Today’s article points out another important risk feature on Logicly. In addition to calculating historical volatility, VaR and Marginal Contribution to Risk (MCTR) of your portfolio, we compute forward looking risk estimates at different confidence intervals. We don’t only provide 95% confidence interval for 6 months out like some other platforms. We provide 95%, 90%, 85% and 80% confidence for 3, 6, 9 and 12 months forward. This is a great conversation piece with your clients, helping frame proposals around the concept of risk.

How do you do this on Logicly?

In the drop down tool menu on the left, select Analysis under the Portfolio Tools

There are 3 ways to retrieve your portfolio

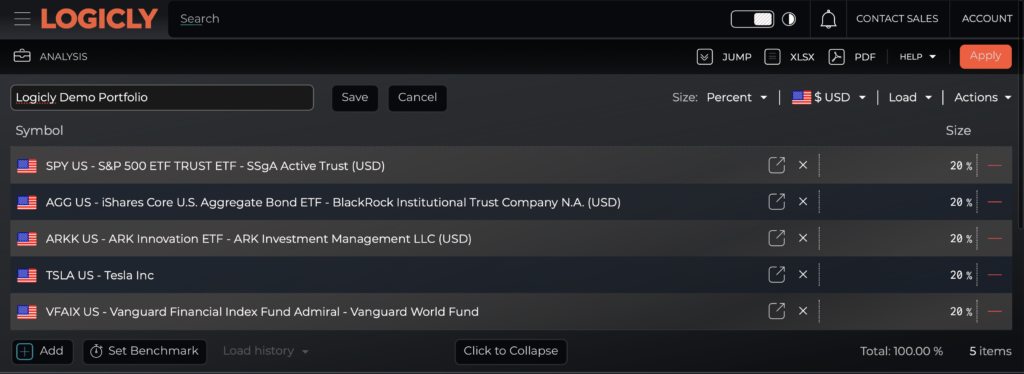

- Create a portfolio by inputting tickers and weights in percent, notional or shares

- Upload your portfolio from a CSV file

- Pull in your portfolios from our integrations with Schwab or RedTail

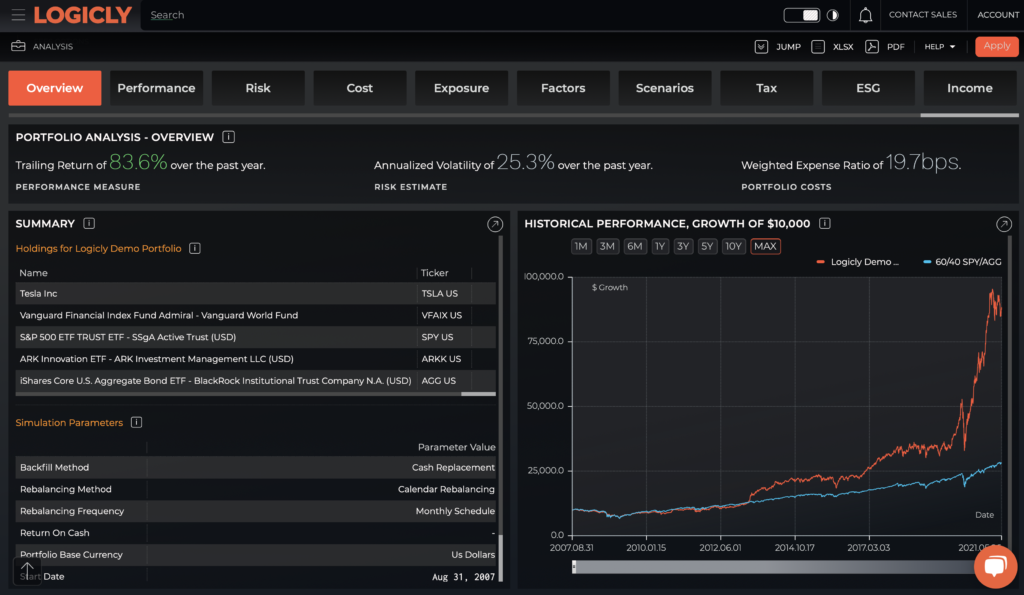

When you hit “Apply” you will see dozens of metrics and a deep dive in to your portfolio

To check out the forward risk estimates of your portfolio, select the “Risk” tab