With all the recent buzz on social media for companies like AMC, GameStop and others, financial advisors are challenged to answer investment questions like never before. For example, how can investors avoid some of this volatility while still getting exposure to these names?

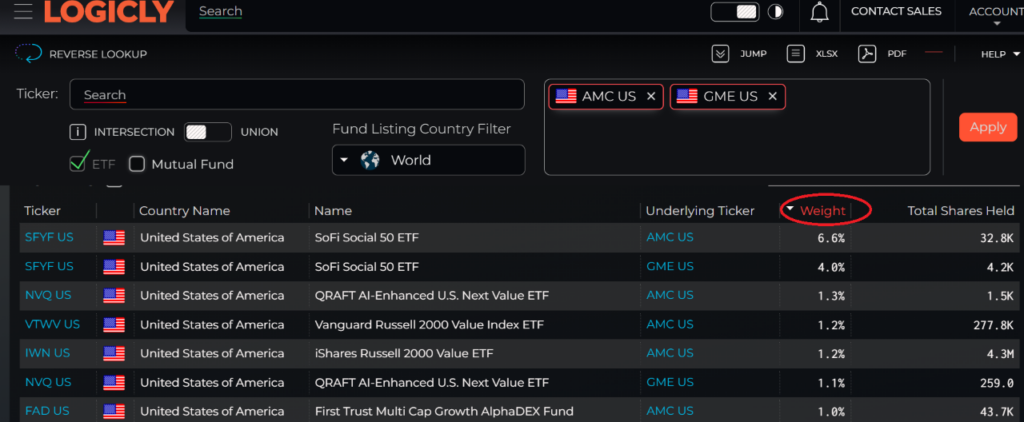

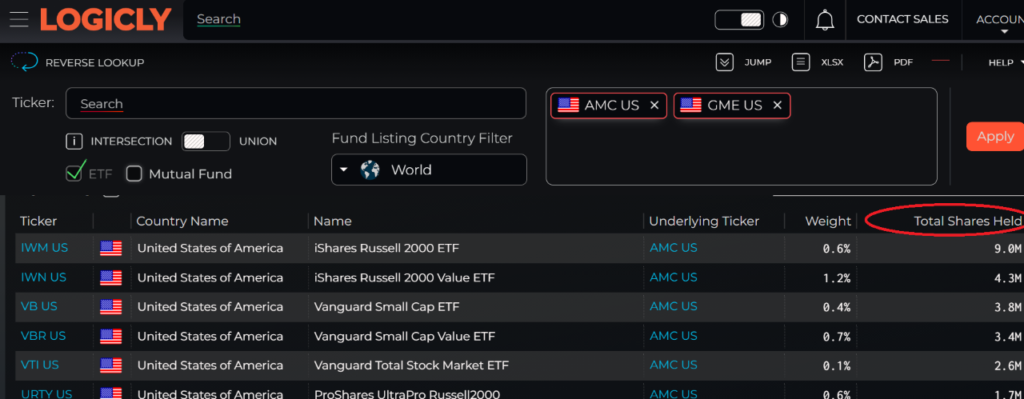

To assist with these kinds of questions, the Logicly Reverse Lookup tool is a great option to help guide your clients. In the tool, you can input one or multiple single stocks and it will show the ETFs that contain those single stocks by % weight and # of shares held.

Let’s put in both AMC and GME and sort by % weights. SYFY, SoFi Social 50 ETF, has the highest weights in both AMC and GME. But if we look at shares held it is a small number.

To assist with these kinds of questions, the Logicly Reverse Lookup tool is a great option to help guide your clients. In the tool, you can input one or multiple single stocks and it will show the ETFs that contain those single stocks by % weight and # of shares held.

Let’s put in both AMC and GME and sort by % weights. SYFY, SoFi Social 50 ETF, has the highest weights in both AMC and GME. But if we look at shares held it is a small number.

To assist with these kinds of questions, the Logicly Reverse Lookup tool is a great option to help guide your clients. In the tool, you can input one or multiple single stocks and it will show the ETFs that contain those single stocks by % weight and # of shares held.

Let’s put in both AMC and GME and sort by % weights. SYFY, SoFi Social 50 ETF, has the highest weights in both AMC and GME. But if we look at shares held it is a small number.

To assist with these kinds of questions, the Logicly Reverse Lookup tool is a great option to help guide your clients. In the tool, you can input one or multiple single stocks and it will show the ETFs that contain those single stocks by % weight and # of shares held.

Let’s put in both AMC and GME and sort by % weights. SYFY, SoFi Social 50 ETF, has the highest weights in both AMC and GME. But if we look at shares held it is a small number.