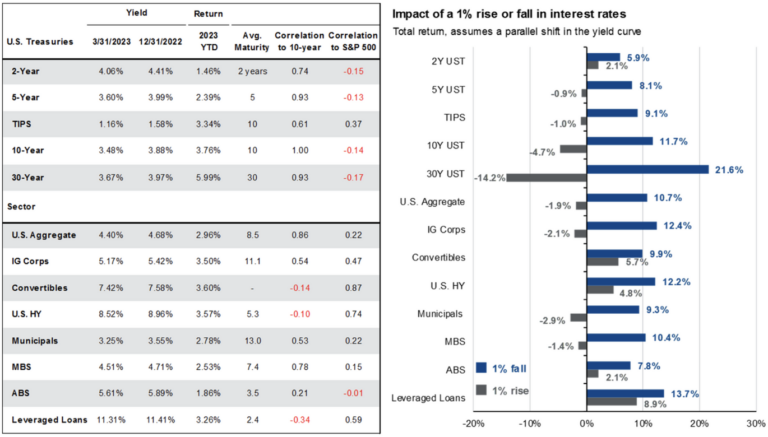

The ensuing global inflation led central banks to launch the most aggressive interest rate hike campaign in modern history, resulting in elevated market volatility as liquidity was withdrawn throughout 2022.

These abrupt rate hikes reverberated through client portfolios, as evidenced by the 1% rate rise in the below chart provided by JPMorgan.

In the United States alone, there were 500 basis points of rate hikes, leaving some portfolios in 2022 looking drastically different compared to 2021. Amid these turbulent times, the financial industry is witnessing an uptick in advisory firm consolidations.

The Rise of Risk Management as Alpha

We anticipate the trend of wealth relationship shifts to persist in the coming years. According to a 2021 Ernest & Young report, 28% of clients plan to change wealth relationships within the next three years, intending to transfer an average of 38% of their assets to another provider.

This presents a significant opportunity for advisors who can deliver both quantifiable and non-quantifiable alpha, as highlighted in Vanguard’s white paper.

Terry Duffy, Chairman and CEO of the CME Group, penned an article in the Financial Times titled “Risk management is the alpha for a time of uncertainty” in late February of this year. He emphasizes the growing need for investors to navigate uncertainty and argues that effective risk management has become the true alpha.

In this climate, events once deemed rare are now commonplace, propelling risk management from a supporting role to center stage.

Duffy contends that relying on traditional investment strategies is not only insufficient but also the riskiest approach. He concludes his article by asserting that economic and geopolitical uncertainty will persist and that investors must be prepared. Effective risk management will be crucial for success in delivering that elusive added alpha.

Rethinking Alpha in a Changing World

Throughout our discussion, we’ve explored alpha from various perspectives and demonstrated that it doesn’t have to be solely performance-based, although it’s still tempting to view it that way.

Expanding the concept of alpha to encompass both its quantitative and qualitative aspects is a more fruitful approach that can benefit advisors, clients, and practices alike.

LOGICLY assists financial advisors in applying and implementing strategic frameworks, such as those outlined in Vanguard’s white paper. Our global investment data-analytic platform simplifies workflows by leveraging innovative investment research capabilities powered by AI.

At LOGICLY, we recognize the importance of time for advisors, both in retaining and growing their businesses, as the global macro picture appears increasingly bleak.

In a recent article by my colleague Brian Fechter, titled “Why some RIAs Say No to AI,” he highlights how advisors can utilize the insights and capabilities offered by LOGICLY instead of merely discussing investment strategies or portfolio performance.

By changing the conversation in this manner, advisors can set themselves apart from competitors and establish themselves as trusted partners and advocates for their clients’ financial well-being.

Ultimately, this could be the deciding factor in determining whether alpha, in any quantifiable or qualifiable form, is achieved.

Enjoy reading this article? Other content you may find interesting:

- How to Navigate the Complexities of Tax Loss Harvesting

- 5 Must Know Strategies for Mastering Tax Season

- Solving the Challenges of Regulatory Compliance for Advisors

- ETFs and Volatile Markets

- 5 Ways to Implement ESG Investing into Your Practice

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

To connect about media inquiries or to discuss the article, please email Andrew Unthank at: andrew.unthank@thinklogicly.com