In June we wrote an article, Social Media Buying Frenzy, highlighting ETFs holding GME and AMC as a way for investors to participate in the rally while avoiding some of the volatility from holding individual stocks outright. Today, we highlight the uranium precious metals theme, the rallying radioactive metal that has retail traders from Reddit’s WallStreetBets forum focused. If you don’t know which stocks to buy, take a look at uranium focused ETFs.

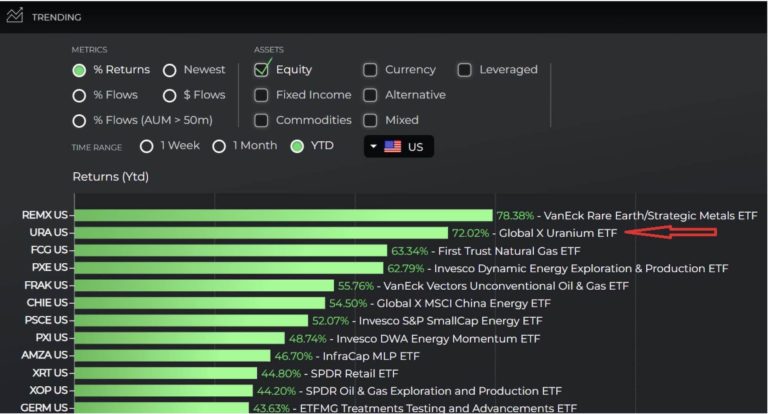

For example, Global X Uranium ETF, URA, is up 72% YTD, which is the highest YTD return across US listed Equity ETFs behind VanEck’s Rare Earth/Strategic Metals ETF, REMX, which is up 78%.

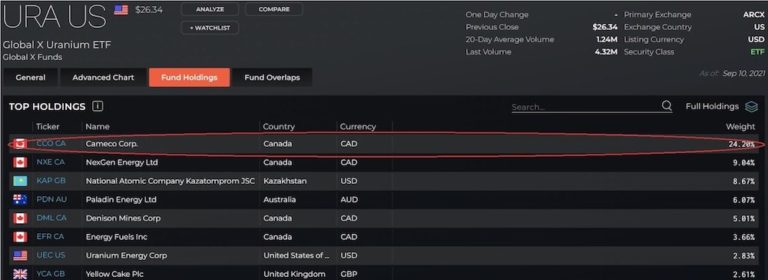

On the LOGICLY platform you can drill down to learn more about the composition (fund holdings) of URA. In the Security Overview page there is a tab for fund holdings where we see that 24% of the ETF is composed of the Canadian listed company, Cameco Corp (CCO CA).

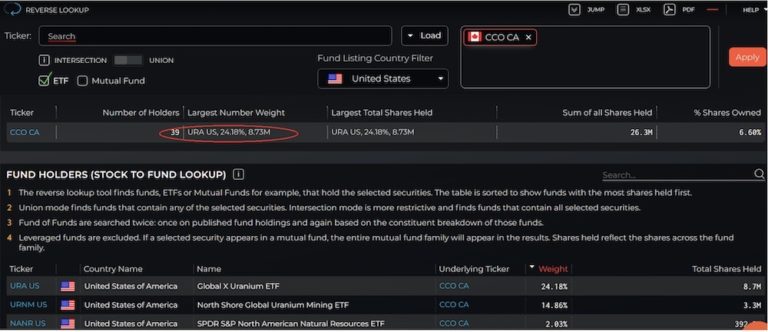

There are a few things we can do from here. Let’s see what other ETFs have exposure to CCO CA by using theReverse Lookup tool.

There are 39 ETFs holding CCO CA in the US. URA has the highest weight followed by North Shore Global Uranium Mining ETF, URNM, and SPDR S&P North American Natural Resources ETF, NANR.

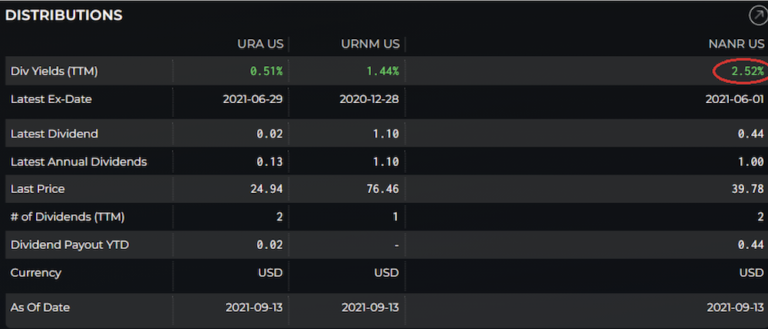

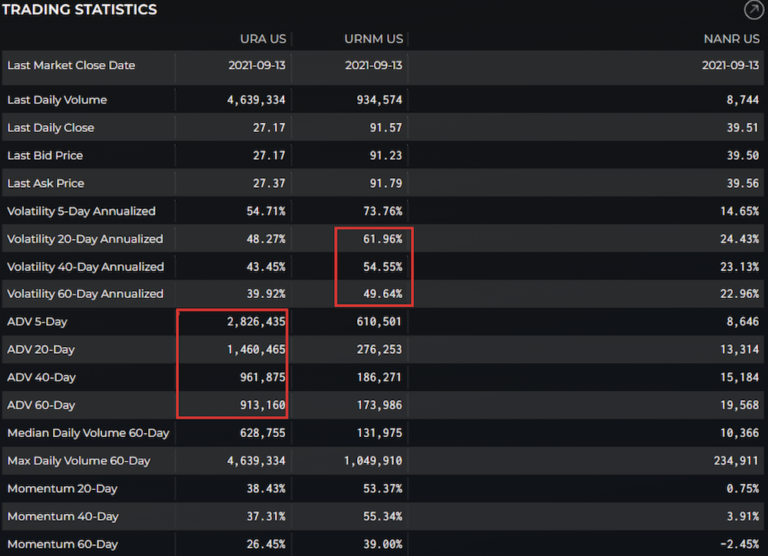

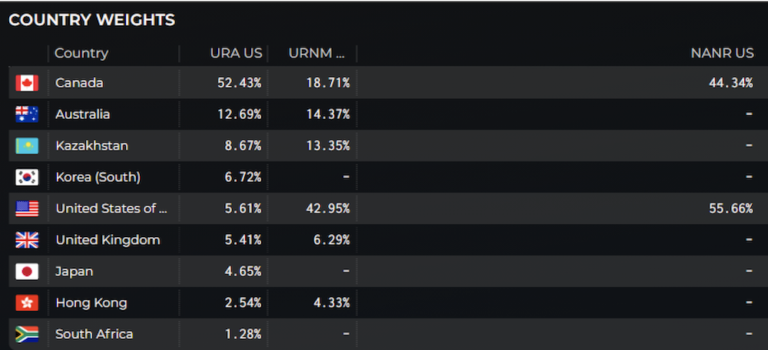

How do you know which fund is right for you? LOGICLY can help by using our Fund Compare tool. Let’s compare URA, URNM and NANR across hundreds of metrics such as dividend distributions, trading statistics like volume and price-based historical volatility, price-based returns, country exposures and sector percent exposures by percentage weight.

Here you see that NANR has a higher dividend yield than the other two funds in the Fund Compare tool.

URNM is the most volatile of the three ETFs and URA has the highest average daily volume (ADV). We tend to look at the 20-Day ADV which takes the daily average of the last 20 trading days.

As expected, with higher risk (measured as annualized volatility by looking back 5, 20, 40 or 60 trading days) comes higher returns. URNM leading by returns.

NANR, the North American Natural Resources ETF, only has exposure to companies in the Canadian Rockies and the US. Almost half of URA’s Canadian exposure comes from its 24% weight in CCO CA.