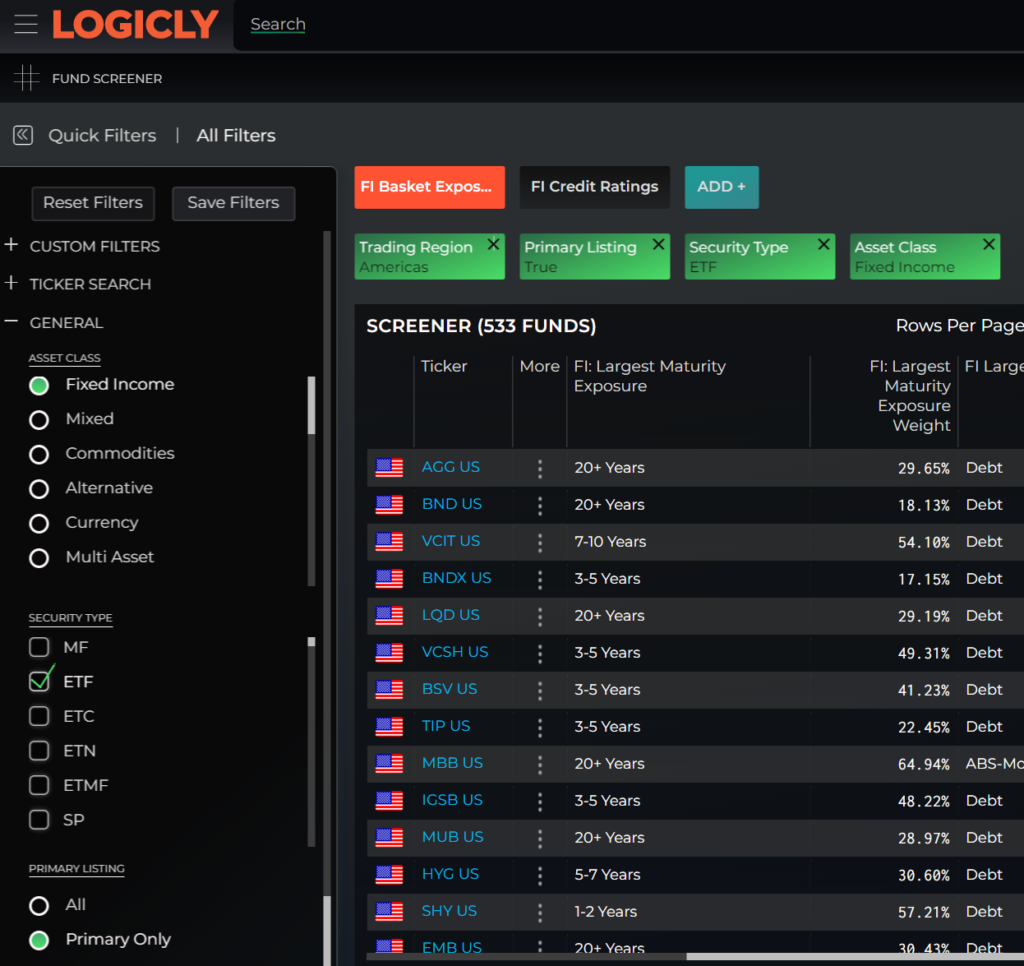

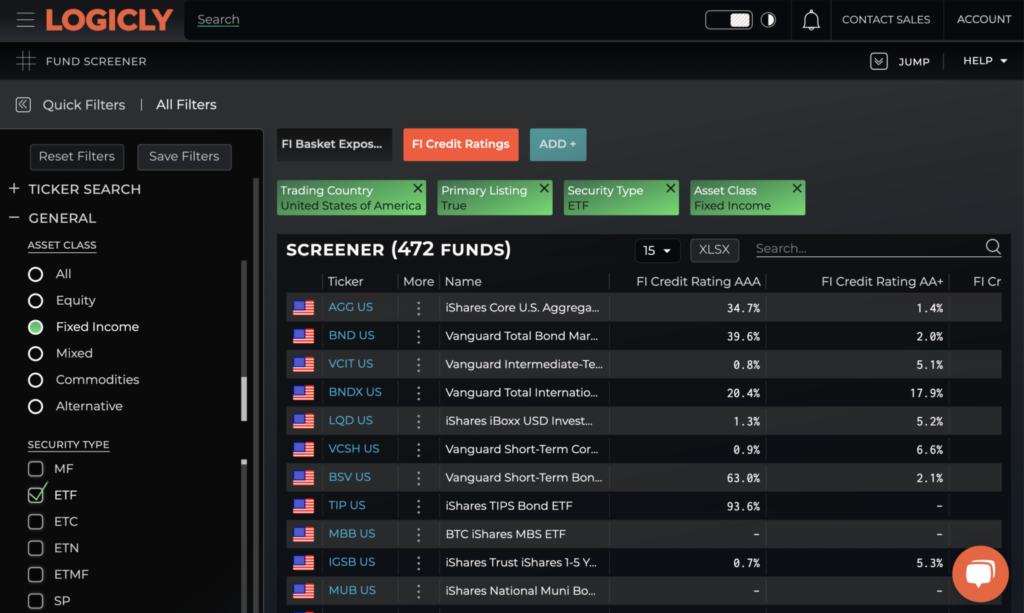

At Logicly, our mission is to deliver best-in-class portfolio workflows. So, this week we rolled out enhancements to better understand Fixed Income ETFs and Mutual Funds.

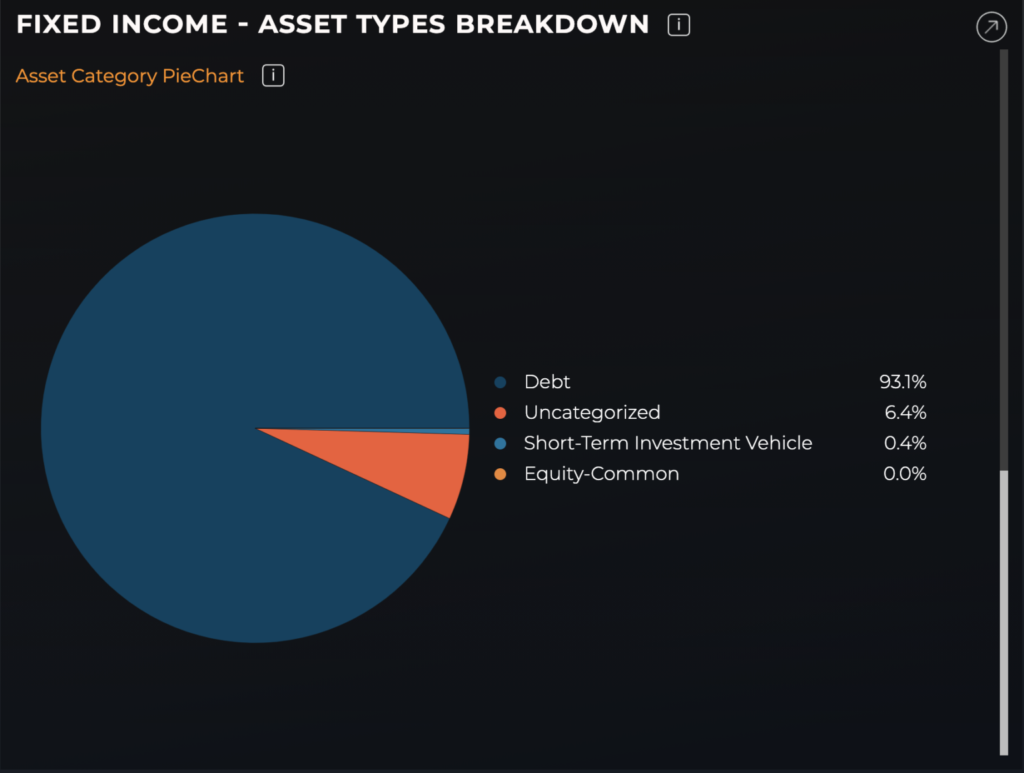

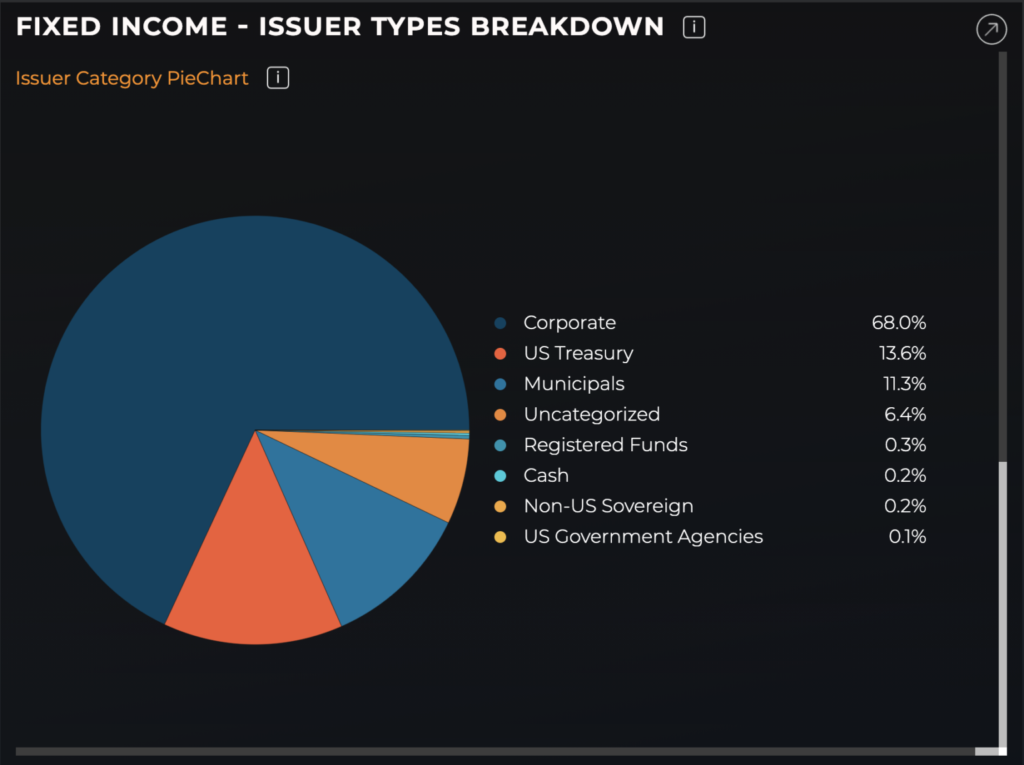

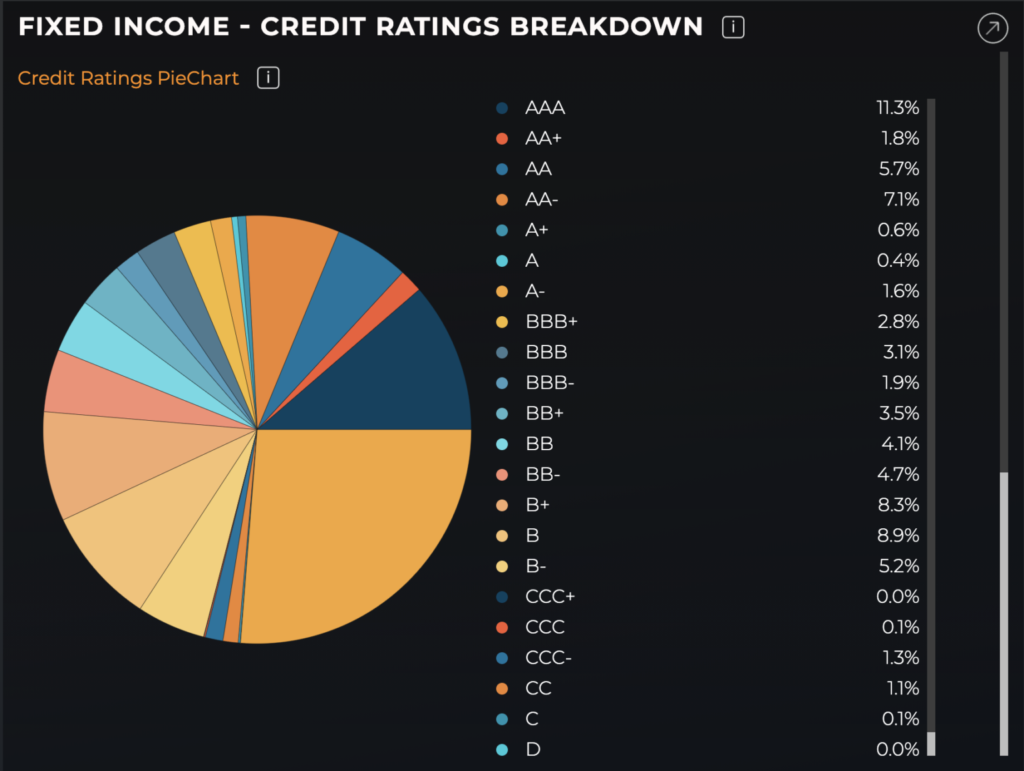

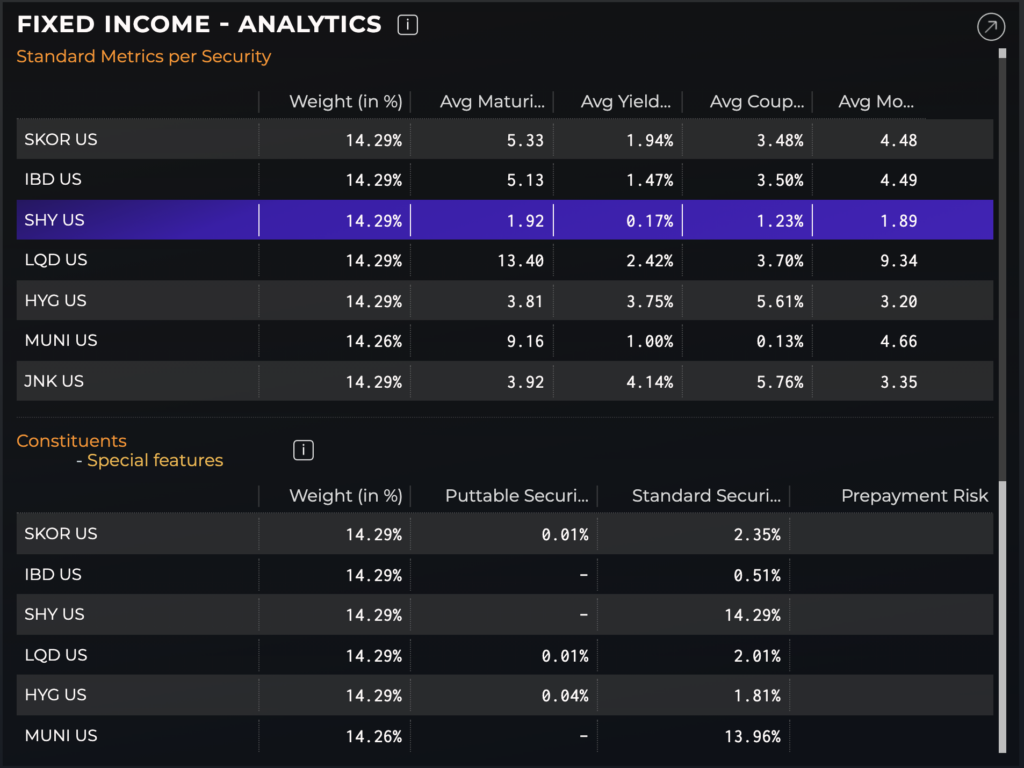

These analytics look at the individual bond holdings, exposure breakdowns by bond maturity, asset categories, issuer types, credit exposures, coupon rates and more … all for easy fund-to-fund comparison! You can get all these analytics now on the Logicly Screener as well as through our flagship Portfolio Analysis workflows.

Here are some Logicly workflow ideas:

- Compare 1000s of ETFs and mutual funds in the screener across 500+ price, risk, cost, liquidity, premium-discount and fund holdings metrics

- Understand relative credit ratings exposures to fine tune your credit risk

- Filter down to specific fixed income characteristics and find the right fund that fits your maturity and yield requirements.

- Build a portfolio with more control and understanding of its fixed income characteristics

- Download our high quality analytics to a spreadsheet for your own analysis

Check out some screenshots of the new updates:

Featured:

Portfolio Analysis with PieChart analysis breakdowns