By: Brian Fechter

In the modern age of wealth management there have been a myriad of innovations and advancements that posed a threat to displace the long-standing roll of financial advisors.

When Robo-Advisors rose in popularity, the industry and critics were certain that we saw the beginning of the end for traditional investment management practices. This was also coupled with a rise of self-investing tools from many of the top custodians and brokerages in the world.

Investors now had access to advice, tools, and data to manage their funds on their own or with some guidance from their preferred machine-advisor.

But, why hasn’t the advisory space shriveled up and disappeared completely yet?

There are a multitude of potential reasons for this, but I believe it all ties back to the value placed on strong interpersonal relationships, the establishment of trust between clients and advisors, and the expertise required to design tailored strategies using vast online resources for individual client needs.

Can We Compete With the Machine?

In an article published last week, LOGICLY’s Robert Bisewski explored the potential impact of AI technology advancements, like ChatGPT, on the day-to-day operations of portfolio managers at the institutional level.

Building upon this observation, the influence of AI on numerous industries and professions is hard to ignore, as they have been compelled to modify and innovate their workflows to keep pace with the impressive speed and efficiency of machine learning and the rapidly growing capabilities of AI.

From a fund manager’s perspective it is difficult to compete with the 24/7 accessibility to investors and market changes, and lower management fees due to lack of human labor involved.

With that being said, the competition has been amped up but the finishing blow to the advisory and fund management space is far from being dealt.

Human Advisors Keep Calm and Carry On?

While there are plenty of similarities between fund managers and advisors, the needs being addressed and value derived from their respective work is quite different. This means that the implications of AI adoption affect the two niches of the financial services world a bit differently.

Advisors have been competing with ‘the machine’ since the dawn of Robo-Advisors. While these tools may meet the needs of younger investors or those with straightforward financial situations, the majority of wealth management clients require more intricate planning for their finances, taxes, and wealth transfers than even cutting-edge robo-advisors or AI can manage.

This highlights the primary reason for my belief that advisors who consistently go beyond just meeting the basic needs of their clients have no cause for alarm in the face of new contenders like ChatGPT and other AI innovations.

Zechariah Schaefer, wealth management thought leader and founder of Ascent Personal Finance, said it best, “Those who are worried are likely the advisors coasting along providing no planning advice, rebalancing clients mutual funds every 6 months, and charging fees vastly above the value provided; all things that AI can easily replace.”

He further emphasizes, “Those who aren’t worried are the ones laser-focused on providing tremendous ROI on the fees clients pay quantitatively, through tax savings and investment optimization, and qualitatively, in the form of peace of mind and clarity; things AI has yet to demonstrate aptitude for.”

3rd Party Man-AI-gers

Coinciding with the topic of AI being a threat to an advisor’s business and overall practice, there is much debate amongst the wealth management community around whether advisors should be utilizing third party managers to handle client funds, models, and rebalancing.

From a workflow perspective, it makes sense to free up as much time as possible to focus on courting new business and bringing in more AUM for your firm.

Traditional third party managers, and now the implementation of AI to guide a firm’s investment management process, seems to be a no-brainer when the meat and bones of financial planning have been commoditized via the implementation of an ever-advancing market of funds, like ETFs and Mutual Funds, that are cheap and openly available to invest in.

On the other side of the coin, many advisors feel that in-house investment management is the crux of their business and the main reason why clients trust certain firms with their life savings and retirement assets.

Investment News recently wrote an article showcasing this point very well, by highlighting why many prominent advisors in the wealth management space refuse to outsource investment management in any form.

Paul Schatz, President of Heritage Capital, feels that control and trust are the biggest reasoning, stating that, “Right or wrong, I’ve always wanted to have ultimate control of our net exposure and you can’t do that if you outsource. I just don’t trust somebody to be as all in as I am for my clients.”

This lines up with my initial assumptions that trust and a working relationship between a client and the advisor they choose is paramount to their decision to work with them.

After their first meeting with an advisor, clients are often impressed by the advisor’s attentive manner and professional expertise, which leads them to choose to work directly with the advisor. Clients are not usually swayed by a third-party manager located elsewhere who does not share the same values and principles as the advisor’s firm.

With the emergence of AI, numerous advisors are considering adopting these services as their third-party manager. However, I would argue that this is no different from relying on a random person.

AI simply collects data from the internet, without considering the individual client’s goals, concerns, or overall financial situation. While AI can certainly simplify the job, it is essential to remember the ultimate objective of providing the best possible service to clients.

Not All AI Is Your Enemy

While I have spent the majority of this article going through the reasons why AI is not coming for your job as a wealth manager and how handling the investment management process yourself is key to providing maximum value from the client’s perspective – not all implementation of AI in an RIA is bad and strips away from your value proposition.

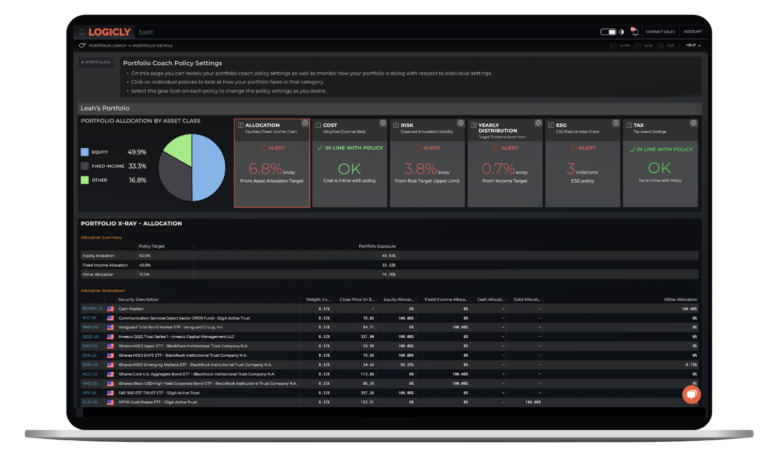

Take LOGICLY’s Portfolio Coach, for example.

It is an AI-powered engine that sits on top of your book of business and monitors your client accounts and households 24/7 against their custom IPS. Letting you know when a client or household is deviating from their targets so you can be on top of their needs, goals, and suitability.

The Coach doesn’t take away value from your practice and relationships, instead it serves as a reliable partner, freeing up your workflow to enhance client engagement and cultivate new business opportunities.

With The Coach on your side, you can focus on delivering the best possible service to your clients and growing your business.

Informing clients that their portfolios are being monitored around the clock and that you will reach out regularly to discuss potential opportunities for improving income, tax loss harvesting, or ESG exposure is a powerful reminder of the value you provide. It reinforces the reason why clients entrust you with their assets and pay you a management fee.

This is a perfect example of AI implementation that doesn’t impede you or your clients but, instead, streamlines your workflow, making it easier for you to serve your clients effectively. The results are an improved client experiences and a more efficient, effective practice.

Changing the Conversation

The reality is that all advisors seek to enhance the efficiency of their workflows and grow their practices. Some prioritize attracting new client assets over everything else, while others aim to eliminate tedious day-to-day tasks that they know can be delegated to someone else – or something else.

Whether they choose to utilize a third-party manager, AI implementation, or roll up their sleeves to do it all themselves as a true value proposition: LOGICLY is here to help change the conversation with their clients to empower and inspire confident outcomes.

Rather than simply discussing investment strategies or portfolio performance, advisors can use the insights and capabilities provided by LOGICLY to engage clients in more meaningful and personalized conversations about their financial goals, values, and priorities.

By changing the conversation in this way, advisors can differentiate themselves from their competitors and position themselves as trusted partners and advocates for their clients’ financial well-being. And with the support and resources offered by LOGICLY, advisors can achieve this transformation with greater ease and efficiency than ever before.

Enjoy reading this article? Other content you may find interesting:

- How to Navigate the Complexities of Tax Loss Harvesting

- 5 Must Know Strategies for Mastering Tax Season

- Solving the Challenges of Regulatory Compliance for Advisors

- ETFs and Volatile Markets

- 5 Ways to Implement ESG Investing into Your Practice

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

To connect about media inquiries or to discuss the article, please email Brian Fechter at: brian.fechter@thinklogicly.com