By: Dounya Hamdan

dounya.hamdan@thinklogicly.com

As regulations continue to evolve and regulators ramp up their scrutiny of the financial industry, the stakes have never been higher for financial advisors and broker dealers when it comes to compliance.

Financial compliance involves a set of regulations that govern the financial industry, designed to safeguard clients such as investors, shareholders, and banking customers.

It can often feel like an unnecessary burden, a maze of regulations that advisors and broker dealers must navigate to stay out of trouble.

But by approaching compliance as a strategic opportunity rather than a regulatory burden, advisors can successfully navigate the maze and build a stronger, more trustworthy practice that benefits both themselves and their clients.

Better to Not Be Late or Sorry

Staying up-to-date on regulations is crucial for financial advisors who want to maintain a successful practice and build trust with their clients. With regulations changing frequently and sometimes rapidly, staying informed is essential for ensuring compliance with the latest requirements.

To stay informed about regulatory updates, financial advisors can follow industry news sources such as financial blogs, podcasts, and newsletters. They can also attend industry events, such as seminars or roundtable discussions, to gain insights from expert speakers and network with other professionals in the industry.

Staying aware of the SEC’s Division of Examinations risk alerts is also essential for financial advisors who want to maintain compliance with SEC regulations.

These alerts, which highlight common compliance deficiencies identified during examinations of advisory firms, provide crucial insights into areas where advisors may be at risk of noncompliance, and can help them proactively address potential issues to mitigate risk.

Disclose for Trust’s Sake

One of the most important aspects of maintaining trust between financial advisors and their clients is full and transparent disclosure.

Regulators have increased scrutiny on undisclosed revenue-sharing arrangements in recent years, highlighting the potential for conflicts of interest. These arrangements, which compensate firms for recommending specific products or services, can incentivize advisors to prioritize revenue over their clients’ best interests.

To ensure transparency, advisors, for example, should clearly outline the specific services and fees included in their advisory agreements. This includes detailing the scope and duration of any financial planning services, the exact amount and timing of fees, and how fees will be prorated and billed.

Advisors and broker-dealers who fail to provide adequate disclosure can lead to misunderstandings, miscommunication, and even legal issues.

The cost of compliance is far less than the potential penalties, fines, and reputational risk that comes from not following regulations, such as Regulation Best Interest (Reg BI).

Best Interest at Heart

Regulation Best Interest (Reg BI) represents a significant shift in the way that financial advisors must approach their work. It places the client’s best interests at the forefront of every transaction, elevating the standards of professionalism and transparency in the industry.

By adopting a comprehensive Reg BI compliance plan, firms can build trust with their clients and differentiate themselves in a highly competitive marketplace.

That’s where leveraging today’s innovative technology comes in.

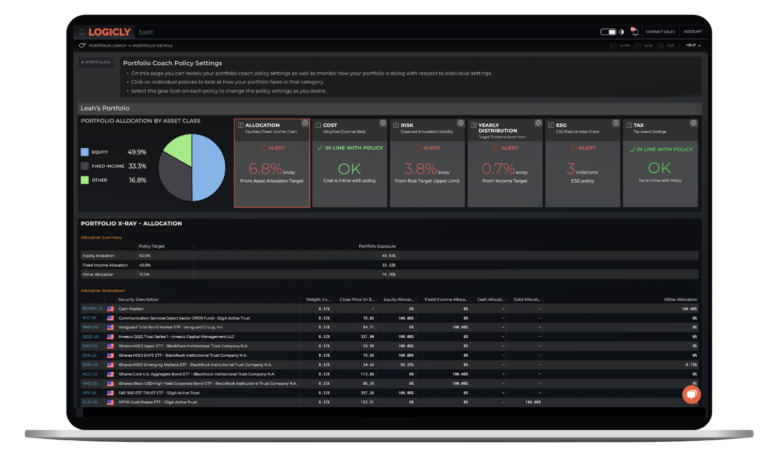

LOGICLY is able to help in this area by seamlessly integrating our platform into your practice. It assists advisors in meeting Reg BI requirements with tools that capture key IPS elements that documents Reg BI compliance including:

- Document that recommendations are in the client’s best interests

- Show an understanding of risks, rewards, and costs of recommendations

- Factor in the cost and expense to show that the cheapest option isn’t necessarily suitable

LOGICLY’s AI monitoring system has the ability to run 24/7 to pinpoint if portfolios are in or out of the policy. Not only is the system monitoring your practice, but it gives you the option to save down changes made to the portfolio and the date in which it was changed.

With Reg BI, the stakes are high, but technology can be used as a powerful tool to help firms meet their obligations and stay ahead of the regulatory curve.

Compliance in the Digital World

In today’s digital age, it is crucial for financial advisors to be mindful of compliance requirements while building and maintaining their digital presence. Recently, the SEC provided guidelines for financial advisors to ensure that their online presence is in line with the regulatory requirements.

The SEC’s new marketing rule, launched in 2022, recognizes the power of digital channels for advertising and establishes regulations to ensure transparency and accuracy in investment firms’ statements.

False information and misleading practices can easily spread online, which is why detailed rules are necessary to protect investors and prevent conflicts.

Some of the key takeaways of the SEC marketing rules include:

- Disclose conflicts of interest

- Ensure transparent fees

- Back up all facts in advertisements

- Provide complete and clear information

- Justify any insinuated results

- Balance performance information

By adhering to these rules, investment firms can maintain credibility and build trust with their target audiences.

Greater Long-term Yields

Though regulatory compliance can be challenging, it ultimately has a positive impact on financial advisors and their clients.

By embracing technology and prioritizing compliance, financial advisors can build stronger, more successful businesses that deliver real value to their clients while minimizing risks and maximizing opportunities.

Financial advisors can steer clear of common compliance pitfalls by proactively assessing their firm’s compliance risks, addressing conflicts of interest, and staying up-to-date with regulatory guidance from the SEC.

Enjoy reading this article? Other content you may find interesting:

- 5 Ways to Implement ESG Investing into Your Practice

- The 5 Keys to a Successful Advisor-Client Relationship

- Get Prepared for Reg BI Enforcement in 2023

- Cryptocurrency and the Rise of Custodied Assets

- The Future is Here: How Thematics is Disrupting Investing

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

To connect about media inquiries or to discuss the article, please email Dounya at: dounya.hamdan@thinklogicly.com