By Lindsey Tewell and Dounya Hamdan

Baby boomers (age 57-75) have long been considered foundational clients for financial advisors. With retirement taking place in droves (in part due to the pandemic) and a considerable amount of wealth being transferred to heirs, advisors should focus on next generation HNW client segments – women and millennials (age 25-36).

Firms emphasize diversifying client portfolios; why not move toward diversifying the client base too?

Women represent the industry’s largest emerging market, despite the many financial and societal barriers they face.

Hurdles women often face:

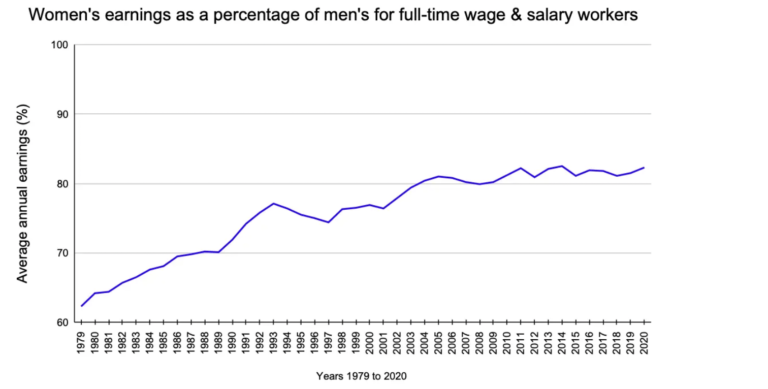

- Wage/pay gap (women earn $0.82 cents for every dollar a man earns)

- Inequality of household responsibilities, including caretaker responsibilities

- Pandemic-driven unemployment and potential recession

According to WealthManagement.com, “Women, millennials and HNW newcomers are all flagged as emerging, high-potential market segments, yet only 27% of responding firms said they actively pursue these prospects.”

Curiously, the obstacle for advisors is identifying a strategy to attract and retain these clients by understanding their distinctive financial and personal needs. In the way that “one-size-fits all” won’t work for all clients, using the same strategy with women and millennials that’s used with other demographics won’t work.

So, how can advisors position themselves as an asset rather than as an afterthought to women and millennials?

Early Bird Gets the Worm

To reach women and millennials, advisors should familiarize themselves with their personal interests, including family, who are often beneficiaries.

Why? Eye-popping studies show that approximately 88% of heirs won’t use their parents’ financial advisor. Cultivating relationships across the family pays dividends long-term.

Being a multi-faceted resource that goes beyond just handing out financial advice is a differentiator. Advisors will gain a better understanding of how they can build a relationship with spouses and children long before the transfer of wealth occurs.

Family members often don’t prioritize getting financial advice until they see a need for it. Advisors who recognize this can better serve the family by understanding next generation needs:

- College planning

- Buying a first home

- Retirement planning

- Appetite for investing

Advisors can engage with family members in many ways. Through email and/or a newsletter, advisors can share valuable information from college planning to choosing 401k investments, and everything in between. Hosting in-person “meet and greets” with the family offer a relaxed setting to deepen engagement. By building connections across the family, advisors can become the go-to, trusted resource for the family.

Financial Empowerment with Confident Outcomes

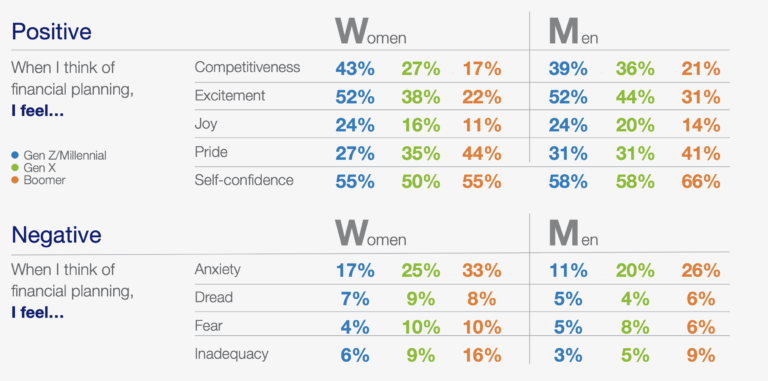

Choosing a financial advisor is one life decision that can be overwhelming. Women tend to feel overwhelmed from a lack of confidence about financial literacy and planning. Advisors can provide support through a personal, supportive lens rather than a transactional relationship.

Understanding the needs of female clients means asking questions like:

- What are your short/long term goals and life priorities?

- How do you feel about risk vs stability?

- What college plans do you have?

- How would life-changing events shape your views?

For advisors, breaking the ice with female clients means open conversations about experience with financial planning and how investment strategies are modeled. Advisors ease nervous, jittery clients with respect to staying the course, especially during turbulent markets.

Building a portfolio specific to each client’s life and financial goals showcases the advisor’s ability to have clear, frank discussions about long-term planning. Clients look for advisors and firms to educate them about investments relative to their risk tolerance.

Webinars give advisors an opportunity to answer frequently asked client questions. They also provide a forum to address misconceptions like “you shouldn’t invest when paying down debt” or the false belief that income alone is enough to build long-term wealth. Financial wellness programs offer a starting point for clients unsure of how to begin their financial planning journey.

To diversify a client base, firms can start by adding female advisors. Clients seek advisors who deliver excellent service though it’s clear that men and women approach finances differently. Women look to see how their finances impact others around them, while men are often more comfortable with risk.

This isn’t to say male advisors are better or worse than female advisors, but with diversifying the firm’s advisor base, it gives clients an opportunity to have more options to choose from.

Retirement Planning

On average, women tend to live longer than men. In the US, women live to the age of 81 compared to men who live to 76. This five-year difference is less of an advantage considering that women are behind in terms of long-term financial planning and investment performance. Implementing a plan for accumulating retirement income that aligns with life goals is vital.

Most people procrastinate retirement planning as they’re under the illusion that they have plenty of time with retirement so far away.

While women make up two-thirds of the US workforce and almost half of the US population, unfortunately the gender pay gap continues to exist. As such, they may feel like long-term income will need to be stretched much further than their male counterparts. Research shows that women in the United States are 80 percent more likely than men to fall into poverty once they retire solely because they earned less than men. Compounding this is when a lack of confidence about financial planning and investing limits risk-taking, resulting in a negative impact on retirement savings.

Advisors can guide female clients in overcoming these issues by discussing important considerations like:

- Reviewing employer retirement savings plan options

- Evaluating spending habits and budgeting for large purchases

- Kickstarting their financial planning journey

- Becoming more involved in household finances

Russ Thornton runs Wealthcare for Women, an advisory business that provides retirement planning for women in their 50’s and 60’s. Commenting on this niche demographic, Russ notes, “In addition to the above-mentioned hurdles facing women, they’re also primarily responsible when it comes to caring for an aging parent. And with more college graduates finding it challenging to “get off the family payroll” women can really feel the sandwich generation squeeze. This is yet another reason why women can make wonderful clients.”

Equipped with this knowledge, advisors will need to position themselves as a trusted partner in assisting female clients with retirement planning to ease the present stress of planning for the future.

Speaking about servicing a female clientele, Russ notes, “You have an opportunity to help women ‘put the oxygen mask on themselves first’ before helping others, even when it’s family. Many women are natural caregivers, and while this can be a rewarding role to play in the lives of others, women need to make sure they don’t jeopardize their own financial independence in the process.”

When building a financial plan for women, advisors must consider less common retirement planning challenges like caring for an aging parent or supporting an adult child.

The Future of Advisory-Client Relationships

In a previous article, “Using AI to Achieve Confident Outcomes”, we wrote about the rapidly evolving influence of technology and how the Advisor-AI relationship simply can no longer be overlooked.

According to Cerulli Associates, millennials are set to inherit approximately $27.5 trillion as the “Great Wealth Transfer” gains more traction.

Millennials grew up with fast-moving technology, from social media apps to online banking and more. This technology-driven culture has led millennials to be more reliant on technology than human interaction for financial services. However, studies show that, for big decisions, they do seek counsel from interpersonal relationships. The more advisors can connect with the entire family, across generations, the more likely millennials will see them as a trusted advisor.

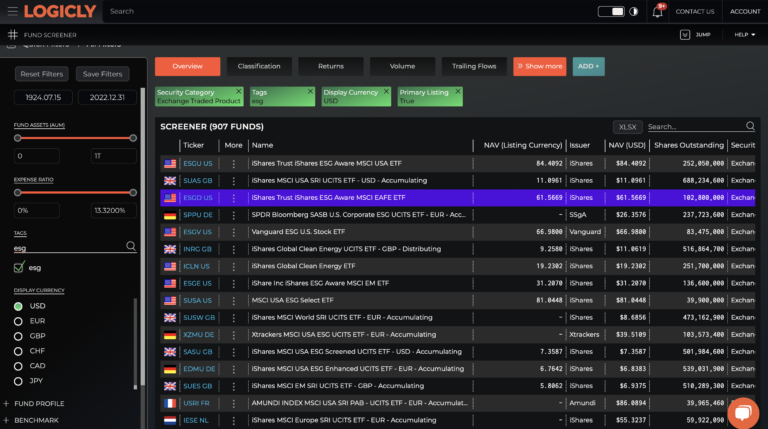

Aside from millennials being tech-savvy, conversations surrounding environmental sustainability and social justice issues are at the forefront of their minds. If they’re tweeting about it, they are also looking to take action that supports the cause at hand. Future growth of ESG strategies are expected to be driven by millennials opting to invest in a socially responsible manner.

Advisors can work with millennials to explore ESG investing, for example, and other sustainable portfolio options that align with values. LOGICLY’s Fund Screener gives advisors a lightning-fast look into the global ETF universe of over 12,000 funds. Using tags to filter allows an advisor to find all funds with the tag in the fund name. For example, the “ESG” tag identifies the 900+ funds with “ESG” in the fund name.

It’s time to have honest conversations about likely financial stress points despite how far away these pivotal life events may be. Being accountable increases the likelihood of success when it comes to life goals, particularly when it comes to financial objectives.

Advisors are advocates for women and millennial clients in bridging gaps of uncertainty and investing confidence. With so many complexities, like retirement planning, wealth transfers, and financial literacy, advisors play a key role in bringing peace of mind to an underserved clientele by strategizing an answer to the most important question: “Am I going to make it?”

Read about our solutions for advisors including:

- How to Use One of Wall Street’s Best-Kept Secrets

- The Appeal of Thematic Investing

- Using the Tax App to Increase Tax Alpha & Efficiency

- How to Win More Business with the Efficient Frontier

- Why You Should Analyze Fund Regressions BEFORE Choosing ETFs or Funds

To connect about media inquiries or to discuss the article, please email Lindsey at lindsey.tewell@thinklogicly.com or Dounya at: dounya.hamdan@thinklogicly.com.