New tier gives financial advisor community access to institutional-caliber investment data, research, and analytics tools.

March 14, 2022 (New York, NY)- LOGICLY, a U.S. fintech company and leading provider of analytics and portfolio tools to the wealth management industry, today announced the rollout of a no-cost subscription tier subscription tier. This new tier, BASE, gives the financial advice community direct access to investment data, research, and analytics tools typically reserved for institutions.

“LOGICLY is committed to providing financial advisors and the clients they serve with investment research and analytics tools used by institutions, and at an economically sensible entry point,” said Emil Tarazi, CEO and Co-Founder of LOGICLY. “As an industry leading FinTech company, we’re excited to bring the unique analytics and portfolio tools our team has built to the financial advisor community. With our no-charge BASE tier, we empower our users with better data and analytics which means they can do better for their clients. And empowering and inspiring confident outcomes is what drives us.”

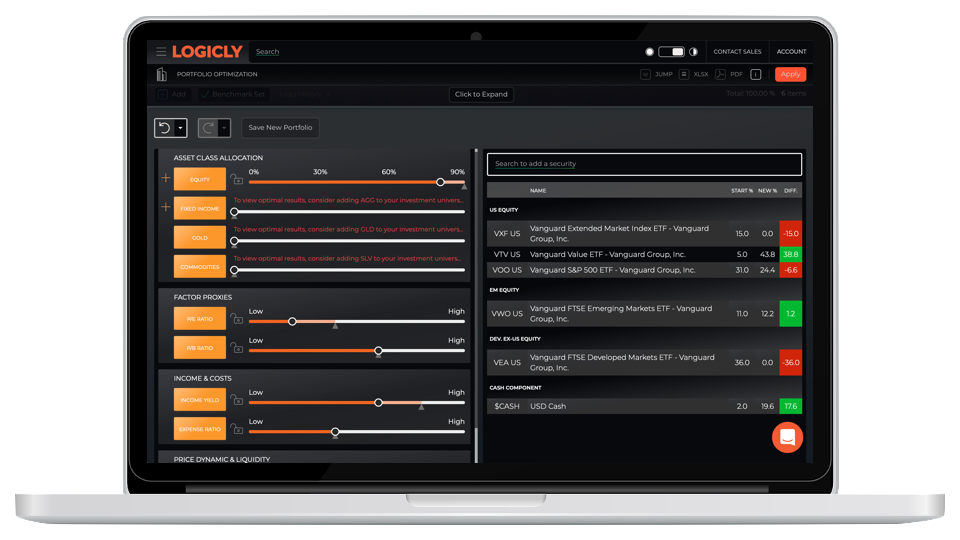

The financial advisor community uses LOGICLY’s suite of tools, including the one-of-a-kind Portfolio Coach, to meet increasing demand for transparency from clients and connect a client’s investment policy statement to outcomes. Advisors gain a competitive edge with smart, timesaving, AI-powered tech that simplifies and automates portfolio management. LOGICLY tools provide daily monitoring and actionable alerts tailored to each client’s IPS, tax-aware rebalancing, seamless custodian integrations, active trade recommendations, and compliance audit trails. Portfolio Coach also provides advisors and firms with the flexibility to use a custom index or model portfolio instead of typical benchmarks.

ETFLogic integrates with a growing number of custodians to seamlessly bring account and tax-lot information into LOGICLY. In combination with LOGICLY’s Portfolio Analysis, you can seamlessly analyze portfolio performance and holdings. Banks and other financial institutions that offer self-directed brokerage services use LOGICLY to offer clients greater transparency in knowing what they own, paying the right price, and leveraging existing products to stay on track.

Learn more about LOGICLY subscription packages here: https://logicly.finance/subscription-plans/.

###

About LOGICLY / ETFLogic

ETFLogic is a U.S.-based fintech company and provider of LOGICLY, the leading investment research, analytics, and portfolio management tools and solutions to the financial advisor community, RIAs, Broker Dealers, Asset Managers, Financial Institutions, ETF Issuers, Compliance Teams, and Hedge Funds. LOGICLY delivers global ETF and fund data across a complete universe of funds, giving advisors a competitive advantage with powerful, institutional-grade technology that streamlines research and analytics, and automates portfolio management. LOGICLY also offers financial institutions via API, iFrame, widgets, or custom development a way to deliver self-directed solutions focused on ETFs, mutual funds, and individual stocks to a retail client base. Headquartered in New York, ETFLogic serves a diverse and international client base. For more information about ETFLogic/LOGICLY, visit our website at https://logicly.finance/. Follow LOGICLY on LinkedIn at https://www.linkedin.com/showcase/logicly-platform/ and Twitter at https://twitter.com/InvestLogicly.

For media relations or press inquiries, please contact:

Steve Sullivan

Head of Marketing

ETFLogic

610-324-5402