Our continuous innovation of the LOGICLY platform makes it easier and simpler for clients like you to work every day. That’s how we empower and inspire confident outcomes.

Today, we’re sharing exciting news about our latest release!

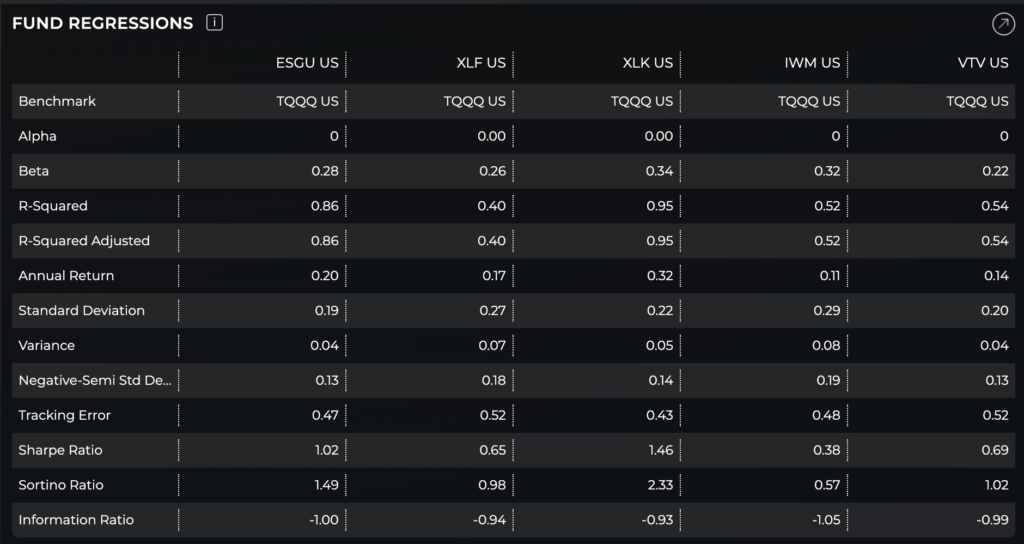

With today’s release, LOGICLY subscribers and users can now, in Fund Compare, see the results of analysis that shows fund regressions for several ETFs or funds against a benchmark (users can select a benchmark). This is a key update for users that look to measure a fund or ETF against a benchmark in the investment selection process. In this release, updates will include a view of fund regressions including:

- Alpha

- Beta

- R-Squared

- R-Squared Adjusted

- Annual Return

- Standard Deviation

- Variance

- Negative-Semi Standard Deviation

- Tracking Error

- Sharpe Ratio

- Sortino Ratio

- Information Ratio

This release serves asset managers, portfolio managers, RIAs, Broker Dealers, research teams, hedge funds, financial institutions around the world, and the financial advisory community. The above image shows an example of the updated Fund Regressions view that subscribers and users will now see when using Fund Compare functionality in LOGICLY.

Contact us to learn more about LOGICLY and important advisor decision-support tools like Fund Regressions. You can subscribe to our YouTube channel to see useful videos: LOGICLY on YouTube.

Get LOGICLY BASE at no cost. Register today!