dounya.hamdan@thinklogicly.com

Two things on almost everyone’s holiday wish list this year: financial independence and peace of mind. Of course, these wants (some would say “needs”) may come with a high price tag and much needed guidance and support.

This leads to two key questions for financial advisors:

- What does this mean for advisors whose clients have these financial expectations?

- Are these goals attainable for everyone?

Financial Independence vs Retirement

Recently, Franklin Templeton surveyed U.S. workers who are re-evaluating work and retirement and the majority of respondents (84 percent) stated that “I am more focused on becoming financially independent than on traditional retirement.” Seventy-six percent said financial independence is a primary objective.

Financial independence may be defined differently for each individual and often shows up in the below approaches:

- Spending less and/or saving more (some choose one or both tactics)

- Leaving a corporate job for freelance work

- Searching for opportunities for passive income (real estate, investments)

These choices supplement savings accounts. While budgeting is important, financial planning is mandatory when it comes to charting a course for long-term financial independence.

Retirement is different.

Quite literally, it is the “action or fact of leaving one’s job and ceasing to work” and the traditional view is that it happens around the age of 65 in the U.S.

The topic of retirement prompts visions of holding a refreshing, colorful drink while blissfully walking along a sun-drenched beach in Florida, or soaking up the sun’s rays while lounging in a chair watching waves lap ashore. The thought of never having to obey an alarm clock for work again because the financial and investment plan worked is priceless.

It begs the question: Does this version of retirement still exist or has it become a fantasy thanks to economic issues and quality of life expectations?

Which version of retirement best suits your client?

The COVID-19 pandemic has reshaped our lives, specifically our relationship with work and careers. With the ongoing change in how we choose to live our lives, it’s inevitable that it will impact our future retirement plans. Retirement may still bear a standard definition as noted above, but like everything else, a “new normal” is happening.

Three types of retirement strategies

- Traditional retirement

- Semi-retirement

- Temporary retirement

Traditional retirement, as noted above, is when a person exits the workforce and begins life as a retiree. The income flow from salary will cease and will be replaced by income generated from savings and investments.

Semi-retirement is for individuals who choose to leave their current position and find another job with a steady income, usually working fewer hours. For some clients, this is driven by a need to continue to receive income from external sources; for others, it’s as much about not being bored as anything else. With more time for relaxation and a life of leisure, some clients can find the transition challenging.

Temporary retirement works well for those who choose to take longer periods of time (in some cases, up to a year or more) to vacation or follow other interests and activities, while at some point returning to an income-producing position. This arrangement often appeals to individuals who have found an “encore career”, which is defined as a second vocation beginning in the latter half of life. Often this can take the form of part-time consulting arrangements.

Advisors can be more than just an investment advocate for clients by discussing these retirement strategies to best determine which suits the client’s current lifestyle and future goals. With more open and honest discussions, the better the financial planning process will be for both the advisor and client in planning for, and achieving, retirement goals.

What About Inflation…

Current economic conditions have produced the highest inflation rate since 1981. With a growing chance of a recession, most clients, particularly those approaching/in retirement, are worried about their future financial status. Retirees who are no longer receiving a salary are often impacted the most when the cost of living increases for goods and services.

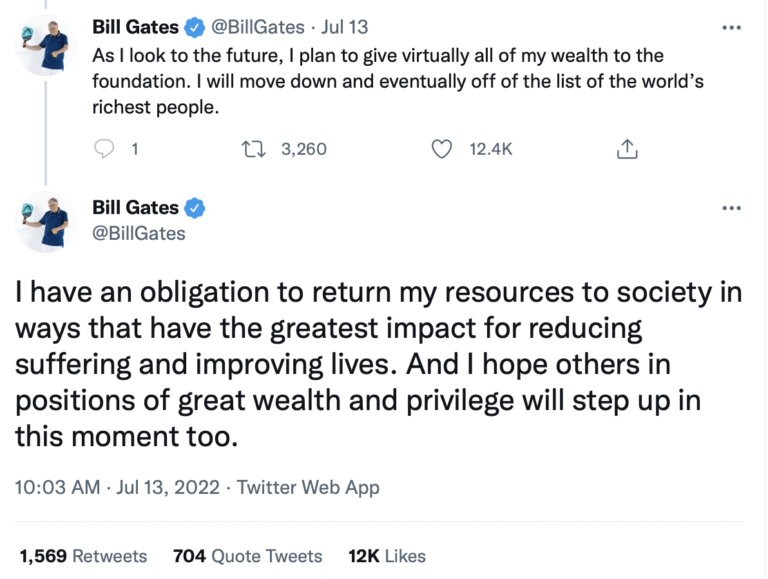

A retiree’s worst nightmare (running out of money) is Bill Gates’ philanthropy dream come true. In July, he announced his pledge to give away “virtually all of my wealth to the foundation” (the Gates Foundation, that is), in an effort to drop off the list of the world’s wealthiest people by giving to causes that reduce suffering and improve lives. For most of the people on the planet, we can only dream of having too much money, and needing to find an outlet to give it away.

For retirees, their main source of income comes from investments, Social Security, pension checks, 401(k)s, and IRAs. With inflation on the rise (the July CPI reading printed at a lofty 9.1 percent), a retiree’s expenses are increasing. Even with stock exposure in their investment portfolios and its potential for long-term growth, it may not keep up with the rise in cost of living and the longer-than-expected (based on actuarial tables) average life expectancy of retirees.

Returning to the workforce may not be a desired choice, specifically for traditional retirees, but it may be necessary to find peace of mind. Further, and this is where an advisor’s knowledge and experience is invaluable, doing a comprehensive review of the client’s investment portfolio to find answers to the main question: “Am I going to make it?”

Peace of mind…please and thank you

A question on every retiree’s mind is: “Do I have enough?

Peace of mind can be difficult for clients when facing the burden of carrying debt that could derail the client’s financial plan and investment strategy supporting retirement. A client’s overall well-being is closely linked to their financial health.

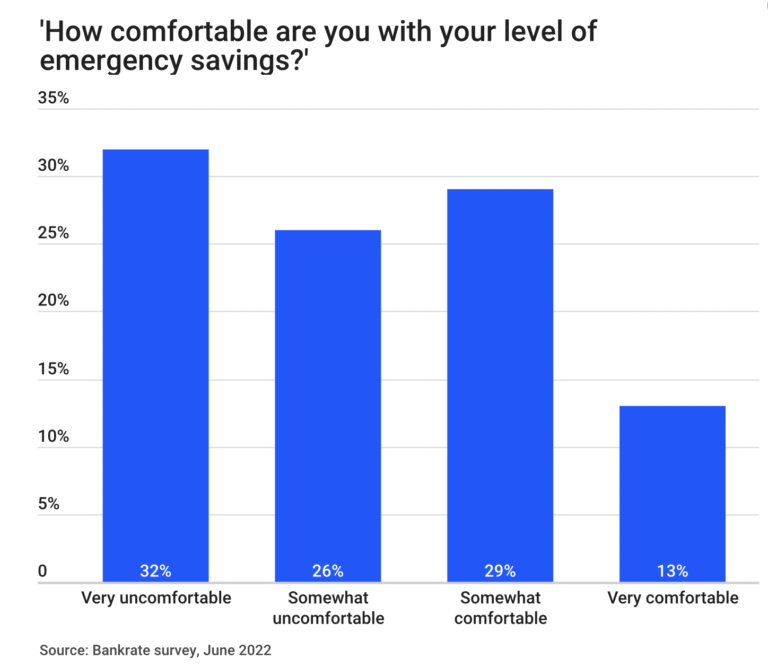

In a nationwide Bankrate poll, more than half (57 percent) of the 1,025 adults surveyed are uncomfortable with how much they have in emergency savings.

On average, Americans spend 20 years in retirement, approximately one-fourth of their entire life. That is a pretty generous piece of our life yet the majority of Americans haven’t calculated how much they need to save for retirement.

Advisors can assist clients in managing and overcoming financial stress by connecting them with educational resources and planning strategies to deal with burdensome debt. Financial security can be strengthened with knowledge. In moments of uncertainty and stress, advisors can engage clients and improve the advisor-client relationship by educating, informing, and guiding clients in making decisions that restore balance and perspective.

Clients can save money every year, but that is only part of the retirement equation. It’s also how clients allocate investments to prepare for approaching retirement. Setting aside time to go over a client’s employment benefits and retirement savings plan is integral to overall long-term financial planning – from maximizing 401(k) contributions to making IRA investments.

Rebalancing Financial Independence and the Future

“Lost time is never found again.” – Ben Franklin

It can feel at times like we are running in a race against time – and it’s a race we didn’t agree to. Having a time machine handy to reverse all of the spending or lackluster investing decisions we’ve made in the past to smooth out the path to retirement would be ideal.

However, without a flux capacitor-powered DeLorean available, advisors can still take the opportunity to chat with clients and plan how to get back on track. Rebalancing allows an advisor to tweak the asset allocation or other investment policies (Risk, Cost, Income, Tax, ESG) of a portfolio or household of portfolios to match a client’s investment preferences. This is particularly important for clients approaching, or in, retirement, where needs often change.

When observing current market trends, advisors tell us how LOGICLY’s Portfolio Coach assists with tax aware rebalancing ideas, generating trade recommendations, and delivering real-time alerts that give advisors additional and more frequent touch points with clients.

Clients turn to financial advisors to set plans in place that mitigate downside risk while maintaining exposure to the markets. Every client has a personal set of challenges that require the expert hand of an advisor to navigate. And for retirees, having to determine a retirement strategy, the guidance of an advisor is invaluable in setting the long-term course, whether that means taking a part-time position, returning to work, or staying retired, but perhaps taking more risk or spending less.

Work, partially work, or retire? Tough questions that need serious answers.

See other useful content for advisors including:

- Getting paid…in Bitcoin?

- Harley Davidson, Sustainability, and ESG

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

- The Appeal of Thematic Investing

- How to Win More Business with the Efficient Frontier

To connect about media inquiries or to discuss the article, please email Dounya at: dounya.hamdan@thinklogicly.com.