-By Andrew Unthank, Sales Development Representative andrew.unthank@thinklogicly.com

-By Andrew Unthank, Sales Development Representative andrew.unthank@thinklogicly.com

“Follow the trend lines, not the headlines.” – William J. Clinton

President Clinton isn’t a financial professional, but he is spot on about following the trend and not the headline. Headlines attempt to guide people in how to interpret a given topic or news item. They entice and initial reaction or emotion from people about the topic behind the headline. That emotional response is why many businesses use headlines as click bait to lure customers and prospects. When it comes to the financial services industry, following current headlines about volatility, bear markets, inflation, and a looming recession serve up more than enough emotion-driven red meat to prompt clients to contact their financial advisor, demanding to pull all money out of the market.

Trends, on the other hand, reveal more than just surface noise. And spotting trends early, before they become too big and mainstream makes all the difference. Once everyone knows, it’s no longer a trend. One trend that seems to be more than just a headline is “Thematic funds”. Thematic fund investing gives investors the ability to invest in long-term themes or trends. Over time, these funds have moved in and out of favor, though in the past decade, thematic funds have enjoyed a resurgence, grabbing an exponentially greater share of global investments.

A recent article from Financial Times (FT) noted that that “thematic funds have tripled their share of global investments market to 2.7 percent of all equity funds in the past decade, as investors increase bets on trends from Artificial Intelligence to Generation Z”. Thematic funds (including both ETFs and mutual funds) look at particular sectors and make bets on macro trends within those sectors over a given period of time. Recent thematic funds have focused on investing in areas such as cannabis, cloud computing, EV, and clean energy.

Growth in thematic funds has surged over the past decade, resulting in more than $800bn in assets. With rapid growth comes concern that history may be repeating itself, and that despite the thematic fund growth story, many have underperformed the broader market over the years. History seems to bear this out as, according to FT, “US-listed thematic exchange-traded funds often launch at or near the top of the market for their theme.”

Views about the applicability or suitability of thematic funds vary. Some advisors see these types of funds as too risky for clients, while others see thematic funds as a complement to a client’s overall strategy. Even so, the timing of investment in a thematic fund can determine the advisor-client experience, good or bad. To that point, and as noted in the FT article, investors tend to purchase thematic funds at the peak of the fund’s particular market theme.

For example, Cathy Woods’ Ark Innovation ETF (ARKK) peaked in February 2021. ARKK, which bets on future technology and companies with innovative, disruptive potential, is down more than 65% from the peak. Seeing 65% losses in the short-term is difficult for any investor to stomach. Investors who believe in the fund’s long-term outlook and have both the willingness and ability to stomach the corresponding volatility and risk, thematic funds like ARKK can be an effective complement to client portfolios.

At LOGICLY, we believe that thematic investing will continue to be a viable trend, while also a topic in the headlines. Knowing how to spot trends and pivot as information changes is a key attribute of successful advisors. With thematic funds becoming a major theme in 2020s, standout advisors will have the ability to discern the correct trend – and relevant fund. With 589 thematic funds launched in 2021, more than double the 271 launched in 2020 (and bring the total to 1,952 such funds), thematic investing is a growing trend.

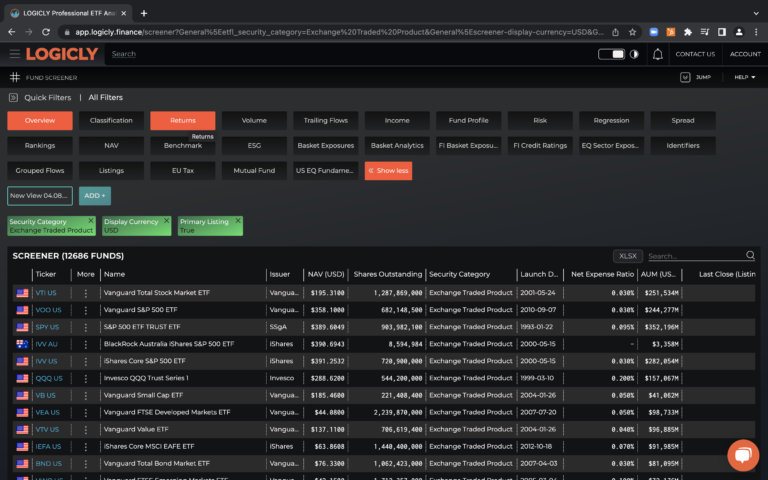

Advisors today use the LOGICLY ETF Top Trends and Fund Screener to screen for any particular group of securities within any sector. With the ability to filter by asset class, fund focus, sector focus, issuer or other metrics, advisors can use LOGICLY’s Fund Screener to research thematic funds to see which, if any, may be appropriate for a client’s portfolio.

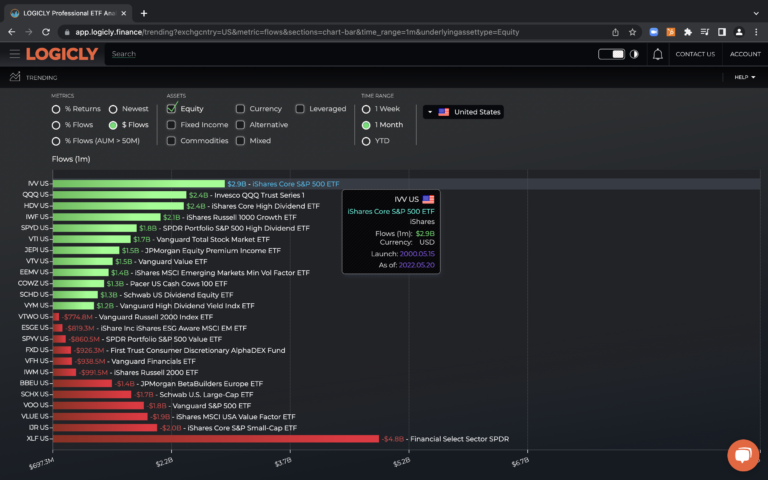

Fund Screener offers different groupings of quantitative and qualitative metrics, such as trailing returns, basket exposures and regression analysis views. ETF Top Trends gives advisors a snapshot view of the ETF trends by asset class and region on a one-week, one-month and one-year basis. Flows can be viewed by percentage and dollar amount to give advisors a clear picture of inflows and outflows. The importance of flows is seen by the growth of thematic investments from $255bn to $806bn in two years (by the end of 2021), and where inflows have slowed since the peaking in the first quarter of last year (2021) when the pandemic prompted new investment themes. Leveraging technology to guide research and due diligence is more important than ever for advisors, with the global investment landscape more complex even though the world is more connected now than ever before.

If any industry is capable of creating and launching new product offerings, it’s the financial services industry. And as we enter a time and space where fund managers launch funds to make big sector bets on the future and raise the necessary capital, the important question for advisors is: “Do I have the tools and resources to best serve my clients by sifting out the noise from constantly changing headlines to empower and inspire confident outcomes?”

Advisors use LOGICLY’s tools and solutions to identify relevant trends, not emotion-inducing headlines, to steer clients toward their financial and life objectives.

To connect about media inquiries or to chat about the article, please email me at: andrew.unthank@thinklogicly.com.