By: Dounya Hamdan

dounya.hamdan@thinklogicly.com

For many of us, not only do the 90s spur nostalgia, it’s also coined as the most “advanced” pre-Web era in terms of culture. It’s the decade that launched an increasingly popular investment vehicle, ETFs.

On January 22, 1993, State Street Global Investors released SPDR S&P 500 Trust ETF (Ticker: SPY), which tracks the Standard & Poor’s 500 index (S&P 500).

SPY initially launched with close to $7 million in securities. Fast forward to today, where the ETF universe has surpassed $6.5 trillion in AUM.

Growth like this shows that the still fast-growing ETF market continues to expand and accelerate popularity with investors across demographics.

As with any hot-growing product in the investment industry, the oft-asked question: what exactly are ETFs and can they withstand today’s volatile market?

WTF are ETFs?

Simply put, an ETF is an exchange-traded fund that is made up of a basket of securities which investors buy or sell through a brokerage firm on a stock exchange.

U.S. Large Cap ETFs comprised many of the early ETFs. Today, this has dramatically risen, with more than 4,600 ETFs currently trading on US stock exchanges, offering exposure to other sectors, asset classes, and markets around the world.

Index ETFs, like VNQ (Vanguard Real Estate Index Fund), allow investors to track specific indexes like the S&P 500. Fixed Income ETFs, like AGG (iShares U.S. Aggregate Bond ETF), give investors exposure to fixed income investments like bonds including municipal, high yield, corporate, US Treasury and more. Sector and Industry ETFs, like XLK (Technology Sector SPDR), follow specific industries like tech, financials, health and energy.

Unlike Mutual Funds, ETFs provide investors with more flexibility when it comes to navigating the markets. Investors can buy and sell ETFs just as they would individual stocks, throughout the trading day. Note: there are some ETFs, like SPY and QQQ that trade 24 hours a day.

ETF: Exposure, Transparency, Flexibility

ETFs have enjoyed immense popularity for their passivity, which gives advisors the ability to follow a market without much effort.

With the explosion of ETFs, investors are able to view markets through either a macro or micro lens.

As ETFs continue to evolve and provide investors with access to markets around the world, these are the four key advantages that have remained unchanged:

- Flexibility: ETFs are bought and sold throughout the day when markets are open. Share prices fluctuate during the day, giving investors flexibility to trade at any point during the day, with laser precision about bid/ask prices.

- Portfolio Diversification: ETFs provide investors with the ability to invest in a majority of asset classes, various commodities, and currencies. ETF shares offer exposure to many sectors, industries, and countries worldwide. Diversification is important to investors in managing portfolio risk.

- Lower Costs: ETFs can be passively managed offering low expense ratios and streamlined operational costs. Another cost saving feature of ETFs is the lack of redemption fees.

- Tax Efficiency: Investors who sell individual stocks realize capital gains (assuming the stock has appreciated) once sold. ETFs are more tax efficient when it comes to capital gains tax, as the investor realizes a gain when he/she sells the ETF position, not when the fund sells underlying positions.

With these key advantages, ETFs can meet the expectations of clients who are looking for flexibility and transparency when it comes to their investors.

The key question is: can ETFs rise to the occasion when volatility continues to wreak havoc amongst today’s markets?

ETFs and Volatile Markets

The 2022 stock market has taken a beating since the early part of this year and it has been one of the most volatile markets to date. Rising inflation rates, a growling bear market, the S&P 500 nearly dropping twenty percent, and tighter monetary policy continue to spook investors.

Volatility has become synonymous with 2022, and investors and advisors alike, are holding their breath in suspense for what’s to come in 2023.

So, are ETFs a great investment choice during these unpredictable times?

With broader exposure to various markets, investors have turned to ETFs to better manage risk and allocate to thematic investments.

For many investors, challenging market conditions call for investments that are less risky and more liquid. ETFs are popular with investors for their ability to be easily bought and sold on the exchange market.

Secondary market liquidity sets ETFs apart from other investments in that it provides investors the ability to issue or withdraw shares on the secondary market depending on the investor supply and demand.

As for the primary market, broker-dealers can overcome supply and demand imbalances by creating new shares in the primary market. As of March 2022, primary market order numbers have been over 200% higher than normal.

ETFs have proven to lay a strong foundation in client portfolios and act as a source of stability during these tough times.

So Many ETFs, So Little Time…

As the popularity of ETFs continues to grow with more and more funds hitting the streets, it may become much more difficult to sift through all the choices to find what’s best for clients.

It’s necessary for advisors to have future-proof technology, like LOGICLY, to have a competitive advantage and to aid their clients in choosing the right ETF for their portfolio.

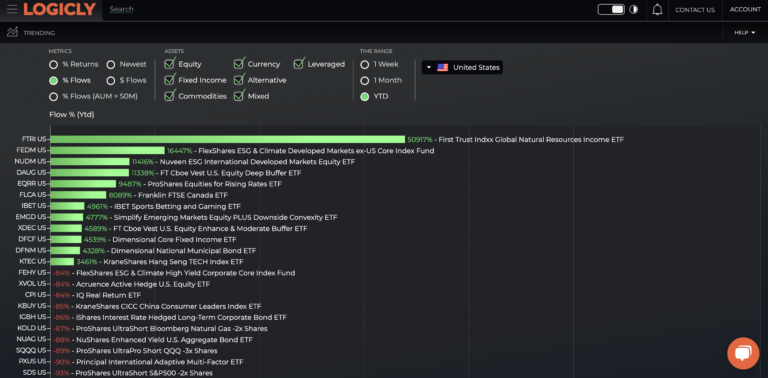

LOGICLY’s ETF Top Trends gives insights into what is driving a particular market by viewing top ETF trends by asset class and key metrics like returns and flows on a weekly, monthly and year-to-date basis.

Having the ability to track and understand trends within the financial market place is essential when building and managing a diversified portfolio.

Investors continue to find ETFs as a useful tool to present their views on thematic investing and which specific markets they want exposure in.

ETFs are one of the few investment tools that provide access to everyone when it comes to prices and fees. Advisors can take this opportunity to guide their clients in understanding the purpose and methodology behind ETF’s, the underlying securities’ liquidity and which funds align with their overall values.

Enjoy reading this article? Other content you may find interesting:

- Getting paid…in Bitcoin?

- Deflation: A Different Kind of Deflate-gate

- A Friend Request from Your Advisor

- Cryptocurrency and the Rise of Custodied Assets

- The Future is Here: How Thematics is Disrupting Investing

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

To connect about media inquiries or to discuss the article, please email Dounya at: dounya.hamdan@thinklogicly.com