“Nothing is certain except death and taxes.” – Ben Franklin

While Franklin was right (on both counts), what is uncertain is the amount of taxes. Tax-efficient investing aims to decrease tax liability and pay it as far out into the future as possible.

Tax-efficiency is one of the key elements in effective portfolio management. During the life of a portfolio there are two essential elements that advisors and money managers should consider when implementing tax-management strategies: (1) tax deferral and (2) tax loss harvesting (TLH) opportunities. Equipped with the knowledge of how to navigate these often-treacherous tax waters, advisors can greatly enhance their value to their clients. Volatile and turbulent markets (like 2022) create opportunities to generate tax-alpha (defined as enhanced after-tax returns) for client portfolios and offer a silver-lining during tough times.

When speaking with clients about tax deferral and TLH, there are important scenarios to consider. Explaining how a deferred tax asset works, as well as how to account for them. And that when losses are taken, this reduces profit, which, in turn, lowers taxes.

On the topic of tax loss harvesting (TLH), advisors should be able to articulate to clients that when they are experiencing losses within the portfolio, there is a moment where it might be worth exiting a position to realize a tax loss. The last part of the process involves having the ability to explain to clients that they can reinvest that loss into a different security depending on the investment strategy. Note: the security must not be “substantially identical” to not run afoul of the IRS’ Wash Sale safe harbor rule. It’s a topic for another piece, but those interested can read more about the nuances of the Wash Sale Rule here.

A recent Morningstar article, “Use Tax Alpha to Add Value to Your Portfolio” mentioned that “falling markets can provide the best opportunities to increase tax alpha.” Opportunities for Tax Alpha can vary depending on market conditions. With the volatility of current market conditions resulting in uncertainty, there are opportunities for advisors to do full reviews of client portfolios and each client’s investment policy statement (IPS). This allows advisors to see where they can optimize their client’s potential ability to increase tax alpha credits and allow for a more active approach to tax-efficient investing.

Successfully realizing TLH opportunities within client portfolios is not easy. Advisors should have a solid foundational understanding of the risk profiles of their clients and of the securities they select. Knowing how to exploit losses within the portfolio can determine an advisor’s ability to meet or exceed objectives. As noted in the Morningstar article, “By comparing the portfolio’s after-tax return to a benchmark, rather than simply its pre-tax return, we are able to more clearly discern the manager’s skills from the normal variation in tax-management opportunities”. With most of the market currently experiencing volatility and bear market fears, this may be one of the best times for advisors to ensure that they are optimizing tax-efficient measures within their practices, and that they have the resources and capabilities to act as swiftly as needed.

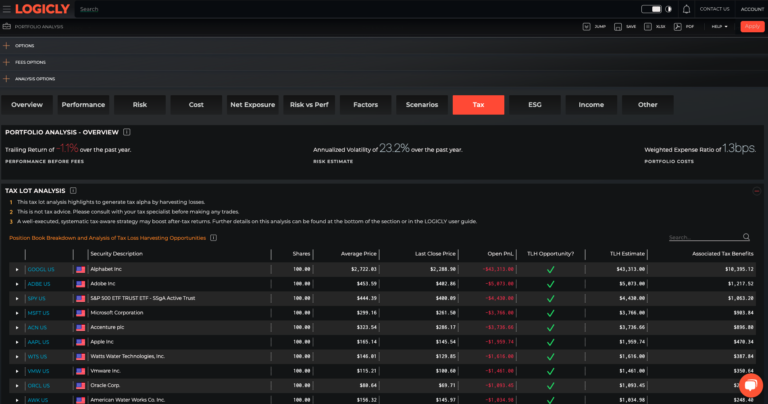

At LOGICLY, we have developed a tax-aware tool within our flagship Portfolio Analysis suite. With this tool, advisors can answer tough questions around the tax situation of a client’s portfolios. This is especially important when there are questions like, “If I take a loss but don’t want to be in cash, what should I do?”.

Leveraging the powerful research and analytic tools of LOGICLY’s platform, advisors can answer this question by finding new ideas around tax-efficient investing. By some estimates, tax alpha can boost after-tax returns by one percent (100 bps) or more each year. Driving tax alpha is market volatility and the client’s tax bracket at the time of investment and liquidation. Being tax-aware puts advisors in a better position with their clients to inspire confident outcomes.

Powerful tax alpha components of the Tax App allow advisors to (1) View tax status at the tax-lot level and find tax lots to trade depending on the tax positioning, (2) Compare “percent-focused” and “notional focused” approaches, and (3) See tax transition strategies that are available within the tax app. These strategies include:

- Realize ONLY capital losses

- Realize NO capital gains overall

- 5% decrease needed to offset tax liability

- 10% decrease needed to offset tax liability

- Full liquidation of the portfolio

The ability to run and view tax transition analysis on a percentage or notional basis allows advisors to take an active approach in tax-efficient investing. Implementing a TLH strategy in the first stages of the portfolio can generate Tax Alpha, by deferring gains or losses over the life of the portfolio. Using tools that increase after-tax wealth gives advisors a significant differentiator in improving existing client relationships and prospecting for new clients.

LOGICLY’s technology enhances the resources and capabilities of its users. Our Tax-Aware solutions enable advisors to take a more active approach in tax-efficient investing, and to systematically uncover TLH opportunities across all accounts.

For advisors looking for new, client-friendly ways to view tax-efficient investing, our Tax App can find new ideas and generate effective talking points to clients, and ultimately, empower and inspire confident outcomes.