By: Dounya Hamdan

dounya.hamdan@thinklogicly.com

With the holidays and year-end fast approaching, advisors are looking over their to-do list and they’re checking it twice. An important item on this list is tax loss harvesting, better known as TLH.

From the many headlines we have read, it is no surprise that 2022 has been a volatile year. We can list every anxiety-inducing event that has taken place in the last twelve months, but for the sake of ending the year on a high note, let’s focus on the silver linings.

One prominent silver lining is the art of tax loss harvesting and the tax saving opportunities it presents for investors and advisors alike. This is part of our ongoing multi-part LOGICLY Tax Aware Strategies series, and here are a few other articles you may find useful:

A Closer Look at TLH

Tax loss harvesting is a tax-aware strategy that involves selling investments that are experiencing capital losses, which can be used to offset capital gains in other investments. Capital gains occur when an investment is sold for a profit, while capital losses occur when an investment is sold for less than the original purchase price.

TLH can help reduce an investor’s overall tax bill by decreasing the amount of capital gains that are subject to taxation. It’s important to understand that this isn’t just a tax issue, but it can also be a part of an advisor’s investment strategy on behalf of their clients.

In an article, featured by the Financial Analysts Journal, it cites that a “tax-aware portfolio outperformed a similar buy-and-hold portfolio by a total of 27% over a 25-year period.”

With these statistics, it’s imperative that financial advisors have the necessary tools to guide their clients in managing potential tax implications, regarding their investment decisions and improving their overall portfolio performance.

Further along, we will discuss how advisors are empowered to effortlessly and consistently monitor client portfolios for opportunities to realize tax alpha by timely locking in open losses using LOGICLY.

Diversify Your Portfolio, Diversify Your Risk

Managing tax loss harvesting opportunities and rebalancing portfolios go hand in hand. Rebalancing helps to ensure that a client’s portfolio remains aligned with their investment goals and risk tolerance.

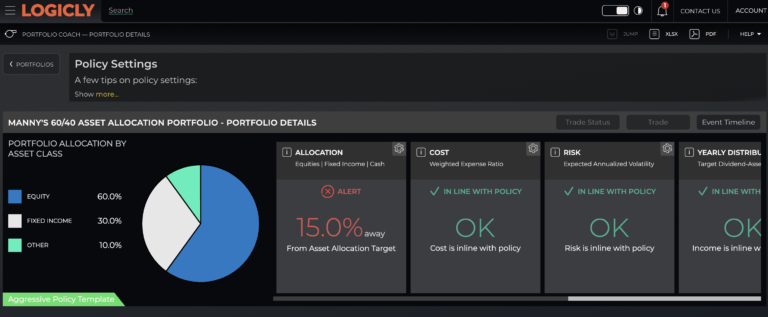

LOGICLY PRO gives advisors the opportunity to do full reviews of client portfolios and each client’s investment policy statement. This includes automated monitoring, advice and rebalancing capabilities to allow advisors to scale across thousands of portfolios.

It connects your clients’ portfolios with their investment policy mandates across several metrics, such as asset allocation, cost, risk, income, ESG and tax.

By diversifying a client’s portfolio, advisors can guide their clients to invest in a wide range of assets, and in return they can spread potential risks across various sectors and industries. Not only does PRO alert advisors, it provides suggestions of how to get the portfolio back in line with the client’s IPS.

Where There’s a Problem, There’s a LOGICLY Solution

Whether you have seasoned clients or those who are new to investing, tax loss harvesting can be better understood when broken down into digestible segments. LOGICLY gives advisors much-needed tax information to facilitate conversations with clients, including:

- Reviewing tax considerations at a tax-lot level

- Evaluating and comparing the impact of the exit strategy

- View the tax-related impact of transitioning out of the current portfolio

- Generating proposals for new and existing clients

Advisors may find themselves asking, “How do we transition from the client’s current allocation to the proposed allocation?”

Our Tax-Aware solutions enable advisors to take a more active approach in tax-efficient investing by providing access to tax-aware strategies right at their fingertips. By building an analytics framework for tax considerations, advisors get the right degree of involvement with their clients’ portfolios.

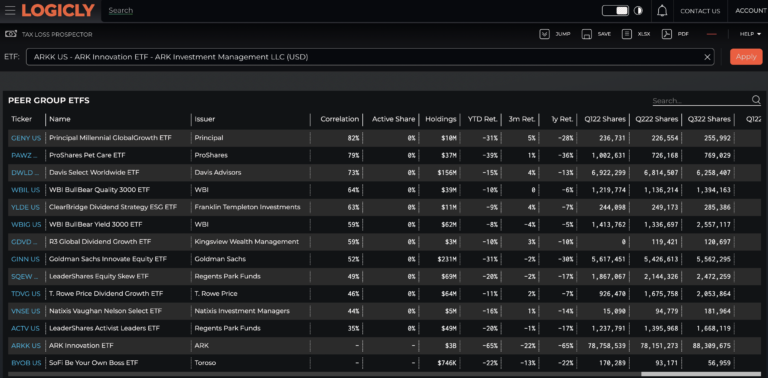

With a complete picture of tax-related impacts associated with possible portfolio transitions, the Tax Loss Prospector tool analyzes portfolios to surface TLH opportunities. Advisors are then provided with securities to consider for suitable alternatives for a swap trade.

Below is an example of the tool in action: ETFs that are classified in the same Peer Group as ARK Innovation ETF (Ticker: ARKK). Sorted by Correlation.

When identifying optimal ways to redeploy a client’s freed-up capital, LOGICLY’s efforts are focused on establishing optimal exit strategies, for advisors and their clients, based on minimized disruptions to the target allocation.

Striking a Balance Between Losses and Gains

At LOGICLY, we believe that the mission of a financial advisor is to guide their clients towards achieving the desired outcome for their portfolio(s). We recognize that talking about losses with clients can be difficult, challenging conversations, and at LOGICLY we want to better facilitate such conversations between advisors and their clients.

Having a plan that includes tax aware strategies equips advisors with the ability to keep the client focused on long-term goals, and not on potentially destructive, behavioral impulses. As mentioned earlier, thinking about taxes and implementing the simplest tax-aware strategy should occur throughout the year, not just at year-end.

It’s our mission to empower and inspire confident outcomes for advisors, so that they can create long-term confident clients. We continue to develop technology that empowers advisors to focus on delivering a high-touch experience to their clients.

Enjoy reading this article? Other content you may find interesting:

- Getting paid…in Bitcoin?

- Deflation: A Different Kind of Deflate-gate

- A Friend Request from Your Advisor

- Cryptocurrency and the Rise of Custodied Assets

- The Future is Here: How Thematics is Disrupting Investing

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

To connect about media inquiries or to discuss the article, please email Dounya at: dounya.hamdan@thinklogicly.com