andrew.unthank@thinklogicly.com

“Sustainability is no longer about doing less harm. It’s about doing more good.”

-Jochen Zeitz, President and CEO of Harley Davidson.

Harley Davidson, an American motorcycle company that was founded more than 100 years ago, is a pillar of sustainability, despite the rebellious imagery often associated with the company. Since its founding in 1903, it has endured more than a century’s worth of world events such as the Great Depression, two World Wars, a reputation crisis, labor strikes, poor economic conditions, a Global Financial Crisis, and multiple organizational restructures. While showcasing its adaptability to the ever-changing environment around it, Harley Davidson provides a blueprint on how sustainable investing can work and drive change, quite literally.

What is sustainability investing?

Sustainable investing is defined as a way for firms and investors to achieve financial returns while also delivering a positive impact on society in the long-term. With environmental, social, and governance (known as “ESG”) top of mind for advisors and investors, it will pave the way for investment decisions that are for the betterment of society.

In our recent article, ‘Women, Millennials and Financial Planning’, we had highlighted how millennials choosing to invest in a socially responsible manner will drive future growth of ESG strategies. This specific investor demographic focuses on environmental and social justice issues and look for investment strategies that are aligned with these personal values. Encouraging companies to adopt sustainability practices inspires and empowers confident outcomes that go beyond investing trends and the goods or services a company provides.

The rise of ESG investing principles has pushed companies to take a thorough look at business practices to see the impacts they create. And where these impacts are negative, the company’s will recalibrate the course forward, while amplifying positive impacts. This guides investors in identifying the sustainable progress a company has made, and how well positioned the company is for long-term sustainability.

Boston Consulting Group notes that, “Capital markets have seen tremendous growth in ESG-related assets under management, and they are projected to rise from $35 trillion in 2021 to $50 trillion globally by 2025.” This projected four-year growth is impressive and points to an ongoing trend, at least with younger investors (Gen Y and Gen Z, and in some corners of Gen X). This trend boils down to: invest following your own set of values.

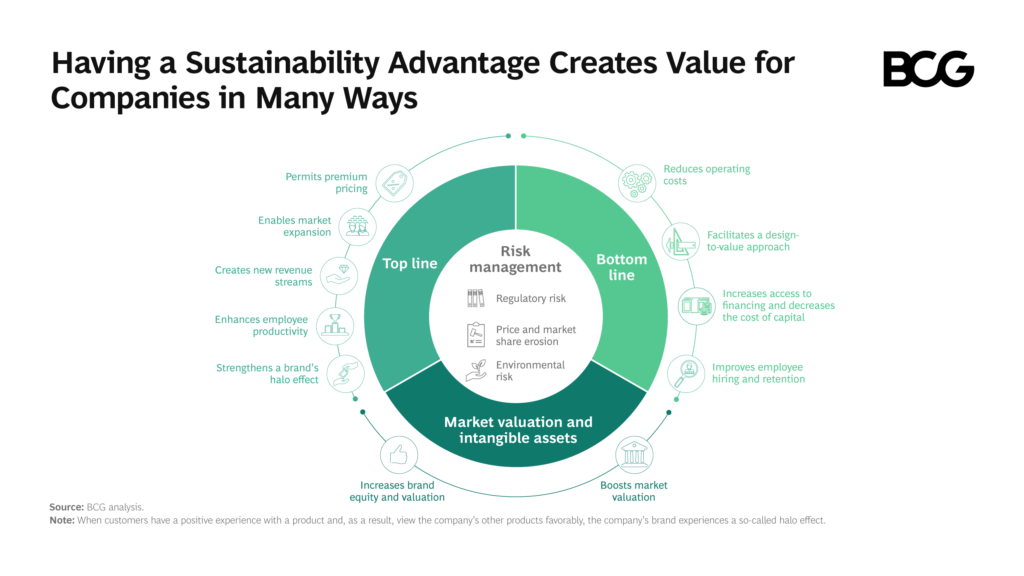

Even so, sustainability at a corporate level has been a more wishful statement than applied practice. Quarterly reports and other shorter-term objectives often get in the way of longer-term, strategic goals. Aligning the board’s interests with those of shareholders, and in a sustainable context can be challenging, with often-competing interests. Overcoming these organizational obstacles means aligning the company’s strategic vision with value-creation driven by sustainability improvements.

The below graph from BCG illustrates the value-add across an organization that adopts a sustainable philosophy.

ESG, the place to be?

A recent Financial Times article noted how former US Vice President Al Gore played a key role in raising awareness of the growing climate crisis by bringing it to the global public’s attention. Increased climate change awareness ushered in the current ESG investing trend. While sustainable investing and ESG are often viewed interchangeably, criticism of ESG as an investment strategy has spiked.

As with anything that hints at controversy, ESG investing has its fair share of proponents and detractors.

BlackRock and Vanguard, two of the largest global asset managers, have somewhat differing views of ESG. BlackRock is touted as an ESG leader in the industry with its self-fulfilling declaration that ESG was the way of the future. Notably, ESGU, BlackRock’s industry-leading ESG ETF, saw record inflows after it was added to BlackRock models. This, even though the ETF quietly held positions in CHV and other non-ESG friendly names while the bulk of its assets were invested with ESG-friendly firms. Vanguard has taken a different approach on how they view sustainable investing. Vanguard, more directly, refused to sever ties with new fossil fuel investments, making clear its goal of maximizing long-term total returns for clients. The fund giant did note that while climate change is a material risk, in its view, it’s only one factor in the investment decision-making process.

With two ETF industry leaders having somewhat differing views of ESG and sustainable investing, it’s not surprising that advisors may be confused about how to best serve clients, particularly those interested in ESG and sustainability.

Best supporting role goes to…

Fixing the climate crisis is not a responsibility borne solely by the financial services industry, or by any other sector, for that matter. That said, the financial markets have an opportunity to play a leading role in supporting sustainability and creating positive impacts about environmental issues facing the world today.

Tariq Fancy, former BlackRock CIO of sustainable investing, quoted in the previously mentioned FT article, is concerned that by 2070, barely live-able hot zones may rise from 1 percent of the Earth today to nearly 20 percent, leading to mass starvation and migration. To avoid this catastrophic scenario, everyone — governments, individuals, investors, businesses — needs to act.

Impact investing will continue to have a seat at the investment strategy table for the foreseeable future, regardless of the future of ESG. Advisors can expect more ESG regulation in the coming years, in part around labelling. Supporting this, the SEC announced in March that it plans to launch a regulated framework to create more transparency about ESG investing. Clarifying ESG investing will give the financial services industry an opportunity to be part of the solution for issues impacting the world today and tomorrow.

While it will take time for these regulations to be enacted, developing a plan to bridge today’s sustainability issues with the future is imperative. Having an acute understanding of the impact, positive or negative, of the company will allow it to uncover strategies or solutions to safeguard its future sustainability. By successfully addressing sustainable objectives, companies will build toward a better tomorrow, one where advisors can personalize investment decisions that align with each client’s personal values. And financial advisors tell us that they use LOGICLY, including our powerful Fund Screener, to find ETFs or funds that fit a client’s values. Investing the way clients want.

Now that’s a sustainable practice!

See other useful content for advisors including:

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

- The Appeal of Thematic Investing

- Using the LOGICLY Tax App to Increase Tax Alpha & Efficiency

- How to Win More Business with the Efficient Frontier

- Why You Should Analyze Fund Regressions BEFORE Choosing ETFs or Funds

To connect about media inquiries or to chat about the article, please email me at: andrew.unthank@thinklogicly.com.