By: Dounya Hamdan

dounya.hamdan@thinklogicly.com

The recent focus of regulatory bodies such as the SEC on ensuring stricter compliance and enforcing Regulation Best Interest signals a shift in the financial landscape. This development underscores the vital role compliance plays in maintaining the integrity of financial services and the trust of clients.

This regulatory scrutiny has also led to 76% of firms reporting increased compliance expenditure in 2022, while firms of all sizes are putting de-risking strategies in place to meet these new demands, according to SteelEye’s 2023 Financial Services Compliance report.

But it leaves us wondering: Are your present compliance strategies strong enough to handle these changes, or could they put you at risk in this new age of stricter regulation?

Regulation Best Interest: A Work in Progress

The SEC’s Chairman, Gary Gensler, described Regulation BI as a work in progress, with the aim of ensuring that financial advisors act in and center their operations around the best interests of their clients.

This regulation emphasizes the necessity for firms to regularly update their compliance manuals, enhance their training programs, and create a cultural shift in the way compliance is approached within firms.

Within Reg BI, there are four component obligations that investment firms need to be aligned with to avoid violations:

- Disclosure Obligation: requires the disclosure of all material facts that are related to the recommendations

- Care Obligation: designed to enhance the already existing suitability requirement by ensuring that investors are fully aware of the risk and return analysis that is attached to the recommended security

- Conflict of Interest Obligation: requires that firms not only establish and maintain written protocols and procedures to disclose all material conflicts of interest, but these must be enforced

- Compliance Obligation: ensure that firms have the proper system controls in place to prevent violations around Reg BI

Regulation BI sends a clear message: successful compliance isn’t only about market oversight but also about the actions of individuals within these organizations.

A Steep Rise in Compliance Breaches and Fines

According to the 2022 Fine Tracker by SteelEye, the number of fines issued by global financial services regulators hit a record high in 2022, demonstrating the severe repercussions for firms failing to meet their obligations.

Indeed, the SEC alone filed 760 enforcement actions, leading to a total of $6.4 billion in financial penalties—an all-time record.

At the 2023 conference of the Financial Industry Regulatory Authority, the SEC’s Division of Enforcement Director, Gurbir Grewal, was asked if there should be an expectation for an upswing in SEC enforcement actions. His response? A confident “You bet.”

So, are firms ready for this heightened level of enforcement? And what measures can they take to prepare for this?

One of the ways is to leverage today’s innovative technologies, which many firms in the industry have begun the process of adopting, to help ensure that you’re in compliance.

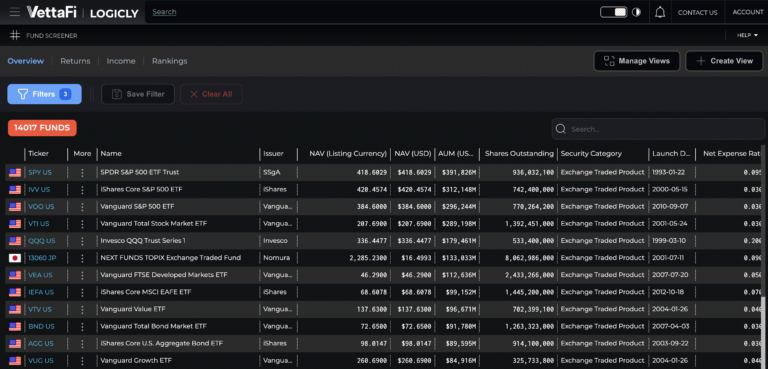

For instance, LOGICLY is able to help in this area by seamlessly integrating our platform into your practice. With the option to screen for ETFs, mutual funds, and stocks with agnostic data points, you have the ability to ensure that your clients are never overpaying for a product.

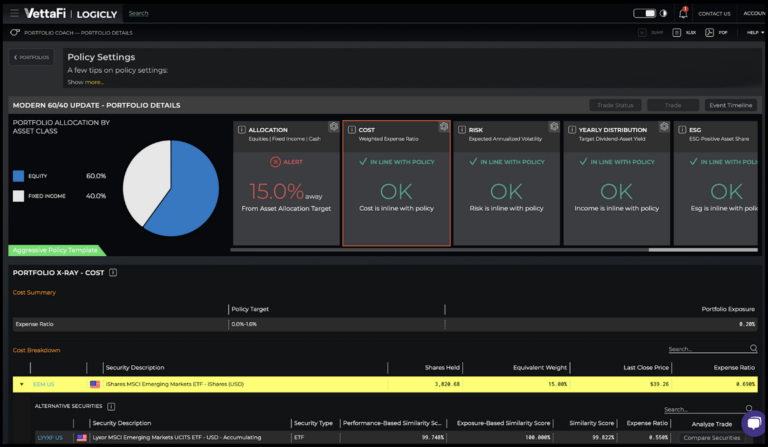

It assists advisors and RIAs by connecting the IPS with portfolio outcomes. This allows for the detailed capture of client conversations and investments and the ability to establish an audit trail of portfolio decision-making, including:

- Document that recommendations are in the client’s best interests

- Show an understanding of risks, rewards, and costs of recommendations

- Factor in the cost and expense to show that the cheapest option isn’t necessarily suitable

The Increasing Significance of Technology in Compliance

In a bid to manage the rising compliance burden, 38% of firms have invested in technology to reduce manual workloads, while 32% did so due to an increased amount of regulation. The use of technology has become integral to compliance, with an integrated approach becoming increasingly crucial to identifying potential risks.

As a matter of fact, approximately 27% of firms spent between 21% and 30% of their total expenditure on compliance in 2022.

Regulators themselves are leveraging data analytics tools to accurately identify malpractice among the companies they regulate. This puts more firms at risk of scrutiny, reinforcing the importance of technological investment for firms to stay ahead of the curve.

LOGICLY, with its powerful compliance solutions, provides an integrated approach to risk identification and management.

Technology like this is extremely powerful in the area of Reg BI because not only is the system monitoring your practice, but it also gives you the option to save changes made to the portfolio and the date on which they were made.

This is extremely helpful in the ability to remain transparent with clients and ensure that your firm is staying within the Reg BI guidelines as we approach the third year of it being in effect, this coming June 2023.

From Cost to Value: Shifting the Advisor-Client Conversation

Amid the backdrop of increasing regulatory pressures and the vital role of compliance, there’s another narrative emerging in the financial advisory landscape. It’s a shift that could fundamentally alter the way advisors engage with their clients: changing the conversation from the “cost of advice” to the “value of advice.”

At the heart of this shift is the need for advisors to demonstrate the tangible benefits that their guidance brings to the table. It’s no longer about justifying fees but about articulating the value proposition—an essential pivot in a regulatory climate that increasingly emphasizes client interest.

Clients need to understand not just what they’re paying for but also what they’re receiving in return. They need to see the depth of analysis, the attention to risk and suitability, and the care put into managing conflicts of interest. In essence, they need to grasp the comprehensive effort that goes into ensuring their financial success and security.

By documenting recommendations, understanding risks, rewards, and costs, and factoring in expenses to ensure suitability, LOGICLY can help advisors demonstrate the complex web of considerations at play in each decision. This is not just about justifying a cost—it’s about showcasing the value of professional advice and the rigorous process behind it.

Ultimately, the ability to change the conversation in this way can make all the difference for advisors seeking to succeed in this challenging compliance landscape. It’s not just about navigating regulatory demands—it’s about illustrating the invaluable role advisors play in guiding clients through the complex world of finance. This is the real value of advice, and it’s a conversation worth having.

Staying Ahead of Rising Compliance Expectations

In conclusion, the landscape of compliance is rapidly evolving, and firms of all sizes must be proactive in ensuring they stay ahead of the curve. As regulatory expectations continue to escalate, the requirement for effective, impactful, and efficient compliance strategies has never been greater.

Technological advancements have emerged as a game-changer in this context, offering immense potential to streamline the compliance process and mitigate risks. As regulators leverage advanced data analytics tools to identify instances of non-compliance, firms are facing an increasing risk of regulatory scrutiny.

This scenario underscores the critical need for firms to invest in technology, such as solutions offered by LOGICLY, to keep up with the compliance tide and ensure they’re not left behind in this evolving landscape.

Enjoy reading this article? Other content you may find interesting:

- 5 Ways to Implement ESG Investing into Your Practice

- The 5 Keys to a Successful Advisor-Client Relationship

- Get Prepared for Reg BI Enforcement in 2023

- Cryptocurrency and the Rise of Custodied Assets

- The Future is Here: How Thematics is Disrupting Investing

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

To connect about media inquiries or to discuss the article, please email Dounya at: dounya.hamdan@thinklogicly.com