The past few weeks have brought on hysteria as the coronavirus spread across the globe and now threatens to become a full out global pandemic.

But the major market drops seen yesterday are not solely due to Coronavirus fears. Global oil markets plummeted as over the weekend OPEC and Russia failed to make a deal to cut oil production. All major US indices fell over 7% sharply at open, triggering a 15-minute trading halt at NYSE.

Russia and Saudi plan to use this opp to flood oil markets, and regain lost market share from US Shale producers. The SPDR Oil & Gas Equipment and Services ETF XES fell over 30% throughout the trading day, and leveraged oil ETFs faired even worse. American oil producers and energy related companies are expected to get hit the hardest. XES has a 94% exposure to the US.

To understand your ETFs geographic exposure, check out our basket trading tool

ETFs to Avoid

Energy ETFs

Anything with heavy exposure to energy is going to be very volatile over the next few weeks to months as the oil markets sort out. As mentioned previously, the target with oil price cuts is the US, so ETFs like XLE and XES are going to be the most vulnerable.

See how much exposure your portfolio has to the energy sector using our portfolio analysis

Consumer Discretionary ETFs

With all of the coronavirus fears and impending quarantine and isolation, it is easy to see that consumers will not be out at restaurants and bars or traveling on many vacations.

This means that any ETFs with airline, cruise ship, or hotel exposure are especially vulnerable during these times.

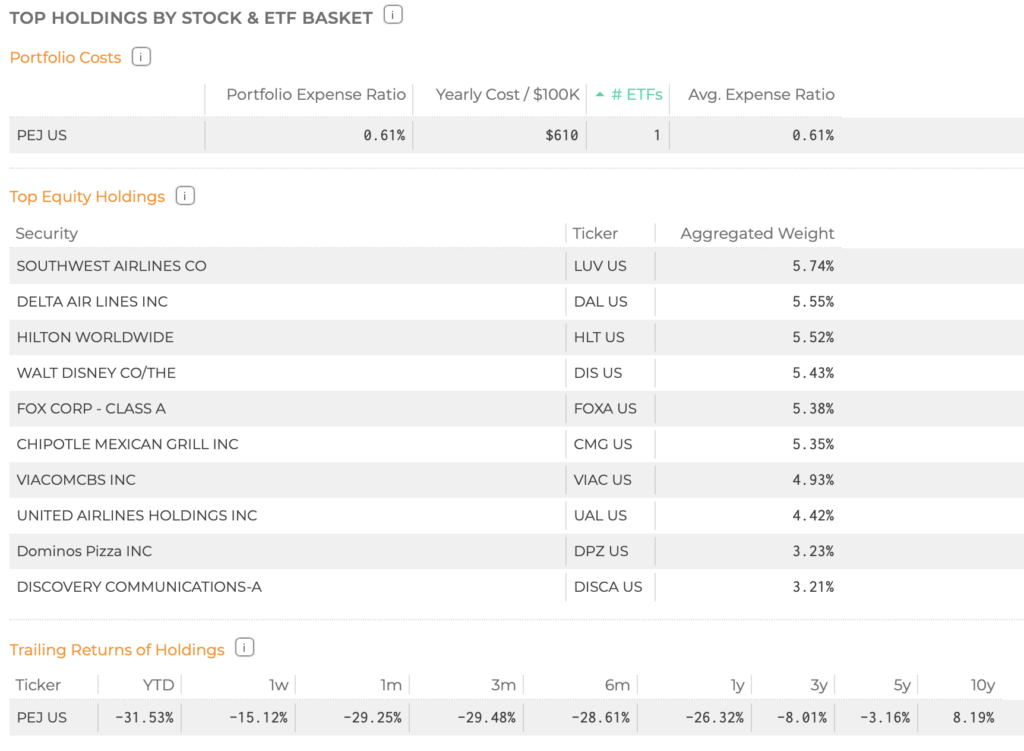

The Invesco Dynamic Leisure and Entertainment ETF PEJ is a great example of this, as it has dropped almost 30% over the last month. It’s top weighting includes Southwest Airlines, Delta, and Hilton.

Safe-Haven ETFs

Low Vol ETFs

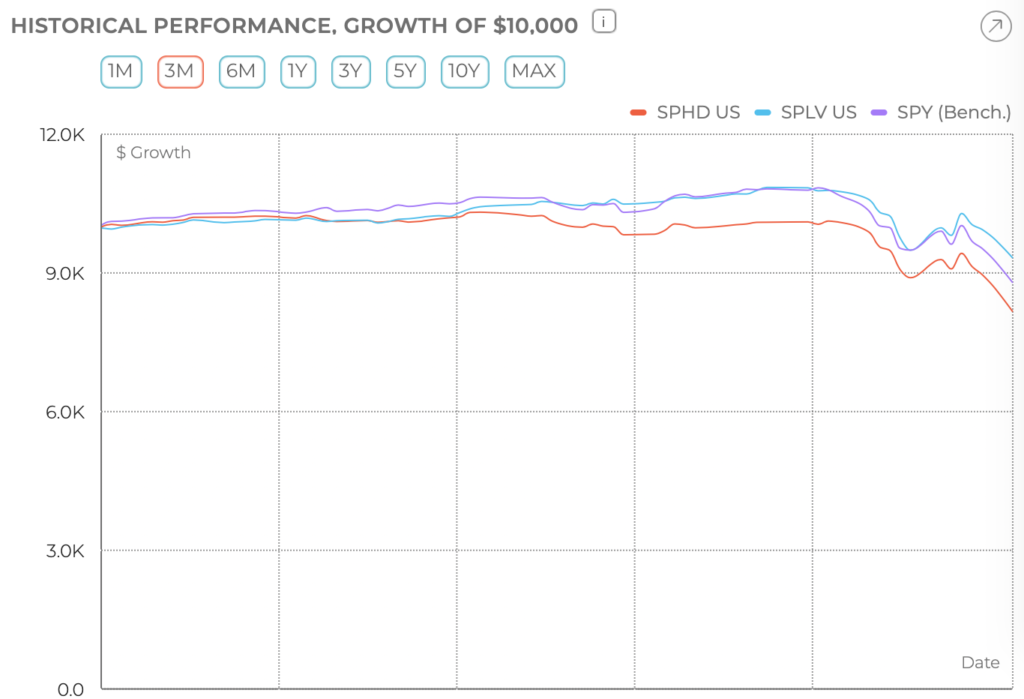

Low volatility ETFs offer strategies that help to cushion investors from major abrupt market changes. Two of the best examples of Low volatility ETFs are SPLV and SPHD.

Gold ETFs

Gold has always been a safe haven asset, and provides diversification that is historically uncorrelated with equities. Gold ETFs are a great way to get exposure, and some common tickers include GLD and IAU.

Healthcare/biotech ETFs

With the coronavirus there are a number of potential opportunities available in the healthcare and biotechnology industry.

Here is a list of the biotech companies currently working on coronavirus vaccines/drugs. Clicking each ticker will bring you to the stock overview page, where you can see if any ETFs have a weighting in the stock.

| Ticker | Name |

| INO | Inovio Pharmaceuticals Inc |

| MRNA | Moderna Inc |

| TNXP | Tonix Pharmaceuticals Holding Corp |

| IPIX | Innovation Pharmaceuticals Inc |

| VXRT | Vaxart Inc |

| NVAX | Novovax, Inc |

| GILD | Gilead Sciences, Inc. |

| BCRX | Biocryst Pharmaceuticals Inc. |

| REGN | Regeneron Pharmaceuticals, Inc. |

| TKPHF | Takeda Pharmaceutical Co |

| HTBX | Heat Biologics Inc |

| PFE | Pfizer Inc. |

| VIR | Vir Biotechnology |

Please note that biotechnology is often a very volatile and risky investment.