Analyzing how your portfolio performed during historical market drawdowns is one of the most straightforward and intuitive ways for evaluating risk. Throwing in a benchmark or other portfolio as a comparison helps you fine tune your drawdowns to ease the market roller coaster ride for your clients and help build the perfect portfolio. With the Logicly platform and our Portfolio Analysis tools, we make this process easy.

We use the S&P 500 Index (SPX) as a proxy for the broad US market. Then, we identify different market scenarios:

- Bear scenario where the market is retracing from recently achieved new highs.

- Bull-Recovery scenario where the market just exited from a Bear trend and has started recovering from the most recent lows.

- Bull scenario where the market has recovered from a high-low-high cycle and is now reaching new highs.

For each type of market scenario, we provide a summary and detailed view of the performance of the portfolio and any chosen benchmarks.

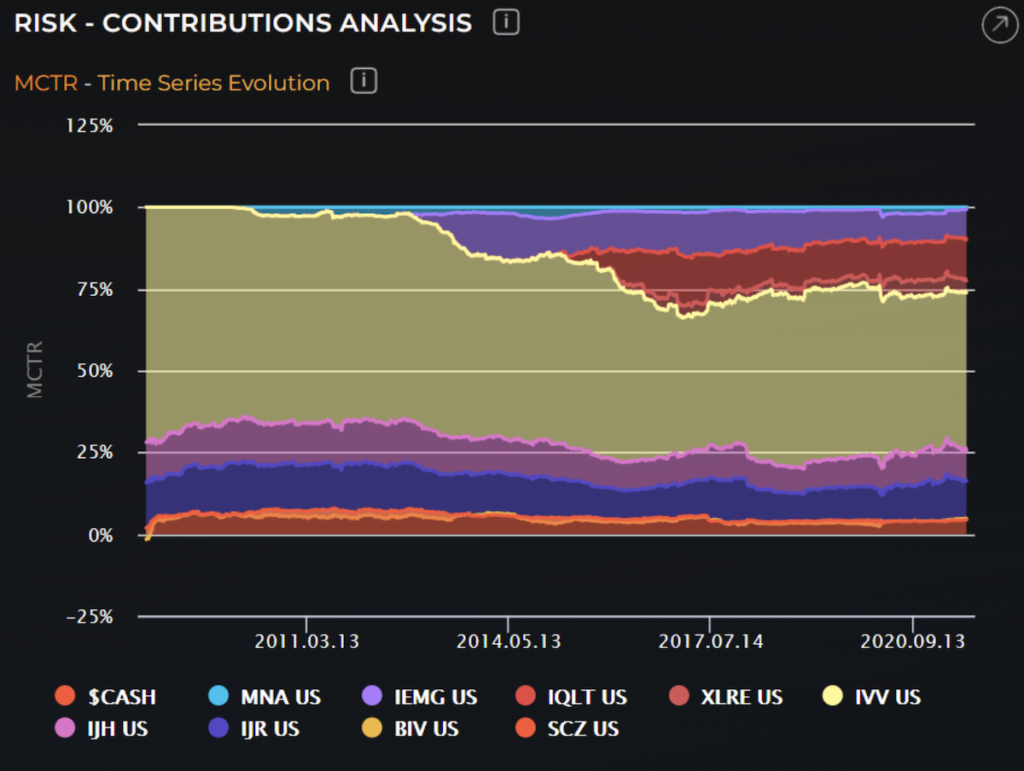

Using a different “risk lens” we can identify historically risky positions in your portfolio. In other words, you can drill down to individual positions in your portfolio that may have contributed to the overall risk of your portfolio in an outsized manner in the past. Using the Marginal Contribution to Risk (MCTR) calculations, you can measure the amount of risk individual securities contribute to the overall risk of the portfolio. Risk is not additive because of correlation or the interplay of different securities in your portfolio.

With the new “MCTR – Time Series Evolution” chart, you have a historical visual of how different securities were contributing to the incremental risk of your portfolio, over time.

Looking at this risk history is important.We know that secular shifts happen in sectors or thematic spaces all the time. For example, the energy sector can move based on oil shocks or other geopolitical events, or new or proposed legislation can make or break entire swaths of thematics. Being able to see these shifts in a historical manner through the MCTR risk lens is just another way to make better portfolios for your clients.