By: Andrew Unthank

andrew.unthank@thinklogicly.com

“The Game is won in the fourth quarter, not in the first half.” – Kambiz Mostofizadeh (Author)

The fourth quarter of 2022 has been dominated by inflation, commentary about a potential recession in 2023, and tighter U.S. monetary policy.

The Central Bank of England came to the rescue of the UK Gilts Markets (UK Government Bonds) to ensure that UK pension funds don’t receive margin calls. The United States has seen a similar story regarding volatility, in both the stock and bond markets.

This volatility is attributed to monetary policy tightening in an effort to curb inflation, the main objective of the Federal Reserve and other Central Banks around the world.

Risk-On, Risk-Off…

The U.S. had experienced a brief bear market rally this past June, only to witness equity markets plunge and bond yields rise directly after Jerome Powell’s Jackson Hole speech in August.

In the first three quarters of 2022, risk assets were in a downtrend and don’t appear to have any upside in the near future. However, advisors who are positioning their clients portfolios to mitigate risk during the recession may be able to catch a tailwind.

For this to happen, market conditions will need to loosen up and central banks around the world will need to pivot from raising rates to either pausing, keeping rates at an elevated level, or beginning the process of lowering rates.

Of course, this may potentially create a more risk-on environment for investors.

May The Odds Forever Be In Your Favor

With Central Banks continuing to fight inflation, it increases the likelihood of global economies slipping into a recession.

In that case, investors will need to take the necessary measures to prepare for a potential recession and for what may come after.

A recent CNBC article touched on three key investing principles that are easy for clients to digest.

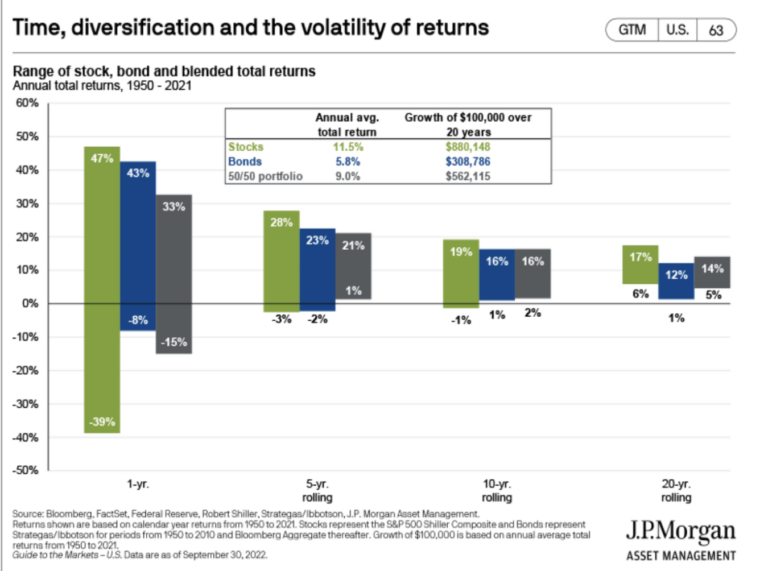

The first principle: having a diversified portfolio. On numerous occasions, across multiple market cycles, a simple 50/50 portfolio of equities and fixed income helps clients mitigate risk over time.

As the below chart illustrates, a 5, 10, and 20-year rolling return basis with a 50/50 stock and bond portfolio had positive performance.

This tracks with what Mark Mirsberger, CEO at Dana Investment Advisors, who was quoted in the article, said, “If you were 60% or 70% in equities, reduce that to 40% or 50%.” He adds that, “The bond side can carry a greater weight because there is less volatility and more opportunity.”

Rick Keller, chairman of First Foundation, adds, “If you are thinking three to five years, you’re going to make some really good money.”

Both Mirsberger and Keller give great insight into how investors should be thinking about diversification.

At LOGICLY, we believe that diversification is a key pillar to any successful portfolio. Having the ability to track and understand trends within the financial market place is essential when building and managing a diversified portfolio.

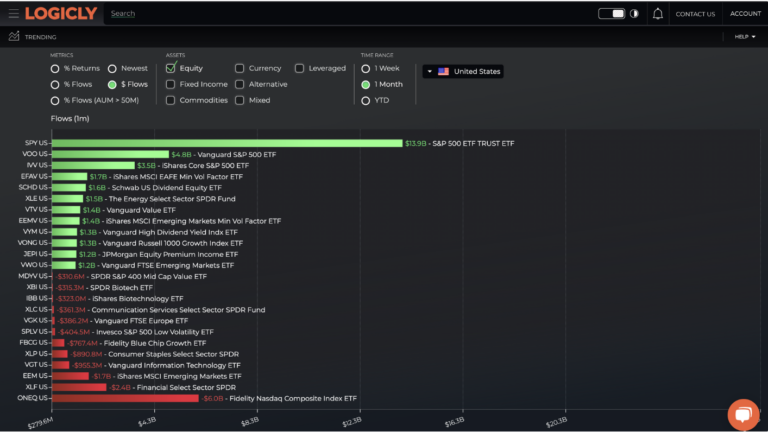

LOGICLY’s ETF Top trends gives insights into what is driving a particular market by viewing top ETF trends by asset class and key metrics like returns and flows on a weekly, monthly and year-to-date basis.

Winning on Wall Street

Wall Street technical analysis legend, Martin Zweig, coined the expression “the trend is your friend”, and 2022 exemplifies this expression. The stock market has been in a downward trend, and inversely yields have been in an upward trend.

Revisiting fixed income allocations is the second principle outlined in the CNBC article. Yields continuing to move higher has allowed investors to take a hard look once again at fixed income.

Fixed income assets have become more favorable in 2022 as Central Banks around the world have raised rates. The US has seen both the two-year and ten-year above 4% this year. This is enticing for investors, who can, more or less, get a 4% coupon on a risk-free asset.

Mirsberger made the point that this is really the first opportunity for what many would say is an acceptable level of return without much risk.

Ronald Albahary, CIO of Wetherby Asset Management, commenting on fixed income, notes that “The good news is now you can get income from your very conservative portfolio or Treasuries.”

Both Albahary and Mirsberger advocate that advisors talk to clients about laddering the fixed income side of the portfolio. Laddering bonds within a portfolio limits the reinvestment risk that is attributed to maturing bonds.

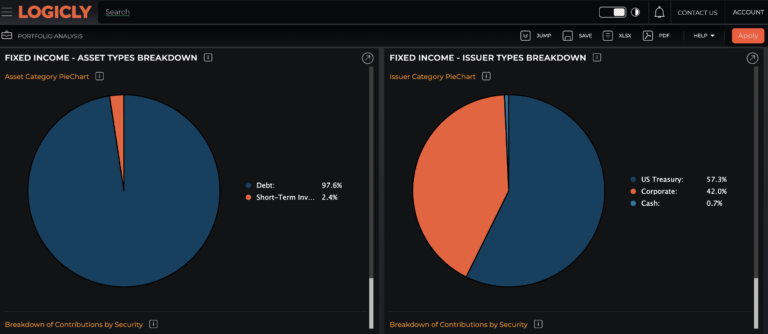

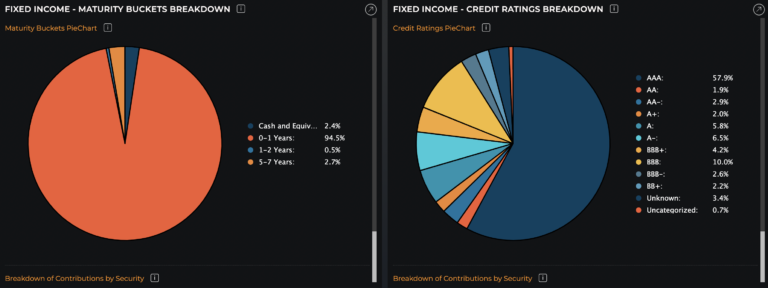

Advisors should also look under the hood of ETF their clients hold to uncover net exposures when crafting a story supporting investment rationale for clients.

The below images, courtesy of LOGICLY, show the breakdown of the Invesco Bullet Shares Corporate Bond ETF (Ticker: BSCM) by issuer, asset class, credit rating, and maturity basket. Using powerful resources like this gives advisors a competitive edge in performing research and due diligence.

Harvest Losses, Reap Gains

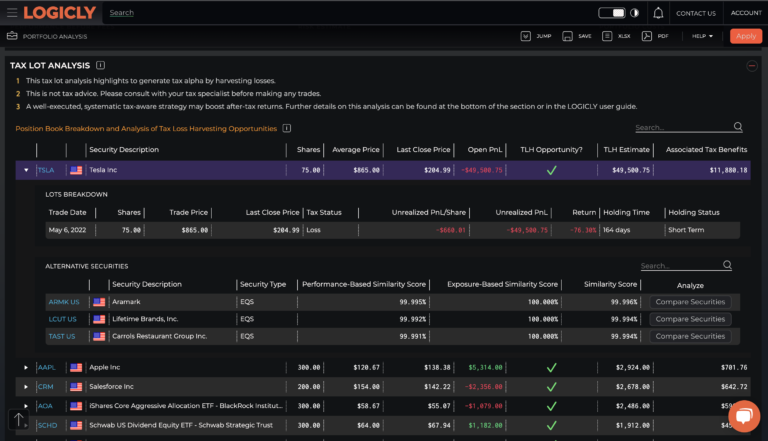

Tax loss harvesting (”TLH”) is the third principle detailed in the article. This concept continues to make headlines, and rightfully so. With year-end fast approaching, investors and advisors alike should be taking advantage of TLH opportunities.

Market performance for 2022 thus far has produced many TLH opportunities (some quite large) to generate Tax Alpha. Advisors often do not relish these conversations as it puts a focus on losing positions. However, it’s these conversations, with an eye toward the future and putting clients at ease by empowering and inspiring confident outcomes, that make the difference in a client’s satisfaction with the advisor.

At LOGICLY, we believe in taking an active approach to managing TLH. We do this by providing insights and alerts to potential tax loss harvesting opportunities, and seeing TLH opportunities at the tax lot level. Tax transition strategies in LOGICLY, shown on a percent or notional basis, offer additional insights for advisors to share and discuss with clients.

Using technology like LOGICLY empowers both the investor and advisor to have better conversations that ultimately lead to more confident outcomes.

Turbulence Ahead, Buckle Up

With only two and half months away from the end of the year, the threat of a recession is not too far off. There is an expectation (priced into the markets) that the Fed will continue to raise rates heading into 2023. As such, many market participants and talking heads project anything but a soft landing.

If a recession is imminent in the coming year, then it will be imperative for advisors and clients to have a sound strategy to mitigate as much risk as possible and to take advantage of opportunities when they arrive.

Enjoy reading this article? Other content you may find interesting:

- Getting paid…in Bitcoin?

- Deflation: A Different Kind of Deflate-gate

- A Friend Request from Your Advisor

- Cryptocurrency and the Rise of Custodied Assets

- The Future is Here: How Thematics is Disrupting Investing

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

To connect about media inquiries or to discuss the article, please email Andrew at: andrew.unthank@thinklogicly.com