By: Dounya Hamdan

dounya.hamdan@thinklogicly.com

It’s Happening…

These days, even Usain Bolt can’t keep up with how quickly we are approaching year end, and he’s the world’s fastest man.

We can’t believe that we’re less than two months away from closing out 2022 and what comes to mind is the scene from ‘The Office’, where Michael Scott is telling everyone to “Stay calm!” during Dwight’s unannounced fire-safety drill.

While economists continue debating if the U.S. is in a recession, the Fed has continued to raise rates to combat inflation, resulting in a range of 3.75-4%, which is the highest level in 15 years.

“Staying calm” may be easier said than done when it comes to investors experiencing stock market volatility, inflation, and multiple interest rate hikes. Adding to all this is determining what adjustments should/need to be done with respect to resetting goals, objectives, and financial plans.

For almost everyone, there is an insurmountable pressure to always end the year better than we have started it, but even with two months left of the year, it’s a bit difficult to predict what may happen in the markets and the economy overall.

As investors are turning to their advisors in a last-ditch effort to offset their losses, advisors can prepare their clients for year-end strategies that will transform financial pains to financial gains.

One Small Step for Markets, One Giant Leap for Investors

It may feel like it was lightyears ago when the economy was healthy, interest rates were low, and technology stocks were all the rage.

With increasing interest rates and the Nasdaq being down by 30% at the beginning of November, tech companies are experiencing an unwelcome reality check. Challenges facing tech companies:

- weak economic growth and inability to predict the economy’s direction

- lackluster earnings due to a decline in revenue

- rising interest rates and ongoing market turbulence

The question is, should investors avoid these stocks altogether or is there a silver lining in the decline?

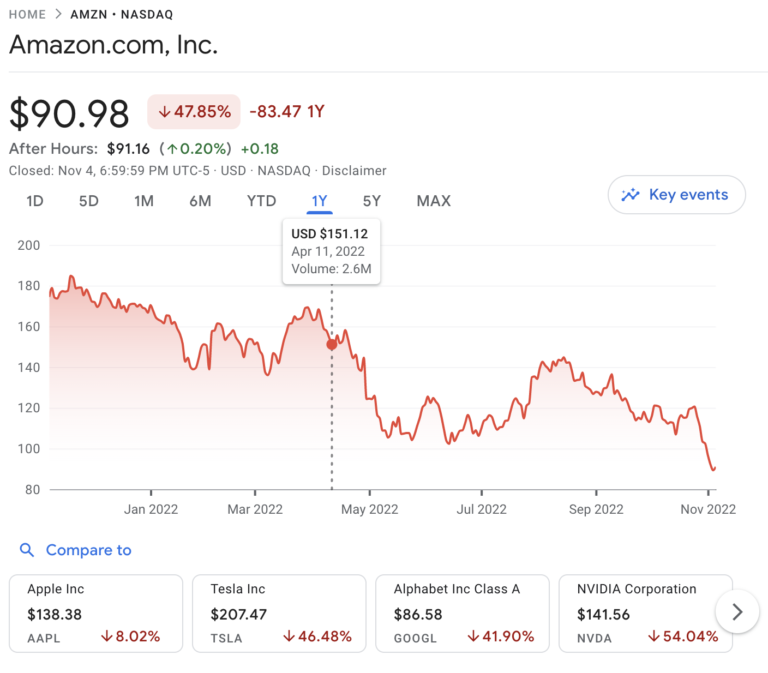

For long-term investors, this may be a great opportunity to invest in beaten-down tech-focused ETFs like Invesco QQQ Trust Series 1 (Ticker: QQQ). ETF investors can build and manage a more diversified portfolio than they could by purchasing individual stocks, such as Amazon (Ticker: AMZN), which is down by 45% year to date.

A previous article, “ETFs and Volatile Markets”, detailed the benefits of ETF investing and the four key advantages in doing so. ETFs offer the flexibility to invest in certain sectors, such as healthcare and pharmaceuticals, that have the potential to remain resilient regardless of market conditions.

This serves as a great lesson for investors to stay the course and to not “panic sell” during periods of high volatility. As history continues to repeat itself, the markets will recover.

Advisors can take this moment to steer investors away from anxiety-inducing decisions and instead empower them to make confident investment choices regardless of the overall health of the economy.

Tis’ the Season for Tax-Loss Harvesting

Heading into year-end, it’s a good time for advisors and their clients to review portfolios and assess what, if any, rebalancing is required.

Managing risk and rebalancing portfolios go hand in hand.

The markets have been unpredictable this year and with certain sectors shifting in value, investors may need to adjust their asset allocations back to target/original allocations. An investor’s goals and values, and risk tolerance, may have changed, particularly with market volatility rattling even the most experienced clients. Advisors play a key role in navigating clients through the emotional ups and downs of volatile markets to stay focused on the plan and the overall strategy, and not be influenced by potentially destructive, impulsive behavior.

As they say, the game is won in the fourth quarter and not in the first half, which means advisors need to take advantage of year-end tax saving opportunities for their advisors.

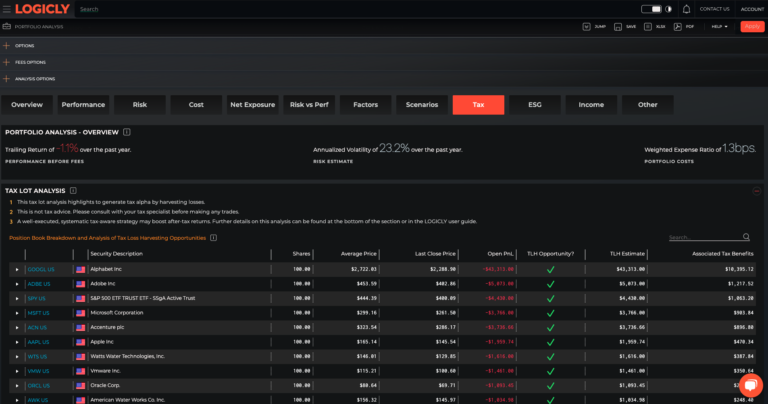

Investors can use the capital losses they’ve realized this year and apply it to any realized capital gains the following year. LOGICLY gives advisors the ability to identify TLH opportunities within a single portfolio or group of portfolios for their clients.

Advisors can guide investors in better understanding the benefits of TLH opportunities and how they can offset taxes on future gains, especially when it comes to long-term investment strategies.

No Pain, No Gain…

Recent rate hikes and their negative impacts on household debts have occupied headlines. Shining somewhat of a positive light, these increased rates also benefit the return on savings, which have reached levels of 3%.

For this current short-term pain, investors can use it to their advantage for long-term financial gain.

From online savings accounts to credit unions, institutions are trying to keep up with the central bank’s rate hikes. With liquidity top of mind for some investors, online savings accounts can be used for potential emergency fund use for households.

During unpredictable times, most financial experts recommend that households have 6 months of cash on hand to serve as a cushion for potential market downturns and shifting personal objectives.

Tying Up Loose Ends

To close out the year, advisors should meet with their clients to revisit their overall financial goals including retirement strategies. With recent market and economic news, client expenses and income may have changed from the beginning of the year, necessitating a change in the plan.

These changes, combined with shifting personal life goals and situations, may impact a client’s spending and savings habits. Advisors can lend themselves as the guard rails for their clients by giving them a sense of control over their current and future finances.

Where appropriate, when discussing a client’s retirement accounts, advisors should suggest that clients maximize contributions while also reaping the benefits of company matches. In addition, it’s a great opportunity for advisors to review the client’s personal information, and make sure that beneficiaries are all up to date.

As 2023 makes its way into the financial picture, advisors and investors alike can use these reminders to stand firm in their investment choices and to avoid allowing current market volatility to affect one’s long-term financial goals.

Enjoy reading this article? Other content you may find interesting:

- Getting paid…in Bitcoin?

- Deflation: A Different Kind of Deflate-gate

- A Friend Request from Your Advisor

- Cryptocurrency and the Rise of Custodied Assets

- The Future is Here: How Thematics is Disrupting Investing

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

To connect about media inquiries or to discuss the article, please email Dounya at: dounya.hamdan@thinklogicly.com