By: Andrew Unthank

As we near the end of summer 2023, the discourse around Artificial Intelligence (AI) remains at the forefront, gaining momentum as we shift from Q3 to Q4.

Throughout human history, technological advancements have often driven society towards greater efficiency for the collective good. Yet, the path to such streamlining is fraught with challenges, a notable example being the introduction of the internet.

Initially, many dismissed the internet as a fleeting trend, predicting it might vanish as swiftly as the dodo bird. However, two decades later, it has become an indispensable part of daily life for countless individuals worldwide.

AI: The New Internet Era for Modern Industries

With the renewed emphasis on the AI discourse, we seem to be at a juncture similar to that of the early days of the internet, where real-world applications of this groundbreaking technology will profoundly shape our existence.

While it may take a while to fully realize its implications, a wide range of industries, from fast food to financial services, are already sensing the impact of not just the AI conversation but its actual integration into their operations.

Recalling the internet’s surge in the late 1990s and early 2000s, we stand on the cusp of a technological revolution, primarily driven by generative artificial intelligence. Grasping how this emergent technology fits into one’s field will be crucial to ensure that both individuals and organizations don’t lag in the tech race.

This is especially critical for financial service professionals. Both institutional and retail firms that invest in cutting-edge technology will be best positioned to capitalize on the growth driven by this technological wave.

AI’s Footprint in Financial Advisory: Balance Between Optimism and Caution

At LOGICLY, throughout 2023, we’ve explored the significance of AI from various perspectives, such as in our article “How AI Portfolios Are Redefining the Investment Landscape”. This piece delves into the concept that AI Portfolios offer a smarter approach to investing and highlights the collaborative synergy between AI and financial advisors.

However, not all financial professionals see the advantages of AI. In “Why Some RIAs Say ‘No’ To AI”, we investigate the nuanced reasons some financial advisors might not view AI as a solution. The article suggests that those hesitant to adopt this technology are often concerned about fees rather than planning and rebalancing advice.

In a time when fees are steadily decreasing and M&A activity in the advisory sector is on the rise, possessing a competitive edge becomes crucial to remain relevant and thrive.

Echoing our insights, a recent Fox Business article emphasizes that the technological strides powered by AI won’t eliminate advisors. However, the roles within firms are likely to evolve.

Fox Business features insights from Lee David, Chief Analytic Officer at Morningstar, who envisions the 2030 landscape where the majority of wealth management clients will expect a data-driven, highly personalized advisory service — yet still value human interaction.

As David notes, “We’re dealing with people’s livelihoods — their nest eggs, their kids’ college funds.” He further mentions that financial advisors will still have a role, but many of their current tasks will be enhanced with AI.

Beyond Numbers: Where AI Meets Tomorrow’s Trends

Morningstar’s endorsement of the expanding role of AI in the financial sector underscores its importance to industry leaders. Crafting strategies that effectively harness the right facets of AI is becoming increasingly vital, particularly in the financial services realm.

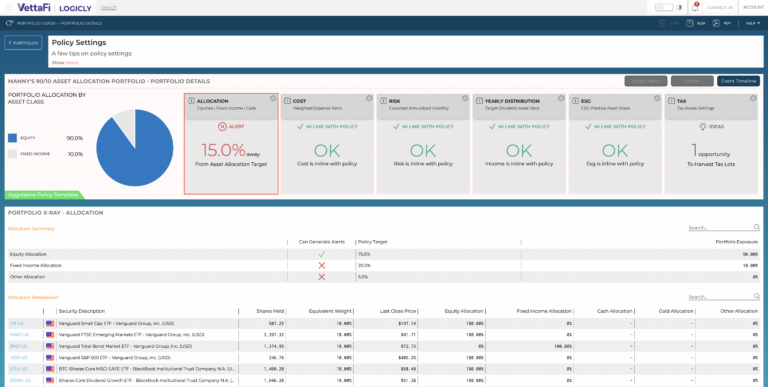

As a part of the VettaFi ecosystem, LOGICLY underscores the transformative impact of AI on the financial world, as exemplified by tools like our LOGICLY Portfolio Coach. This tool harnesses AI to refine the monitoring of Investment Policy Statements (IPS).

The 2023 financial landscape is a mosaic of AI’s transformative potential. Investment management is no longer just about human intuition but involves a symphony of data-driven decision-making algorithms that adjust in real-time.

Risk management, once a reactive domain, is heading towards predictive and adaptive horizons, thanks to AI. But the influence doesn’t stop there. The largest of corporations are reshaping their strategies, leveraging AI not just as a tool, but as a core driver of growth and efficiency.

And as AI integrates deeper into our systems, strategies driven by AI’s discerning eye are rising, offering unprecedented adaptability in volatile markets.

This transformative journey and its broad implications will be part of the discourse at VettaFi’s AI Symposium on August 30th, 2023. As we prepare to transition into Q4 of 2023, it’s evident that the discourse on AI will only intensify. The question is: will you be apart of the continuing conversation?

Enjoy reading this article? Other content you may find interesting:

- How to Navigate the Complexities of Tax Loss Harvesting

- 5 Must Know Strategies for Mastering Tax Season

- Solving the Challenges of Regulatory Compliance for Advisors

- ETFs and Volatile Markets

- 5 Ways to Implement ESG Investing into Your Practice

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

To connect about media inquiries or to discuss the article, please email Andrew Unthank at: andrew.unthank@thinklogicly.com

Think LOGICLY.