LOGICLY is now a part of VettaFi

View Press ReleaseChanging the Conversation.

LOGICLY is designed to help you streamline your investment research and analysis, by putting you in the driver’s seat when delivering strong outcomes for your clients. With LOGICLY, you get comprehensive portfolio management capabilities, real-time alerts and advanced analytics right at your fingertips.

Changing the Conversation.

LOGICLY is designed to help you streamline your investment research and analysis, by putting you in the driver’s seat when delivering strong outcomes for your clients. With LOGICLY, you get comprehensive portfolio management capabilities, real-time alerts and advanced analytics right at your fingertips.

Are you ready to Invest LOGICLY?

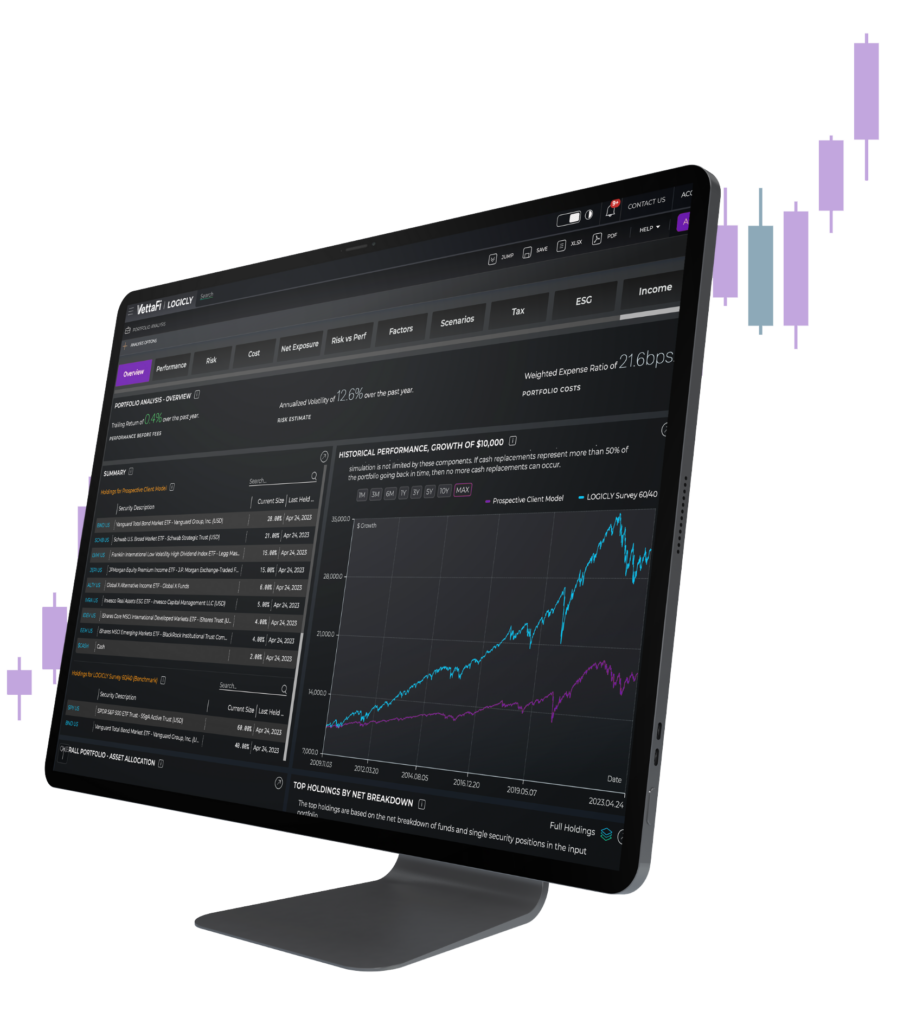

LOGICLY is a comprehensive web-based analytics and portfolio management platform

for advisors to automate their day-to-day portfolio management workload.

Powerful Analytics

Explore ways to improve investment outcomes for your clients using LOGICLY's portfolio optimization features to improve performance, lower cost and risk, better meet client’s ESG goals, and harvest tax losses.

Streamlined Workflows

LOGICLY streamlines portfolio construction by giving you point-and-click access to institutional-caliber analytics. Improve investment decision-making with clients by perform a wide array of analysis.

Custom Reporting

All visuals in the LOGICLY platform can be exported to a customizable PDF report or excel, allowing you to discuss outcomes with your current clients and propose new investment decisions with your prospects.

Simplify and automate portfolio management.

Connect your client’s portfolios to LOGICLY and receive policy alerts, rebalancing notifications, as well as potential trade ideas to improve cost, performance, lower risk and monitor your tax liability. Generate an audit trail on every decision made in your portfolio. Create policies to track model portfolios or customize for asset allocation, cost, risk, income or ESG.

Better analysis. Better investment decisions.

LOGICLY CORE Portfolio Analysis gives you institutional-caliber analytics and the ability to create customized simulations for clients across a broad array of portfolio characteristics. We provide trading history, rebalancing, return on cash, and fee overlays to represent portfolio outcomes inclusive of your fees. Quickly analyze current fund holdings and costs, and compare against potential replacement funds to guide clients in making the most suitable decision.

Do more for clients by doing less.

With a few clicks, you can quickly narrow down the full universe of global ETFs and mutual funds to find ideas that may fit your client’s investment objectives. LOGICLY BASE puts you in the driver’s seat with our easy-to-use Fund Screener tools. We provide you with advanced analysis to find optimal choices, from our Overlap and Correlation tool to quickly viewing performance attribution of ETFs and benchmarks.

Fast data. Faster investment decisions.

LOGICLY Data APIs and Custom Tools

Our fully built analytics and tools are all API driven and easily integrated into your domain. This can cut implementation time for a website analytics project from years to months. LOGICLY’s software-as-a-service model provides flexibility around only the tools you need. Our dedicated team of developers and quants will work with you to ensure seamless integration into your website.

Our Clients

Financial Advisors

Broker Dealers

ETF Issuers

Asset Managers