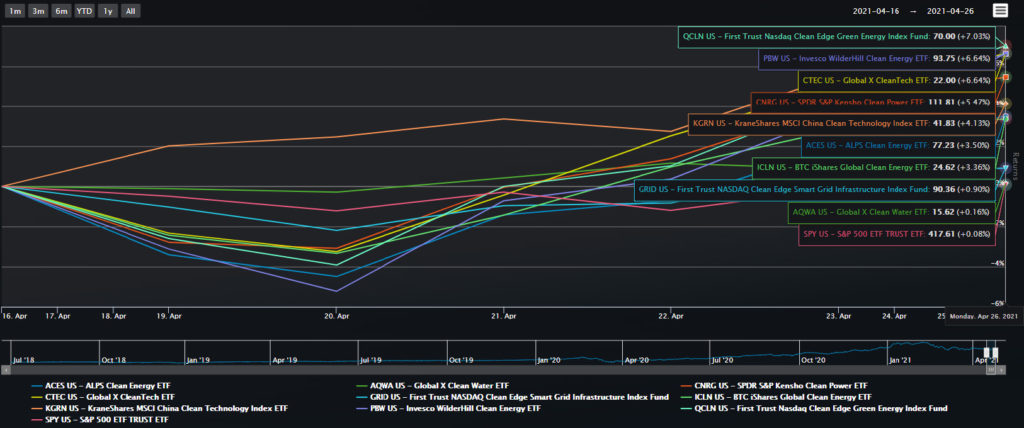

Every week there seems to be some hot new theme in ETF Land. Last week the trending theme was Clean Energy. From Friday’s close on April 16 to the next Monday’s close on April 26, we saw the S&P 500 basically flat against strong outperformance from names like QCLN, the First Trust Clean Edge Energy Index Fund, up +7% and KGRN, KraneShares MSCI China Clean Technology ETF, up +4.13%.

April 16, 2021 to April 26, 2021 Returns:

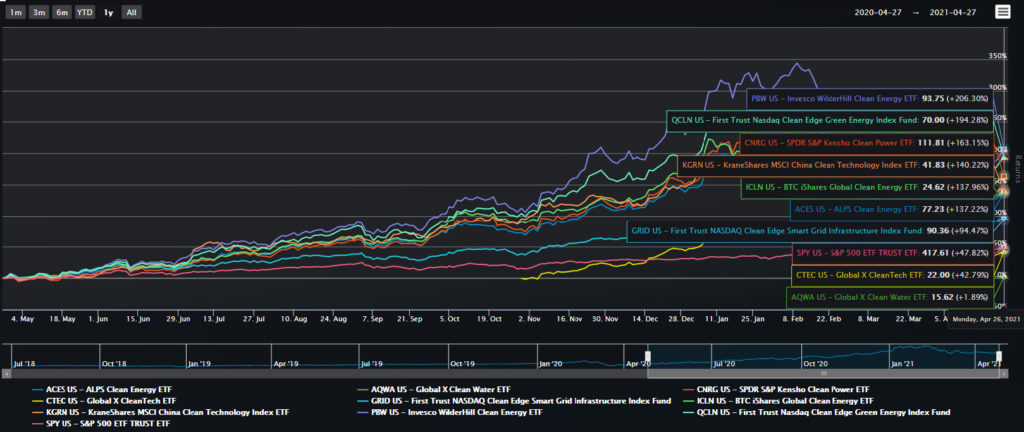

This recent rally comes after an incredible run-up in clean energy names post the November 2020 election in the US and a more recent cooling off in the February and March months. Looking back one year, we see PBW, the Invesco WilderHill Clean Energy ETF, with gains around 200% and CNRG, the SPDR S&P Kensho Clean Power ETF at +150%.

1 Year Returns As Of April 27, 2021

Of course, the headline news is driven by a renewed focus on climate change and an impending avalanche of billions of dollars to thwart that change in a much anticipated Biden infrastructure bill.

That bill plans to make major upgrades to America’s aging electrical infrastructure and focus on building greener, more energy-efficient homes. Thousands of electric vehicle charging stations are expected to dwarf the number of gas stations that exist today, all in the pursuit of carbon-free power generation by 2035 and net-zero emissions by 2050.

Now, the question becomes: Are there flows to back these spectacular returns? Of course. Focusing in on the 3 biggest Clean Energy funds, PBW from Invesco, QCLN from First Trust and ICLN from iShares we see impressive one year flows of $1.5bn, $2.1bn and $4.7bn, respectively. This makes the ICLN fund the largest with AUM of just over $6bn today. YTD flows have also been quite strong, on pace to surpass last year’s flows at this rate.

What’s driving this incredible growth? Are all these different funds holding the same stocks? Is it all correlated? Well, yes, broadly speaking everything has high price-return correlation these days. But correlations in excess of 95% between individual clean theme ETFs is mainly due to broad interest in the theme rather than a high degree of constituent overlap between these funds. In other words, these ETFs all hold varied companies that are all heading in the same direction.

Let’s look again at the “big three” PBW, QCLN and ICLN: running PBW through the Logicly basket fund holdings overlap tool, we note that its active share with QCLN is near 60% and its active share with ICLN is even higher at 92%. Active share measures how different a portfolio is from its benchmark, in this case PBW. An active share of 0% means two funds effectively hold the same securities.

Use the Logicly Screener to get a better feel for predominant exposures

Using the Logicly Screener, we get a better feel for the predominant exposures in the basket. PBW is primarily focused on Small Cap Industrials and ICLN is mainly Large Cap Utilities. This diversity in offering means that non all clean-energy ETFs are made the same way, the spread in price returns makes that clear.

This analysis was mostly focused on ETFs with “clean” in their name. However, as a quick overlap analysis reveals there are similar themed names with SMOG, VanEck’s low-carbon energy fund, TAN, Invesco’s solar-focused fund and BATT, Amplify’s battery tech fund.

To summarize, before you wade into the clean-energy bonanza, here’s a quick (and certainly not exhaustive) checklist to make sure you’re picking the right funds:

- Check the fund holdings and look at concentration scores. High concentration scores indicates too few names, low portfolio diversification or outsized bets within the fund.

- Compare holdings in the screener and check for predominant sector, market cap and country exposures.

- Run a basket holdings overlap analysis on the ETFs or mutual funds you’re interested in. You may find similar funds that give you the same exposures with better fund characteristics like better diversification or lower management fees.

- Run the funds through a portfolio analysis and analyze the holdings as well as ESG exposures. For example, nuclear energy may certainly be a big part of tomorrow’s clean-energy wave. So are you exposed enough to nuclear or have you gone more nuclear than you hoped? These types of ESG scores and warning flags are easy to find through the screener ESG tab.