By: Andrew Unthank

andrew.unthank@thinklogicly.com

“When you invest in thematics, you are exposed to the most interesting parts of the market.”

– Vafa Ahmadi, Head of Global Thematic Equities at CPR Asset Management

Disruptors Shaping the Investing World

It’s fair to say that Cathy Wood of Ark Invest has been one of the biggest champions of thematic investing as we navigate the post-pandemic world. With Ark funds focusing on long-term disruptive innovation themes, some of the names that Ark’s Innovation ETF (ARKK) invests in include are Tesla, Zoom and Roku. All three companies have continuously disrupted their respective industries.

Most notably, Zoom had become a household name at the start of the pandemic with the work from home push. It’s still a major part of not only the work experience but also society’s overall adoption of the digital culture in their everyday lives. Zoom has succeeded in establishing itself as a necessity to consumers and is continuing to expand its reach.

Another ARKK name, Nvidia, is expected to be a major disrupter in the coming years. Nvidia launched its cloud gaming service to the public, called GeForce Now, in early 2020. The product, labeled as the next generation in cloud gaming, gives users the ability to stream games they own on multiple devices.

Game stores, like Stream and Epic Games, can connect to GeForce Now through Single Sign-On (SSO). This enables anywhere/anytime access to games for gamers. Compared to the explosive rise of smart phone use, many experts believe this has the potential to increase screen time beyond that seen over the last 15 years.

Ready for Takeoff in 3,2,1…

A recent article from Seeking Alpha mentions one of the key takeaways by the Global X ETF’s Portfolio Management team is, “social media and video game technology combine to increase user retention and engagement across social gaming platforms. As competition in the digital economy intensifies, we expect investments in the Digital Experiences theme to grow alongside it.”

Both Global X ETFs and Cathy Woods’ Ark Invest expect the digital experience to be an ongoing, growing theme throughout the 2020s and decades beyond. Despite the recent underperformance and negative news around the digital space, from chip shortages for gaming consoles to questions about the recession-proof status of gaming, performance of the crypto market has dominated headlines.

For the majority of 2021, the crypto market “mooned” with not only coins exploding in price, the NFT (Non-Fungible Token) and Gaming sector of the crypto market rocketed as well. From the end of November 2021 forward, all sectors of the crypto market and the stock market have contracted.

There has been a real risk-off appetite for thematic ETFs as well. With funds like (ARKK) returning -55.9% for the year and a significant amount of news around outflows, some have eschewed the idea of thematic ETFs being a viable option for investors at a time of rising global inflation, global central banks raising rates, an inverted yield curve, and many predicting a recession.

Regardless of negative headlines flashing across screens, investors like Global X ETFs and Ark Investment continue to have a strong conviction in the idea that disruptive technologies (not only digital experiences, but Robotics, Big Data, Blockchain, and FinTech) will be major growth areas in the coming years.

On the topic of social network and video gaming, the Seeking Alpha article states, “As an investment theme, we believe digital experiences, including Social Media and Video Games & Esports, offers compelling opportunities because of the ongoing quest to monetize the attention of content consumers as the world becomes increasingly digital.”

One example of this is Meta, formally known as Facebook. Meta recently launched its own experience within the Metaverse (a virtual reality space in which users can interact with a computer-generated environment and other users) and is betting its future on it.

Blockchain Technologies: What is it?

An integral part of the digital experience that is expected to grow is blockchain. Blockchain technology typically gets tied in with the day-to-day activity of the volatile crypto market, which has experienced what many have called a ‘crypto winter’ or ‘bear market’, since November 2021. However, blockchain technology continues to gain popularity from multiple different sectors within traditional markets.

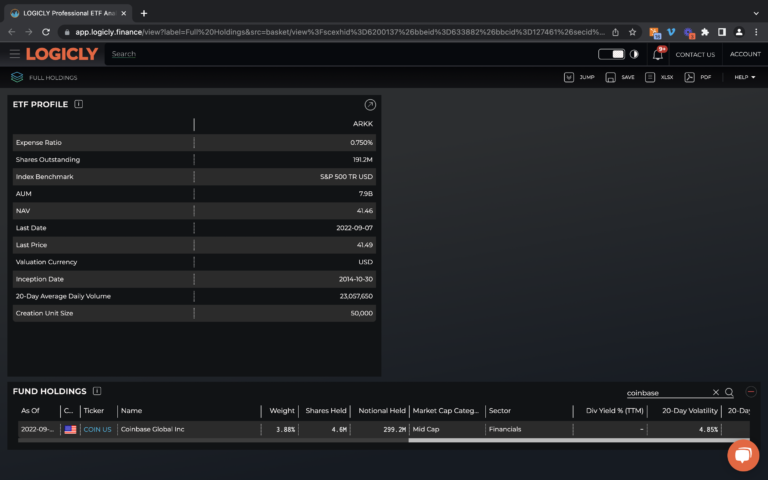

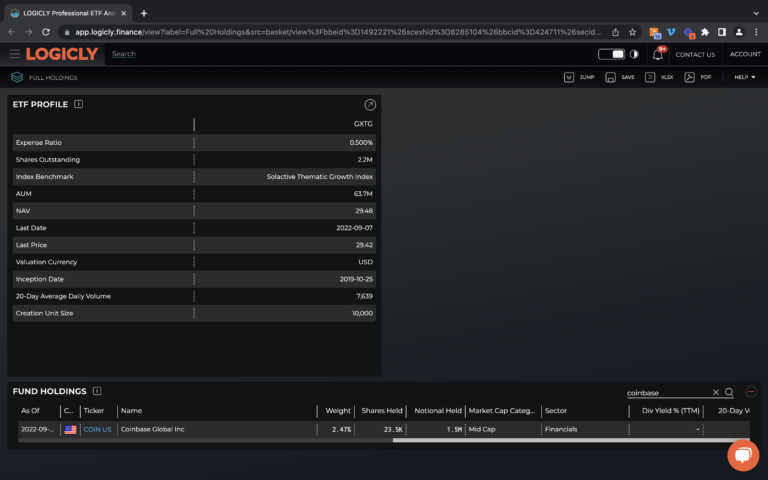

Companies these days care less about the price of a particular coin, and more about the underlying use of a disrupted ledger technology (DLT). Global X and Ark both allocate investment to Coinbase, which is down -74% YTD as-of September 2022. Coinbase, a publicly traded cryptocurrency exchange platform, has been around for a decade following its initial founding in June of 2012.

Despite its negative performance since its IPO in April 2021, Coinbase continues to be a major player within cryptocurrency and blockchain technology community. It is expected to play a major role in our society in the coming years. Supporting this perspective is Coinbase’s recent partnership with the NBA and this past year’s Super Bowl LVI ad spot.

In the last year, Coinbase has not only grown its partnerships, it has also expanded its products and services. One of those products and services is an NFT platform, built within the Coinbase ecosystem, that is currently still in beta form. The platform allows users to connect their crypto wallet to the platform, and begin to buy, sell, and eventually mint NFTs on their platform. It can be compared to the NFT platform, Opensea, an American online NFT marketplace platform. Both the Coinbase NFT platform and Opensea allow for the Ethereum (ETH)-based NFTs to be minted.

Coinbase customers can use the native Coinbase NFT platform and leverage the Coinbase Wallet as well. The Coinbase Wallet is a cryptocurrency wallet that allows users to store their cryptocurrency and NFTs. As digital assets continue to gain popularity and, as a result, see an increase in allocation within portfolios, investors have a fiduciary responsibility to ensure they understand the ever-evolving digital assets landscape. This is especially important, considering the close relationship between thematic investing and the digital experience.

Ethereum “Merge” Changing the Future of Crypto

One of the upcoming major changes in the blockchain space is the upcoming merge on the Ethereum network. Ethereum will be merging from “Proof of Work” to “Proof of Stake”. These are two forms of consensus mechanisms that are key commentators on blockchain technology and share space in the news as to which is better. To learn more about the merge, reference this New York Times article.

The merge has been a significant bright spot for the crypto industry during a time when enthusiasm for crypto and digital assets has chilled (the previously referenced “crypto winter”). Many see this cooling-off period as an opportunity for years to come and positioning to benefit from this thematic approach could reap tremendous benefits and dividends. The rise of crypto-based asset managers and financial advisors is expected to fuel this growth.

Commenting on the crypto market, Erik Smith of 401 Financial, a Registered Investment Advisory firm, said, “In the depths of another bear market in crypto asset prices, innovation and global adoption across the crypto ecosystem continue to grow exponentially. With each new cycle comes new use cases of blockchain and the previous cycle was no different as Non-Fungible Tokens (NFTs) and web3 communities burst onto the scene. In our view, it’s likely that tokenization is in its early stages of unlocking entirely new asset classes that were previously illiquid. We’re excited about the possibilities that blockchain scaling solutions provide and continue to keep a close eye on developments in decentralized finance (DeFi), decentralized autonomous organizations (DAOs), and web3.”

As the digital experience becomes more ingrained in the day-to-day lives of consumers, adoption of these technologies and experiences is expected to accelerate. As a result, the number of thematic, digital experience-based ETFs that in the marketplace will increase. With social media, mobile gaming, and video game providers boosting customer retention in the years to come, more investing possibilities will arise.

Enjoy reading this article? Other content worth your time:

- Getting paid…in Bitcoin?

- The Future of Machine Learning in FinTech

- Beach Bum or Desk Jockey

- Harley Davidson, Sustainability, and ESG

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

- The Appeal of Thematic Investing

To connect about media inquiries or to discuss the article, please email Andrew at: andrew.unthank@thinklogicly.com