Our continuous innovation of the LOGICLY platform makes it easier and simpler for clients like you to work every day. That’s how we empower and inspire confident outcomes.

Today, we’re sharing exciting news about our latest release!

This is the first piece in our multi-part, LOGICLY Tax Aware Strategies series. Recent market action has amplified the benefits of timely and effective tax management for portfolios. One of Wall Street’s best kept secrets has always been its ability to generate money out of positions carrying losses. When being tax-smart, through a Tax Loss Harvesting (TLH) overlay for instance, investors can protect future gains by locking in current losses.

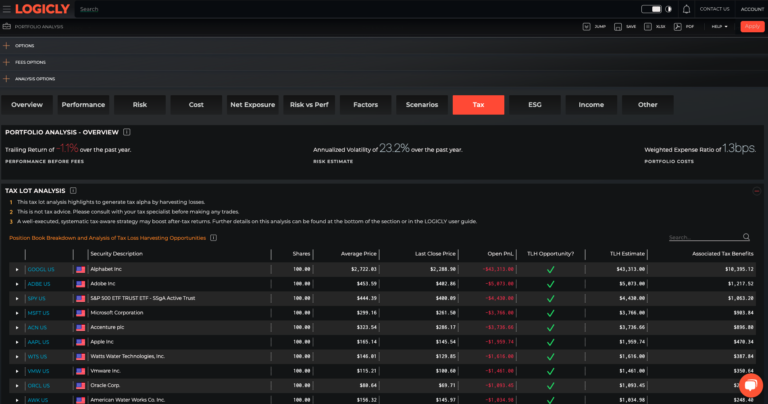

True to our goal of empowering advisors with best-in-class tools and technologies, we’re proud to share that we have released the LOGICLY TAX App in Portfolio Analysis. With this release of LOGICLY subscribers and users can identify TLH opportunities within a single portfolio or group of portfolios. And not waiting until the end of the year to do so. Opportunities that exist currently may not in the fourth quarter.

At LOGICLY, our mission is to deliver confident outcomes. Supporting this, we look to guide financial advisors to stay invested and increase client participation in the market, regardless of volatility conditions.

LOGICLY’s unique research and analytics capabilities combine thorough tax-aware analysis of the portfolio with our powerful similarity detection engine. When trying to capture TLH opportunities, locking losses is only half the work: the capital needs to be re-deployed in an alternative position, which ideally does not significantly change the exposures of the portfolio.

The TAX App gives you the ability to answer a hard question from clients: “If I take a loss but don’t want to be in cash, what do you suggest I do?”

This is a key update that enables users to:

Review tax considerations at a tax-lot level

- Identify lots to trade depending on tax position by getting a complete picture of the tax lots: age, status, trade price and unrealized gains or losses

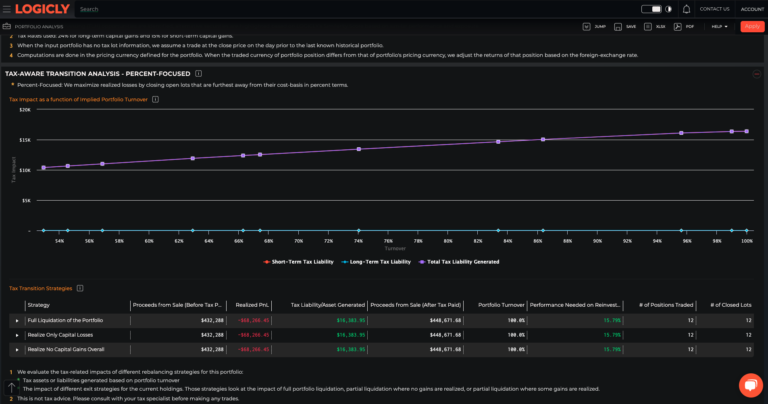

Evaluate and compare the impact of the exit strategy used

- Decision to follow a “percent-focused” (deviation from cost basis) or “notional-focused” exit strategy can have a great impact on after-tax returns for the portfolio

Highlight tax-related impact of transitioning out of the current portfolio. Examples of notable scenarios include:

- Realize ONLY capital losses

- Realize NO capital gains overall

- 5% decrease needed to offset tax liability

- 10% decrease needed to offset tax liability

- Full liquidation of portfolio

Generate proposals for new and prospective clients

- Evaluate current portfolios for tax loss harvesting opportunities

- Show tax transition value of moving to proposed portfolios

This note is the first in our multi-part series, LOGICLY Tax Aware Strategies, and introduces users to the functionality in the TAX tab of the platform. In upcoming parts of the series, we will explore the Tax App in more detail and cover topics like:

- How to use one of Wall Street’s best-kept secrets to unlock hidden value

- What being tax aware means and how it improves client relationships

- Comparing exit strategies for transitioning out of the current portfolio to increase after-tax wealth

- Choosing optimal exit scenarios to free-up capital and increase market participation

- Show value by generating proposals that illustrate tax transition benefits

- Using technology to build effective talking points with clients

This release serves the financial advisory community, asset managers, ETF Issuers, portfolio managers, RIAs, Broker Dealers, and financial institutions.