Fiduciary & Reg BI Compliance

Meet the fiduciary standard.

According to this standard, financial advisors must act in their clients’ best interests, regardless of how it affects the advisor or their income. Talk with clients about their life goals, including financial objectives, and future wish-lists to get the full picture, before building a financial plan and investment strategy.

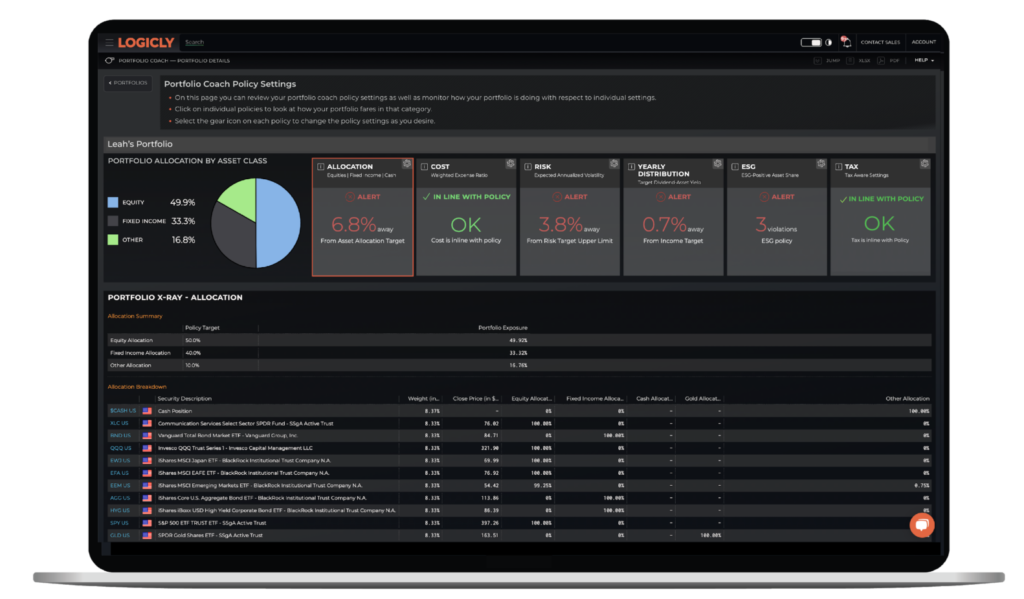

These details come together with other factors like allocation strategies and risk tolerances to form the client’s IPS (Investment Policy Statement). LOGICLY assists advisors and RIAs by connecting the IPS with outcomes. Capture details of client conversations, including investments, to establish an audit trail of portfolio decision-making.

Clear Reg BI challenges.

Regulation BI (Best Interest) is about a Broker Dealer’s advisors inspiring confidence in clients. Confidence that the firm’s advisors are making suitable recommendations and informing them of investment decisions.

LOGICLY assists advisors in meeting Reg BI requirements with tools that capture key IPS elements that documents Reg BI compliance including:

- Document that recommendations are in the client’s best interests

- Show an understanding of risks, rewards, and costs of recommendations

- Factor in the cost and expense to show that the cheapest option isn’t necessarily suitable