By: Andrew Unthank

As we toast to the start of 2023, we will have reached the two and a half year mark since the SEC implementation of Regulation Best Interest (Reg BI) and form CRS, which were designed to increase transparency in the relationships between broker-dealers, investment advisors, and retail investors.

As a result, broker-dealers are required to prioritize their clients’ best interests over their own when making recommendations, and to disclose any potential conflicts of interest.

Broker-dealers and Investment Advisors play a very important role in helping their clients manage, accumulate and invest towards specific long-term investment goals.

For instance, broker-dealers may offer retail clients personalized investment advice and recommendations through a brokerage service. Investment advisors, on the other hand, offer a range of services including portfolio management and investment strategy advice to both retail and institutional clients.

The SEC has announced that it will continue to rigorously enforce this rule and take action against any firms that violate it. Recently, Western International Securities and five of its brokers were charged by the SEC, in June of 2022, for violating the rule through the sale of risky and illiquid debt securities.

We also can’t forget about the hefty $760,000 fine imposed on a $3.6 billion AUM investment firm, HighPoint Advisor Group, which LOGICLY touched on earlier in the year.

The real point: the cost of compliance is far less than the potential penalties, fines, and reputational risk that comes from not following Reg BI.

Putting the ‘Best’ in Best Interest

Within Reg BI there are four component obligations that investment firms need to be aligned with to avoid violations:

- Disclosure Obligation: requires the disclosure of all material facts that are related to the recommendations

- Care Obligation: designed to enhance the already existing suitability requirement by ensuring that investors are fully aware of the risk and return analysis that is attached to the recommended security

- Conflict of Interest Obligation: requires that firms not only establish and maintain written protocols and procedures to disclose all material conflicts of interest, but these must be enforced

- Compliance Obligation: ensure that firms have the proper system controls in place to prevent violations around Reg BI

According to Financial Advisor Magazine, a widespread assessment of broker-dealers across multiple states will be conducted to evaluate the effectiveness of their adherence to Regulation Best Interest.

This review will provide state regulators with a clear understanding of whether these firms are prioritizing the interests of their investors. It is expected to be completed early in the coming year.

Similar exams were completed in November of 2021 and what they found was very unsettling. Andrew Hartnett, who is the President of the North American Securities Administrators Association, stated that “multi-state exams of 443 firms last November uncovered rampant retail advice and sales violations, despite the fact that Reg BI had by that time been in place for more than 15 months.”

The previous exams from 2021, unfortunately, confirm that many Broker-dealers were still putting their firms own interests above their clients.

Hartnett also mentions, “It’s a matter of trying to continue to understand the efforts that the industry has made to grapple with the rule, get rid of conflicts of interest and offer advice that is as conflict free as possible.”

Regulation Best Interest in the Remote Work Era

The SEC, FINRA, NASAA and state regulators all have an important role in ensuring that Reg BI fulfills its mandate. To attain their intended goal, there will need to be clearer guidance, oversight and collaboration with all entities involved.

Here are some of the findings from NASAA’s Regulation Best Interest Phase Two Report:

- The percentage of Broker-dealer firms surveyed that were offering complex, costly, and risky products increased by 11% after Reg BI took effect.

- Sixty-five percent of Broker-dealers firms surveyed are not discussing lower-cost or lower-risk products with their customers where they recommend these products.

- Forty percent of Broker-dealer firms surveyed who recommended leveraged or inverse ETFs had compensation conflicts.

Another concern of NASAA is the continued rise of remote work of, not only Investment advisors, but also Broker-dealers in the post-pandemic era.

Harnett was quoted saying, “Our concern is that with more people working remotely, that heightens the importance of the supervisory function and our ability to use those exams to make sure that nothing untoward is happening.”

This comment comes on the back of FINRA reclassifying brokers’ home offices as remote supervisory locations, enabling the ability for self regulation, and to have an in-person audit exam every three years, rather than annually.

The Key to Achieving Regulation Best Interest Compliance

‘How can my firm stay in the clear and ensure that we’re meeting Reg BI obligations regarding our clients?’

One of the ways is to leverage today’s innovative technologies, which many firms in the industry have begun the process of adopting, to help ensure that you’re in compliance.

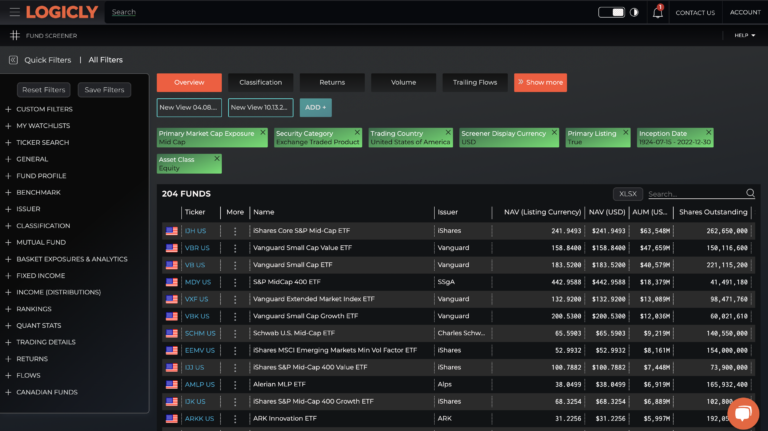

For instance, LOGICLY is able to help in this area by seamlessly integrating our platform into your practice. With the option to screen for ETFs, Mutual Funds and stocks with agnostic data points, there is the ability to ensure that your clients are never overpaying for a product.

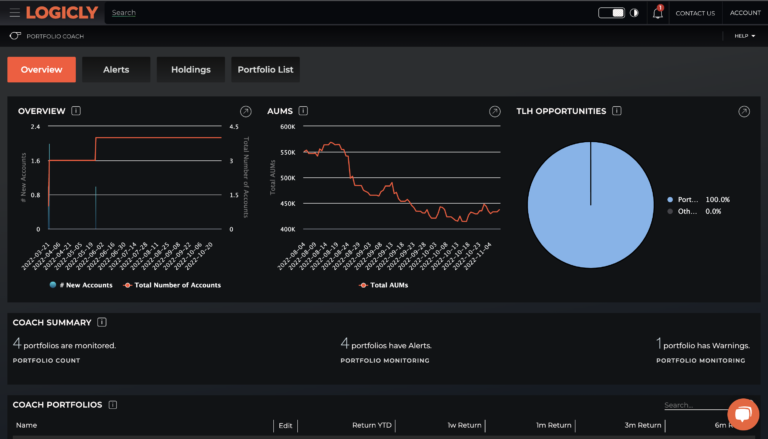

It assists advisors and RIAs by connecting the IPS with portfolio outcomes. This allows for the detailed capture of client conversations, including investments, to establish an audit trail of portfolio decision-making.

With deep dive analytics, a portfolio’s risk is managed appropriately. LOGICLY assists advisors in meeting Reg BI requirements with tools that capture key IPS elements that documents Reg BI compliance including:

- Document that recommendations are in the client’s best interests

- Show an understanding of risks, rewards, and costs of recommendations

- Factor in the cost and expense to show that the cheapest option isn’t necessarily suitable

Once the IPS is created, LOGICLY’s AI monitoring system takes over and continues to run 24/7 to pinpoint if portfolios are in or out of the policy.

Technology like this is extremely powerful in the area of Reg BI, because not only is the system monitoring your practice, but it gives you the option to save down changes made to the portfolio and the date in which it was changed.

This is extremely helpful in the ability to remain transparent with clients and ensure that your firm is staying within the Reg BI guidelines, as we approach the third year of it being in effect, this coming June 2023.

Regulation BI has the potential to significantly impact the way financial advisors conduct business and provide services to their clients. While the implementation of this regulation has faced some challenges, it is ultimately a step towards greater transparency and protection for investors.

As the financial industry continues to evolve, it will be important to closely monitor the effectiveness of Regulation Best Interest and make any necessary adjustments to ensure it is serving its intended purpose. Ultimately, the success of this regulation will depend on the willingness of financial advisors to embrace the changes it brings and put their clients’ interests first.

Enjoy reading this article? Other content you may find interesting:

- Crypto Crash: All Hand on Deck for Advisors

- Welcome to the Internet: the Future of Twitter and Cryptocurrency

- The Future is Here: How Thematics is Disrupting Investing

- ETFs and Volatile Markets

- What Investors Should Do as Year-End Approaches

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

To connect about media inquiries or to discuss the article, please email Andrew Unthank at: andrew.unthank@thinklogicly.com