By: Andrew Unthank

Good Riddance, 2022

As the New Year approaches, there are numerous reasons to say good riddance to 2022. For starters, inflation has raged out of control to multi-decade highs as central banks attempt to tame it through interest rate hikes. The US Federal Reserve led the way with a first rate hike in March, and three additional hikes of 75bps each.

Adding to inflation frustration, every asset class has experienced outflows as investors struggle to find a safety net in a time of explosive market volatility. Unfortunately, investors found few alternative options to park funds, while hiding and waiting for market turmoil to pass.

Notably, this includes investors who were on the sidelines sitting in cash, as the rise in inflation increasingly ate away at their purchasing power.

Despite historic market volatility and significant outflows across all asset classes, one area that has seen large inflows is the ETF market.

Both Europe and the US have seen a huge shift from mutual funds to ETFs, further cementing the investment product as an essential component of diversified portfolios.

The Expansive Universe of ETFs

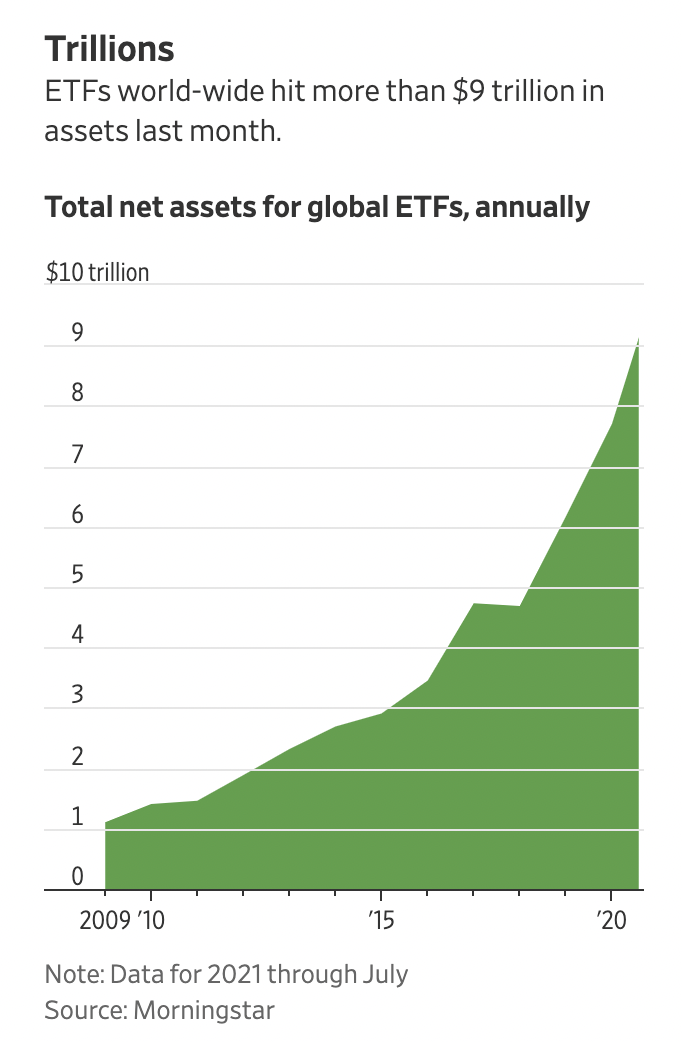

Over the last decade, ETFs have had explosive and exponential growth, with total net assets for global ETFs reaching over 9 trillion dollars in August 2021. The chart below illustrates this, with net flows for ETFs surpassing $700 billion at the beginning of Q3 2021.

Amid the worst pandemic in decades, ETFs have continued to gain popularity as an investment vehicle amongst investors, as they provide numerous benefits, including:

- Diversification

- Low cost

- Tax efficiency

- Transparency

This year alone, ETFs in Europe and the US have attracted at least $550 billion in net inflows. In a recent Financial Times article, Ralph Williams, Associate Director of Europe, The Middle East and Africa insights at Broadridge, attributed the positive flows to “…this year’s market turmoil, the market performance of commodities, and a longer-term trend of passive funds gaining share.”

Similarly, here in the US, Todd Rosenbluth, Head of Research at VettaFi, was quoted by the Financial Times, stating, “It’s a sign that ETFs have become mainstream, and more investors are seeing the benefits despite, or indeed because of, the volatility.”

From Passive to Mainstream

While the overall majority of the ETF market involves passive strategies, actively managed ETFs have also grown in popularity. Historically, investors are more accustomed to hearing about active managers with regards to the managing of open-ended mutual funds.

For about as long as there have been mutual funds, fund managers have extolled the importance of active management. However, mutual fund results leave a lot to be desired, with many fund managers watching multi-billion dollar outflows since the start of 2020.

It’s worth mentioning that in 2022 alone, European mutual funds have had $145 billion (141 billion euros) in outflows. As more ETF products hit the European markets, an investor’s appetite for actively managed ETFs will only continue to grow.

Flows into European active ETFs have been on an upward trend in recent years, with the pace slowing in 2022 due to the Russia-Ukraine war and its impacts on the European economy. The potential for more growth in the ETF sector is seen in the attraction of investors to new, innovative strategies like ESG and thematic investing, according to Bloomberg Intelligence.

Kenneth Lamont, senior fund analyst for Morningstar, stated that, “One of the supposed benefits of active managers is their ability to prove their worth in a bear market.” In the FT article, Lamont continues with, “flows could be seen as something of a vote of no confidence in active managers.”

Even so, an important take away is that ETFs continue to be a larger part of the conversation for advisors and their clients.

ETFs and the Financial Advisory Community

ETFs are not only making a dent in the institutional investor space. Financial advisors are also taking advantage of the many benefits of ETFs, such as tax efficiency, on behalf of their clients.

Ju-Hon-Kwek, a senior partner at McKinsey, shares that with the assistance of their financial advisor, investors engage in tax-loss harvesting (TLH) and avoid incurring capital gains tax by selling losing positions in mutual funds and investing the proceeds in ETFs.

As financial advisors continue to allocate a growing percentage of client assets into ETFs, it’s become abundantly clear that ETFs have become as much of a core portfolio holding as mutual funds.

On the institutional side, ETFs make up more than 75% of index investing as of 2021, according to Visual Capitalist. This implies even further growth of ETF investing with financial advisors and their investor clients.

Financial advisors can stay ahead of this rapidly changing financial landscape by continuing to enhance workflows across the advisory business. Finding ways to streamline investment research and due diligence, uncover key portfolio metrics to improve decision-making, and ultimately, better manage client portfolio through monitoring and alerting that identifies policy drift against each client’s IPS gives advisors a competitive edge.

Institutions allocate millions (in some cases, billions) of resources to find the most efficient financial market information, while the average financial advisor has to find more fiscally responsible ways to get this same information.

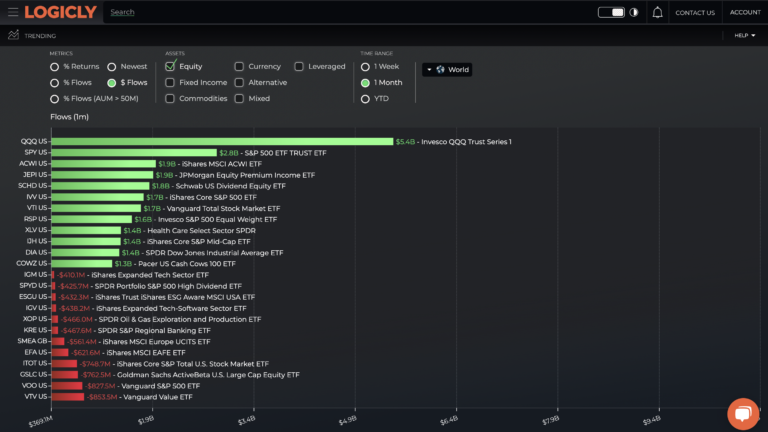

LOGICLY, a web-based analytics platform, simplifies these challenges by providing custom toolsets for advisors who serve individual investors. It allows users to quickly identify top ETF trends and ETF flows across the globe, ultimately facilitating faster, more informed decisions that inspire confident outcomes. And this power comes at no-cost to advisors.

The ETF landscape will continue to gain market share in comparison to other investment products, like mutual funds, in the coming years. Cash flowing out of mutual funds will likely end up in ETFs, and mutual fund conversions to ETFs will also continue.

Either way, ETFs will continue to see inflows for years to come.

Enjoy reading this article? Other content you may find interesting:

- Crypto Crash: All Hand on Deck for Advisors

- Welcome to the Internet: the Future of Twitter and Cryptocurrency

- The Future is Here: How Thematics is Disrupting Investing

- ETFs and Volatile Markets

- What Investors Should Do as Year-End Approaches

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

To connect about media inquiries or to discuss the article, please email Andrew Unthank at: andrew.unthank@thinklogicly.com