Disclaimer: The views in this piece reflect the thoughts of the author and should not be considered investment or trading advice.

While many are focused on the stock prices for Pfizer PFE, Moderna MRNA, and AstraZeneca AZN, there is actually a whole lot of other companies investors should be thinking about when it comes to the production, distribution, and administration of the COVID-19 vaccines.

And actually, just betting on the vaccine makers would not be a very profitable move.

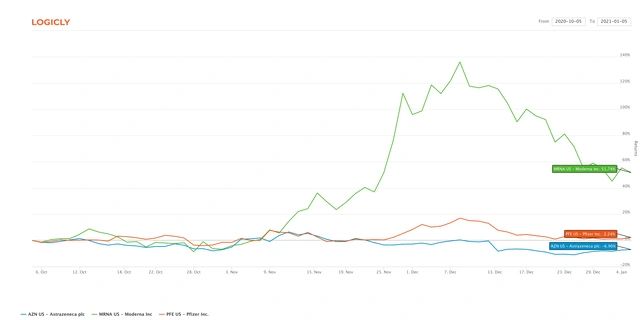

When we take a look at the stock prices for PFE, MRNA, and AZN over a 3 month time horizon, we can see that PFE and AZN are actually pretty flat. And while MRNA saw a peak of +136% on December 8th, it saw a steep decline of -35.72% since.

While Moderna has played out well, investors should shift more focus onto the companies that are involved in the distribution of the vaccine. The big players involved in vaccine distribution include Abbott Laboratories, ABT, Thermo Fisher Scientific, TMO, and Becton, Dickinson And Company, DBX.

Abbott Laboratories has been a key player in COVID testing, having rapidly developed over 8 different virus and antibody tests that are in use to help diagnose COVID patients.

Thermo Fisher Scientific has also been a big player in virus testing, and also supplies necessary lab equipment and supplies for testing sites. Given their position in the industry, we can expect their involvement will increase and they will be a major supplier of immunization equipment as well.

Becton, Dickinson, and Company has partnered with the US government for a $70 Million manufacturing project to help develop new manufacturing lines for the vaccine. As we continue along with immunization of the masses, we can expect their involvement to increase as more manufacturing lines are required.

But for your average investor who does not have a lot of knowledge on the healthcare sector or medical devices, managing investments in these names might not be optimal.

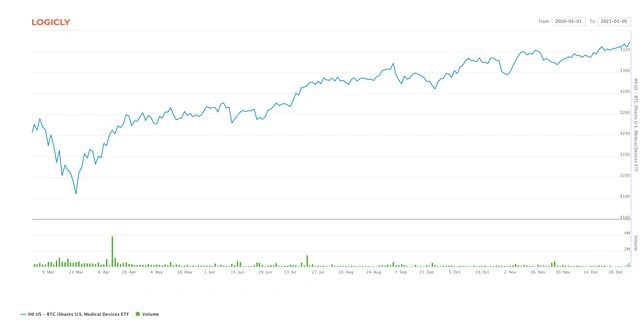

Instead, they should look towards ETFs to make a more diversified play on the sector, specifically the BTC iShares U.S. Medical Devices ETF, IHI.

Since March 1st, IHI has steadily rose 31%. And even before the vaccine, IHI provided steady returns for investors. With high exposure to the three stocks mentioned above that are heavily involved in vaccine distribution, investors could expect to see even bigger gains in 2021.

Here are the top holdings for IHI:

| Stock Name | Ticker | % Exposure in IHI |

| Abbott Laboratories | ABT | 13.16% |

| Thermo Fisher Scientific | TMO | 12.73% |

| Medtronic | MDT | 10.58% |

| Danaher Corp | DHR | 7.98% |

| Intuitive Surgical | ISRG | 4.59% |

| Becton, Dickinson, and Co | BDX | 4.49% |

| Stryker Corp | SYK | 4.37% |

| Edwards Lifesciences Corp | EW | 4.20% |

| Boston Scientific Corp | BSX | 3.95% |

| Idexx Laboratories | IDXX | 3.23% |

We can see that just in the top two holdings, Abbott Labs and Thermo Fisher make up 25.89% of the holdings in IHI.

It’s important to note that most of the other holdings not mentioned before in IHI have also been working in some capacity in COVID testing or immunization , and given the huge scale required to vaccinate over 300M Americans, we can assume that they will all play some role in the process.

For your average investor to even buy just one share of all the top holdings they would need a total of $2800, compared to the price of IHI of just $330 (as of 1/6/21 @ 10:30am ET). With such broad exposure to the full array of companies involved in immunization and the conveniency offered by the ETF wrapper, IHI is a solid choice for investors looking to cash in on the vaccine rollout.

* all prices and data used in this have been pulled from Logicly analytics, a platform developed by ETFLogic