-By Dounya Hamdan, Marketing Content Associate dounya.hamdan@thinklogicly.com

-By Dounya Hamdan, Marketing Content Associate dounya.hamdan@thinklogicly.com

With analysts and financial network talking heads predicting ongoing market volatility, combined with an increasingly digitized financial services industry, advisors are (rightfully) concerned about the markets, digitization, and how both may impact their future client relationships.

Clients who look for investment returns to meet financial plan objectives also expect the same when working with a financial advisor. For advisors, it’s all about moving the advisor-client relationship beyond just a simple, one-dimensional pecuniary transaction.

The first robo-advisors appeared during the financial crisis in 2008, promising to bring tech-enabled, automation-driven, and low-cost, no-frills investment management to retail investors. It was a shot across the bow of the financial advisory community, with many so-called pundits referring to the advent of robo-advisors as a possible extinction event for advisors. Early statistics seemed to support this thesis, as more and more investors gravitated toward the simplicity and ease of working with robo-powered solutions.

Even so, there was one important factor that robos could not (and arguably cannot) address: interpersonal relationships.

Simply put, clients can’t bounce ideas off of, or even just chat with a robo.

When clients need advice (from planning the purchasing of a home or gifting to grandchildren, to setting and adjusting investment strategies supporting life goals) they need the human interaction and emotional intelligence that can only come from a financial advisor.

Why clients invest in a financial advisor

According to SmartAsset, common investment mistakes include lacking portfolio diversification, not addressing tax implications, forgetting to rebalance portfolios, overlooking fees/expense ratios and having high investment turnover. Tax awareness is a powerful component of after-tax returns, especially when considering market performance for H1 2022. Knowing how to do tax-loss harvesting, and more importantly, when to do it takes a skilled, experienced hand. And technology to back it up.

With a recession looming, investors may be going through a rollercoaster of emotions with anxiety-inducing decisions fast approaching. This is the perfect opportunity for financial advisors to step in and provide an impartial approach when it comes to their clients’ investment strategies while also providing a sense of deep understanding and regard for the client’s needs during such turbulent times.

An exceptional financial advisor is one who is not only the client’s advocate for investment decisions, they also forge long-lasting client relationships. By communicating and planning each client’s short and long term goals (and the future dreams and aspirations driving them) and family relationships, talented advisors continuously work toward bringing their clients’ visions into reality.

Shifting the AI narrative

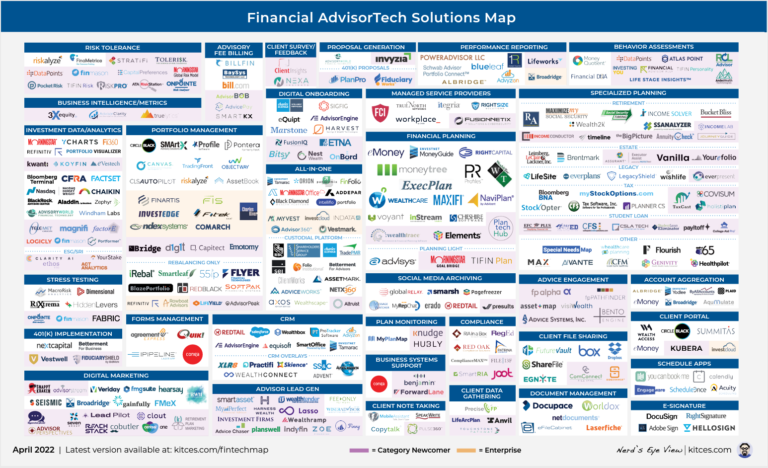

The advisor-tech landscape is daunting.

A quick look at the FinTech map for 2022 from Michael Kitces underscores this point, and then some. With so many choices across so many functional areas, it’s no wonder that advisors feel overwhelmed by technology, let alone adopt it as a driving force of their practice.

The advisor-AI relationship, with the rapidly evolving world of technological advances, simply can no longer be overlooked. It is only natural for humans to fear the idea that robots will one day take over their jobs (or worse, if you’ve seen the ‘Terminator’ movies). With the implementation of AI across the financial services industry, there are many more positive impacts and benefits than downside. As with almost everything, including technology, there are varying degrees of risk involved. That said, and as advisors know well, with risk comes reward.

The coupling of financial advisor and AI-integrated software will pave the way for advancements in automation, creation of efficiency tools, personalized portfolio management, and better, stickier client relationships. Relationships built on trust and guidance, where an advisor’s fees are offset by inspiring confident outcomes.

And when markets are turbulent, as in 2022, it’s a reminder to advisors that clients will remember who guided them during difficult market conditions and periods of uncertainty.

AI empowers advisors

It is common that early stage innovations can at times be widely misunderstood and criticized. Yet they can also be the same product that we can’t live without in the near future – from cell phones to personal computers and even online shopping. It’s hard to fathom that these inventions were once scoffed at when viewed through the lens of adoption and usage.

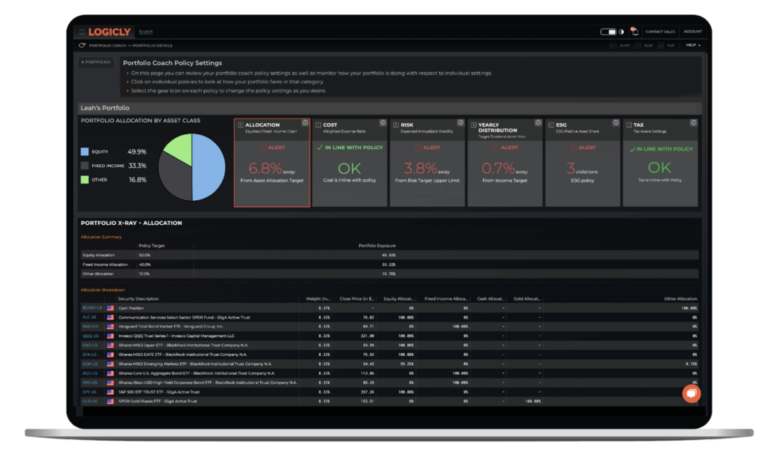

Back to the idea of robos replacing advisors, AI-powered solutions like Portfolio Coach empower advisors to easily build, manage, and scale a business, while also delivering customization to each client. Unlike robos, Portfolio Coach is AI for advisors.

For advisors and firms, Portfolio Coach is a digital portfolio strategist that assists advisors by providing them with the instruments needed in a world where costs and fee compression are an ongoing battle. Advisors tell us that they create investment policies to track model portfolios or customize a client’s asset allocation, cost, risk, income, or ESG with real-time alerting and monitoring.

We hear from our financial advisor clients that they use LOGICLY to tell the story of each client’s portfolio(s), as this puts the client at the center of the conversation. It gives advisors a way to engage clients like never before, with trust-building solutions that keep the client’s eyes on their long-term life goals and financial objectives.

Not only is the advisor empowering confident outcomes for their clients, they are also creating confident investors for the long term. Confident clients are long-term clients.

AI is a financial advisor’s decision support system that guides clients along their journey toward achieving financial milestones. Advisors who rely on AI when it comes to personal portfolio management for clients have a consistent, repeatable, and scalable process. It’s no secret that advisory businesses with practice-wide consistency earn the highest valuations.

One size does not fit all

Is it too ambitious to label AI as Advisory 2.0? Or can financial advisors finally get past their self-inflicted discomfort with technology and use it to their advantage?

Customizing and personalizing the client experience gives advisors a strong foothold across the client base, from those approaching retirement to those awaiting an investable inheritance. AI enables advisors to provide these customized experiences quickly, and at scale.

With almost every sector modernizing the approach to meeting client needs, advisors too must bridge the gap between past and future when it comes to servicing clients. Older clients have different preferences than younger millennials, and AI levels the playing field in giving advisors the tools to customize how they engage with clients.

Clients come from all walks of life. They look for advisors who have the technological and industry savvy to guide them through complex and volatile times in the market. Advisors who use AI provide clients with reassurance that the technology has built effective guardrails around portfolio management.

Staying on track when the markets rattle even the most battle-tested nerves isn’t easy. Clients trust their advisors to keep abreast of current market trends and anticipate shifting markets. By using AI, advisors can augment client relationships and guide clients through times of uncertainty and stress. For clients, this inspires the confidence to stay once the smoke clears.

Read about our solutions for advisors including:

- The Appeal of Thematic Investing

- Using the Tax App to Increase Tax Alpha & Efficiency

- How to Win More Business with the Efficient Frontier

- Why You Should Analyze Fund Regressions BEFORE Choosing ETFs or Funds

To connect about media inquiries or to discuss the article, please email me at: dounya.hamdan@thinklogicly.com.