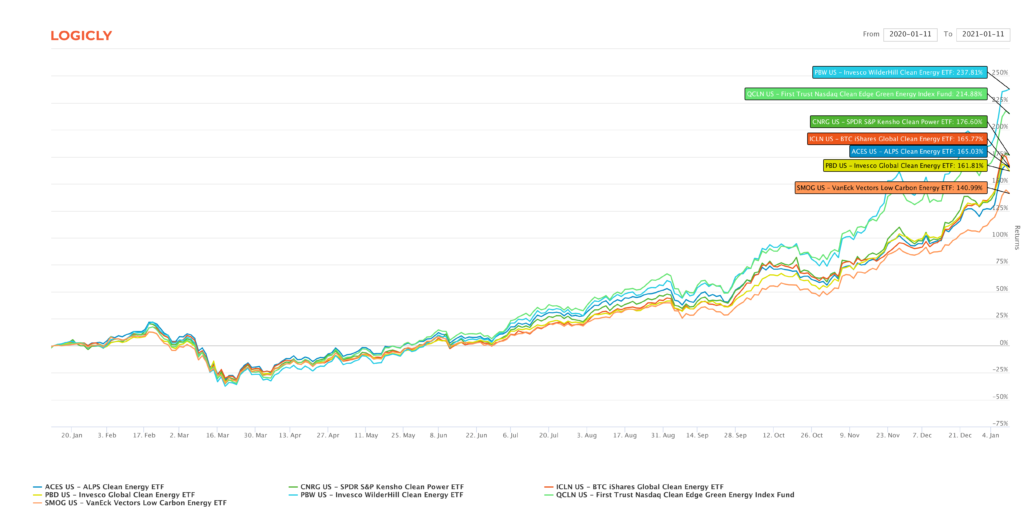

When you pull up the top-performing ETF chart on the Logicly platform, the first trend you will immediately notice is many of the top names are clean energy related.

Why is that?

Many in the investment community expect infrastructure and clean energy to benefit significantly with the incoming Biden administration. We’ve heard from Joe himself that infrastructure is one of the key pillars to his economic revival plan.

And with the outcome of the Georgia elections, the odds of congress being able to pass pro-clean energy legislation has increased significantly.

So what are the ETFs?

The big names in the ETF marketplace for exposure to clean energy are:

ICLN

PBW

QCLN

ACES

PBD

SMOG

CNRG

When we chart these ETFs out, we can see they have absolutely crushed it this past year, with PBW up 237% over the past year.

Which one is really the greenest?

I wanted to explore a little bit further into these clean energy ETFs however to see which is really offering the cleanest energy exposure in its basket. Using the Logicly screener, I loaded my clean energy ETF watchlist in and created a custom view filter to look at total environmental score, % oil exposure, # of oil stocks in the fund, % thermal coal exposure, and # thermal coal stocks.

What I found actually surprised me. But before I go into that, a little more about how we get this ESG data.

About Logicly ESG Scores

The Logicly platform takes in ESG data from Arabesque, one of the leading data providers in the market right now. We take all of the data points that they provide for each stock and then percolate it up to the ETF level. For the portfolio analysis tool, we take it one step further and calculate the entire portfolios that you upload via CSV or one of our integrations.

What we found

It turns out that some of the top funds that are labeled “clean energy” actually have some pretty big exposure to oil – in some cases, almost 16%. That’s why it is so important for advisors to use a tool such as Logicly to ensure that the ESG investments they are allocating to really meet their clients standards when it comes to sustainability and responsibility.

To see the full ESG scores for the ETFs mentioned in this article or any other ETFs, you can sign up for a free trial of the Logicly platform at https://app.logicly.finance/signup

We are also hosting a webinar on ESG investing next Wednesday, January 27th at 3pm ET.