By: Dounya Hamdan

dounya.hamdan@thinklogicly.com

One of the key responsibilities of financial advisors is to help clients navigate the complex world of taxes. Taxes can have a significant impact on a client’s overall financial plan, and by proactively developing tax-efficient strategies, advisors can help clients minimize tax liabilities and maximize after-tax returns.

In this article, we will discuss how LOGICLY’s tax-aware intelligence tools equip advisors with the necessary resources to implement a year-long approach to tax-loss harvesting for their clients.

This offers advisors more time to navigate TLH intricacies while adhering to regulations and aligning with long-term objectives, ultimately enhancing a client’s investment strategy and achieving greater tax efficiency.

Identifying Potential Investments for Tax-Loss Harvesting

Tax-efficiency is one of the key elements in effective portfolio management. During the life of a portfolio there are two essential elements that advisors should consider when implementing tax-management strategies: (1) tax deferral and (2) tax loss harvesting (TLH) opportunities.

Successfully realizing TLH opportunities within client portfolios is not easy. Advisors should have a solid foundational understanding of the risk profiles of their clients and of the securities they select. Knowing how to exploit losses within the portfolio can determine an advisor’s ability to meet or exceed objectives.

The goal is to identify securities that have decreased in value and can be sold to realize a loss for tax purposes.

Here are a few factors to consider when identifying potential TLH candidates:

- Market Conditions: Analyze market trends and individual securities’ performance to identify undervalued assets.

- Investment Horizon: Factor in the client’s investment horizon when identifying TLH candidates. Clients with a longer-term horizon may hold on to undervalued securities, while those with a shorter-term horizon may sell for tax benefits.

- Diversification: Identify undervalued securities while maintaining a diversified portfolio to reduce the risk of significant losses in any one security.

- Risk Tolerance: Take into account your client’s risk tolerance when selecting TLH candidates. High-risk investors may choose to invest in undervalued securities, while low-risk investors may prioritize minimizing potential losses.

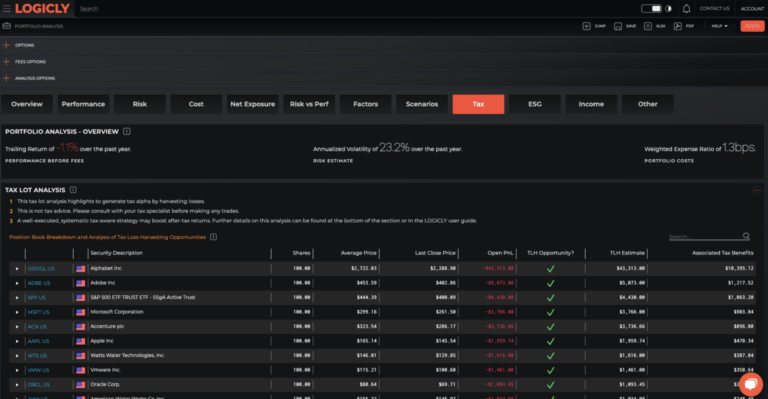

At LOGICLY, we have developed a tax-aware tool within our Portfolio Analysis suite. With this tool, advisors can answer tough questions around the tax situation of a client’s portfolios. This is especially important when there are questions like, “If I take a loss but don’t want to be in cash, what should I do?”.

Our Tax-Aware solutions enable advisors to take a more active approach in tax-efficient investing, and to systematically uncover TLH opportunities across all accounts.

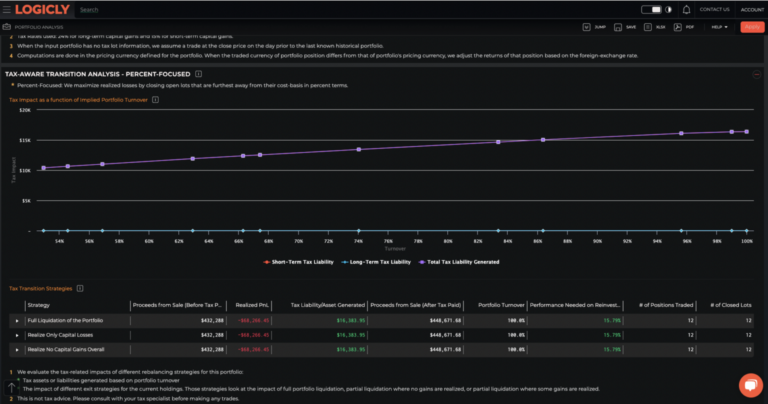

For instance, the ability to run and view tax transition analysis on a percentage or notional basis allows advisors to take an active approach in tax-efficient investing. Implementing a TLH strategy in the first stages of the portfolio can generate Tax Alpha, by deferring gains or losses over the life of the portfolio.

Using tools that increase after-tax wealth gives advisors a significant differentiator in improving existing client relationships and prospecting for new clients.

Balancing TLH Limitations

As with any tax-related topic, there are rules and limitations that should be considered when engaging in tax-loss harvesting. For example, when implementing TLH, it’s important to understand the restrictions on using specific types of losses to offset certain gains.

The IRS requires that long-term losses be applied first to long-term gains, and short-term losses be applied first to short-term gains. Long-term gains are gains on assets held for more than a year, while short-term gains are gains on assets held for one year or less.

By applying losses to the corresponding type of gain, advisors can maximize the tax benefits of the loss while minimizing their client’s overall tax liability. If there are excess losses in one category, these can then be applied to gains of either type.

However, advisors should also be mindful of the wash-sale rule when engaging in tax-loss harvesting. This rule prohibits investors from selling a security at a loss and buying the same or a “substantially identical” security within 30 days before or after the sale.

By carefully selecting securities to sell and avoiding purchases of substantially identical securities within the wash-sale period, advisors can optimize the tax benefits of tax-loss harvesting while complying with IRS regulations on behalf of their clients.

Another instance of a potential limitation in tax-loss harvesting is that if losses are harvested, the investor’s cost basis in their portfolio is reduced by the amount of the loss, potentially resulting in an additional capital gain equal to the loss that was harvested earlier. The net outcome for the investor depends on their tax rate when they deduct the initial loss and the rate at which they realize the later gain.

When it comes to complex and complicated concepts like tax alpha and tax loss harvesting, technology should play a central role. LOGICLY gives advisors the much-needed tax information to facilitate conversations with clients including:

- Review tax considerations at a tax-lot level

- Evaluate and compare the impact of the exit strategy

- View the tax-related impact of transitioning out of the current portfolio

- Generate proposals for new and existing clients

By understanding the limitations and regulations surrounding tax-loss harvesting, advisors can create a comprehensive investment plan for their client that aligns with their financial goals and maximizes tax efficiency.

The Impacts of Tax-Advantaged Accounts

When considering tax-loss harvesting strategies, it’s important to take into account the impact of other tax-advantaged accounts on its effectiveness. Accounts like 401(k)s and IRAs operate under different tax structures than traditional brokerage accounts, making it impossible to utilize losses generated from these accounts to offset taxable gains.

In a 401(k) or IRA, contributions are made with pre-tax dollars, meaning taxes are deferred until the account holder begins making withdrawals. As a result, any losses incurred within these accounts are also deferred and cannot be utilized for tax-loss harvesting.

However, it’s still important to manage these accounts tax-efficiently. For example, traditional IRA withdrawals are taxed as income, so taking advantage of lower tax rates during retirement can save a considerable amount of money.

On the other hand, Roth IRAs are funded with after-tax dollars and offer tax-free withdrawals in retirement. In this case, managing withdrawals in a tax-efficient manner is essential to maximize benefits.

Ultimately, tax-loss harvesting is most effective in taxable brokerage accounts. However, advisors should still be mindful of the tax implications of other accounts and develop a comprehensive tax strategy that takes all accounts into consideration.

The Bigger Picture

Overall, tax-loss harvesting can be a useful strategy for advisors looking to achieve greater tax efficiency in their clients’ portfolios. However, it’s crucial to approach TLH with caution and carefully consider the potential limitations and risks involved.

While TLH can be a valuable strategy for advisors, it’s important to remember that not all losses are created equal. Realizing losses on a single security may seem attractive in the short term, but it’s essential to consider the broader impact on the portfolio’s risk profile and allocation.

By taking a holistic approach to tax-loss harvesting and considering the big picture, advisors can achieve better long-term outcomes for their clients and reduce the overall tax burden on their investments.

Enjoy reading this article? Other content you may find interesting:

- 5 Ways to Implement ESG Investing into Your Practice

- The 5 Keys to a Successful Advisor-Client Relationship

- Get Prepared for Reg BI Enforcement in 2023

- Cryptocurrency and the Rise of Custodied Assets

- The Future is Here: How Thematics is Disrupting Investing

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

To connect about media inquiries or to discuss the article, please email Dounya at: dounya.hamdan@thinklogicly.com