By: Robert Bisewski

robert.bisewski@thinklogicly.com

On August 9th, 2022, the Biden administration signed into law a legislation, called ‘The CHIPS and Science Act’ , which came into effect mid-October.

Amongst other things, it regulates the microprocessor and controller industry in a fashion not previously present, specifically with regards to businesses in China and outside of the US.

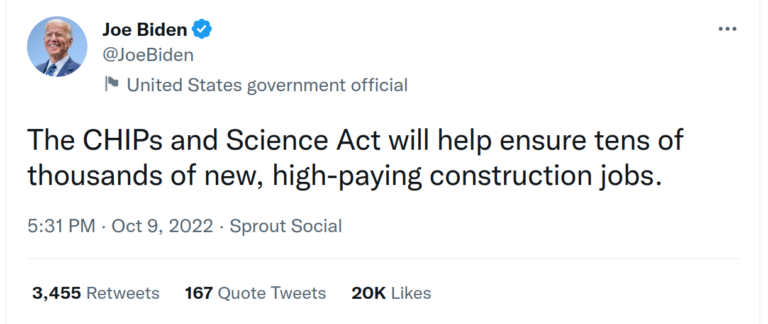

President Biden himself is keen on promoting this as a way to increase job creation and to keep American intellectual property in the United States.

The contents of the Act are pretty interesting and worth a quick glance:

- General research expansion: biology, cybersecurity, neutron scattering, quantum mechanics, AI

- NIST and educational outreach: for mathematics, including STEM outreach

- Energy modernization: a “Fission for the Future” program to significantly promote Nuclear energy

- NASA research and space engineering proposals: ISS, Artemis program, Lunar missions via SLS, Martian missions via Starship

- Promoting and expanding American manufacturing: this includes the creation of a supply-chain database and encouraging adoption of tech made in the USA (which is notable for emphasis of microchip fabrication)

It continues to mention ideas, grants and appropriations with a range of topics that are rather compelling for a government bill.

On the plus side, it gives an idea of what various industries and corporations are focusing their research on, for instance: AI and CPU development, quantum computers, and satellite internet and commercial nuclear power.

The more politically charged components of this bill are geared towards promoting American manufacturing of electronics and microchip fabrication.

From ‘Cold War’ to ‘Chip War’

With these new measures, journalists are calling it the beginning of a “chip war”, suggesting it could mean significant losses for Chinese companies, perhaps short-to-medium term increases in prices and shortages.

Others are making the case for an “industry-wide decapitation”. A potentially massive sprinkle of doom and gloom.

With such serious implications, I wanted to get the opinions of those working in technology to potentially see what the immediate consequences entail.

An industry insider has shared a quick overview of a few of these consequences over at Less Wrong, on the topic of GPU sales and microchip licenses. The article and comments in their entirety are worth a read.

To summarize, the goals of these microchip regulations are:

- To slow the development of Chinese microprocessors and to avoid theft of American intellectual property

- To prevent a situation where American tech companies from becoming entirely dependent on China, for both fabrication of devices and also their components

- To curtail the use of American components in Chinese AI companies, which currently obtain a huge boost to their efforts, via devices made by American GPU companies

- Forcing American workers in Chinese tech companies to choose between their Chinese company job or their US citizenship

One commentator on the article offers an emotional, but frank, examination of the situation.

What Does This Mean for China?

To better answer this question, I have read analysis from Steven Hsu, a physicist, start-up founder, and Chinese-American culture blogger.

He believes that in order to compensate for the EUV lithography machines being costly and the loss of a serious percentage of their talent pool, the PRC government will step in and create a ‘Manhattan Project’ level of effort to catch up.

Hsu argues that right now the most significant factor limiting technology improvements in Chinese chip companies is “market conditions”; i.e. low to zero demand for high-performance Chinese chips in the global market.

CHIPs Act with a Side of Dip

The above take by Hsu is merely a future prediction. For now, we can expect a profound effect on American technology companies, and this may have a serious impact on our financial portfolios and investments.

For investors, the following may be pertinent:

- expect volatility in the once robust US tech stocks, doubly so, for European and Asian markets reliant on these components

- this may shake up portfolios with exposure to US stocks in the short to medium term while everyone races to figure out precisely what this means for the industry

- consider re-evaluating any investments in mainland Chinese tech firms, since potentially there might be more regulations up-and-coming

- non-Chinese tech companies may also be affected, but at the moment the bill seems designed to target China in particular

The CHIPS Act is widely too important to ignore. In fact, since it came into effect, at least one microchip manufacturer has decided to build a new plant in the US.

Micron Technology (Ticker: MU), one of the world’s largest semiconductor companies and the only U.S.-based manufacturer of memory, has announced a historic investment of up to $100 billion to build a megafab in Central New York.

If successful, it will be the largest semiconductor fabrication facility in the history of the United States. Plans include to increase domestic supply of leading-edge memory and create nearly 50,000 New York jobs, including approximately 9,000 high paying Micron jobs.

With the latest news of US export control imposed against China, Apple (Ticker: APPL) has also given up plans to use Chinese memory chips from China’s Yangtze Memory Technologies Co. This only solidifies the potential effects on the supply chain with the announcement of The CHIPs Act.

These days in the computer industry, things are moving fast; which means we should expect the unexpected!

Enjoy reading this article? Other content you may find interesting:

- Getting paid…in Bitcoin?

- Deflation: A Different Kind of Deflate-gate

- A Friend Request from Your Advisor

- Cryptocurrency and the Rise of Custodied Assets

- The Future is Here: How Thematics is Disrupting Investing

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

To connect about media inquiries or to discuss the article, please email Robert at: robert.bisewski@thinklogicly.com