I’m staying mostly quiet on GME, given that “retail” & “single stocks” are pretty far from my “institutional fixed-income” background, but it has been causing some wacky distortions in ETF-space, which I do know a thing or two about. Here are some items:

XRT (SPDR S&P Retail Fund) saw 50% of the fund redeemed out ($700M) in the last 2 weeks as GME grew to an ever-larger % of the fund. Since ETFs redeem in-kind, I assume market makers were using XRT as a source GME stock. Note that no other stock is over 1.5% of XRT.

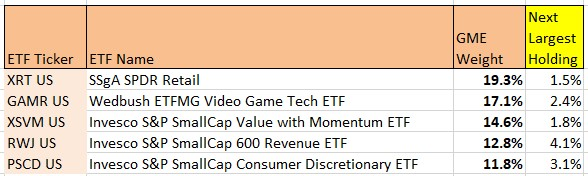

The “rocket symbol” in GME stock has caused it to represent an outsized weight in a number of other ETFs – below I show the 5 ETFs where GME is over 10% of the ETF vs. the next largest stock. eeks.

source: ETFLogic.