By: Andrew Unthank

A leader’s lasting value is measured by succession. – John C. Maxwell

Succession planning is often a key topic of discussion between financial service professionals and their clients, occurring across both the institutional and retail spectrums. The focus sharpens, however, within the retail sector, where many financial advisors serve clients who are neither high-net-worth nor accredited investors.

While high-net-worth or accredited investors often have a dedicated team of financial professionals ensuring their financial objectives are met, this isn’t always the case on the retail side. Here, financial service professionals may operate independently or as part of a small team, potentially having fewer resources available, depending on their circumstances.

Nevertheless, numerous retail financial advisors have constructed profitable, respected businesses, providing outstanding service to their clients. Time and again, these professionals have guided multiple families through the delicate process of transitioning assets from one generation to the next. But as these financial professionals approach retirement age, the question of their own firm’s succession planning comes into sharper focus.

The need for an appropriate structure is critical for a smooth transition of the business to the successor, whether that successor is a small group of individuals or a larger firm. It’s a matter of ensuring continuity, stability, and the preservation of the high standards clients have come to expect.

RIA Succession: Plans or Pitfalls?

In December 2022, Devoe & Company, a leading consulting firm assisting RIA owners and principals with business consulting, M&A advice, and valuations, published their Annual RIA M&A Outlook. Despite the global economic turbulence of 2022, which was characterized by rising inflation and central banks (including the Fed) initiating the process of hiking interest rates, the report reveals that the year marked a record for M&A activities.

Although the pace of deal completions has slowed in the face of increasing global uncertainty, lucrative opportunities remain. These arise when acquiring firms identify value in the target after thorough due diligence. However, a concern has emerged that many sellers may not be fully prepared when it comes to structuring their firm for negotiation.

This point is underscored by David Barton, President and CEO of Mercer Advisors, who was quoted in Devoe’s report, stating, “There are firms coming to the market that are not ready. They don’t know their story.” Barton further adds that the crucial elements required by a buyer to make an assessment often lack upfront clarity, resulting in the buyer needing to spend extra time on due diligence.

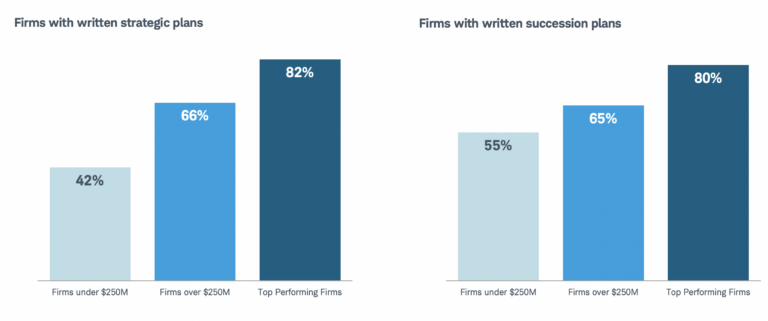

The state of succession planning in RIA firms across different levels of AUM is also concerning. Although most firms have a plan, a sizable number, both above and below $250 million in AUM, do not. This lack of preparation risks their firm, clients, reputation, and legacy. Charles Schwabs RIA Benchmark Study reveals that only 55% of firms under $250 million have a written succession plan, leaving a staggering 45% without one. Among firms with over $250 million in AUM, 65% had plans, with 35% still lacking one.

The study also highlights the success of top-performing firms across all levels of AUM, with 80% of these industry leaders already having a written succession plan in place. Such planning enables these firms to present necessary documentation to potential acquirers and kick-start internal transition processes when needed.

Succession’s Fork in the Road

Whether firms opt for an internal succession plan or decide to sell to an external firm, the leadership team must understand the firm’s mission and objectives related to succession. Various factors come into play, such as the implications for junior staff and administrative personnel following the merger.

According to Devoe & Company’s report, there’s a clear split in succession strategies among the surveyed advisors. 49% of advisory firms intend to pursue internal succession, while 33% are open to external succession. Interestingly, only 2% of the latter group would consider selling to a firm of equal or smaller size.

The trend appears to lean towards larger firms when it comes to external succession deals. This shift could account for smaller RIAs with assets below $250 million being more likely to sell outright to larger firms. However, advisory firms that are forced to sell their assets outright risk eroding decades of goodwill and trust established with their clients.

Inadequate handling of the transition not only jeopardizes the selling firm’s relationship with their longstanding clients but could also cost the acquiring firm potential new clientele based on the management of the transition process.

Navigating succession planning for advisory firms can sometimes feel like starring in your own episode of the TV show ‘Succession.’ But in your case, hopefully there will be less family drama and more strategic planning! After all, it’s about preserving your legacy and setting up your firm for future success.

Planning Ahead: The Long Game or a Short Cut?

Clear examples exist that demonstrate how firms, spanning the AUM gamut, are beginning these vital discussions with their in-house stakeholders and personnel. For a succession plan to thrive, its initiation must occur as early as possible. This early inception allows the plan to organically evolve and expand to meet necessary requirements, rather than being hurriedly assembled at the eleventh hour.

The creation and implementation of these plans demand time. Firms should consider the potential impacts of delaying succession planning on both the selling and acquiring firms.

In an Investment News article, Matt Matrisian, Chief Channel Officer at AssetMark, is quoted as saying that a well-devised succession plan requires a decade or more to carefully prepare and execute. He advises advisors to consider a range of scenarios if they wish to explore options beyond selling to the highest offer.

Matrisian further explains his point by stating that there’s nothing inherently wrong with selling to the highest bidder, particularly in the current market where private equity investments are intensifying wealth management consolidation.

Another noteworthy revelation from this article is the concerning lack of a substantial pool of upcoming young advisors ready for mentorship and training, due to a downturn in advisory training programs. With Mercer Capital reporting that 60% of RIA firms are still under their founder’s leadership, there’s an urgent call for many in the financial services industry to set up the right structures to facilitate a smooth transition.

Behind the Baton Pass

A prime example of a well-executed transition is demonstrated in a recent survey by CityWire, which explored various advisory firms across the AUM spectrums, ranging from $100 million to $1 billion. The survey provides valuable insight into how firms are approaching the subject of succession planning. An interview with Ronald Rough, Partner and CIO of Financial Services Advisory with $707.8 million in AUM, further explains this topic.

Rough described that they’re already in the process of transferring ownership from the founding partner to the next generation of leaders, which includes himself. His statement highlights the proactive approach they’re taking – starting to contemplate his eventual exit and aspiring to attract more individuals to become equity partners. Such firms offer a constructive blueprint of a continuously evolving transition strategy.

When a firm possesses robust structural components and a formally documented succession plan, its attractiveness to potential buyers amplifies. If selling is indeed the objective, grasping the intricacies of succession planning and its implementation within the firm becomes indispensable.

In what ways can advancements in tools and technologies serve to boost a firm’s appeal in the process of succession planning?

Future Proofing Your Firm

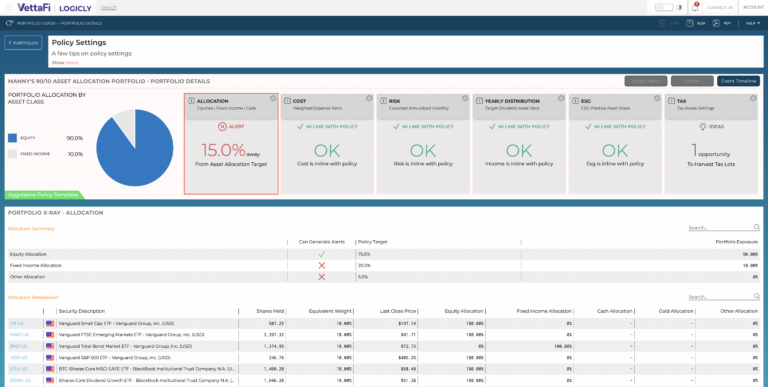

At LOGICLY, we believe in changing the conversation for advisors by helping them transform their client conversations from the cost of advice to the value of advice. With innovative tools, like Portfolio Coach, that leverage artificial intelligence to monitor investment policy statements (IPS), we provide advisors with the confidence that LOGICLY is contributing to the enhancement of their firm’s practices as necessary.

LOGICLY enhances your firm’s attractiveness by providing illustrative client portfolios through AI, enhancing mutual understanding and trust, as well as ensuring optimal portfolio performance that aligns with best practices and regulatory compliance.

Further, our 24/7 AI monitoring provides consistency and reliability, while our robust regulatory compliance tools facilitate efficient navigation through Reg BI requirements, demonstrating your firm’s commitment to clients’ best interests and risk-aware decision-making.

A firm’s vision and structure can often determine whether it is a potential acquisition target. Many sellers, who are well-informed and are seeking to join an emerging platform, tend to do so to find alignment and be a part of a larger vision.

It’s evident that discussions about succession planning are set to gain more importance as more advisors from the baby boomer generation retire. As a result, their assets will increasingly be absorbed by larger firms, be they larger RIAs or entities from the private markets.

Asset transfers are bound to continue for the foreseeable future, and those firms that are not ready with a succession plan risk depreciating their value.

Enjoy reading this article? Other content you may find interesting:

- How to Navigate the Complexities of Tax Loss Harvesting

- 5 Must Know Strategies for Mastering Tax Season

- Solving the Challenges of Regulatory Compliance for Advisors

- ETFs and Volatile Markets

- 5 Ways to Implement ESG Investing into Your Practice

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

To connect about media inquiries or to discuss the article, please email Andrew Unthank at: andrew.unthank@thinklogicly.com