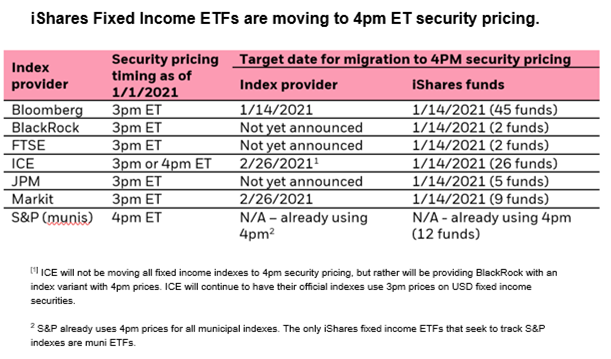

A number of Bond Index Providers are shifting pricing from 3 to 4pm, and semi-concurrently, ETF providers are shifting their NAV pricing from 3 to 4 as well.

At this point, you are asking either “What are you talking about?” or “Why do I care?” Let’s rewind: in Equity ETFs, NAV and index is determined by 4pm exchange prices for underlying stocks, which matches the 4pm-close of ETF trading. Easy. For BONDs, NAV have historically, for numerous reasons, been set at 3pm from various pricing providers. Wierd, right?

This left 1hr of ‘tracking’ every day where the ETF trades but effectively NAV and index have already been determined. As practitioners, we just accepted this as a quirk of wrapping an equity instrument around bonds, and honestly, the difference between 3 & 4pm pricing was minimal as liquidity is dead by then.

Now, with better technology and the rise in ETF trading volume, it seems this hour gap either got too much to bear or was no longer necessary. Thus, both NAV and index pricing is shifting to 4pm. (see comment)

Giving credit to a great catch by Ben Johnson, CFA of Morningstar on Twitter: https://lnkd.in/gz5Ne4M