By: Brian Fechter

brian.fechter@thinklogicly.com

A ‘Great Shift’ is Coming

Eighty-four trillion dollars is a rough estimate of the total transfer of wealth set to take place between now and 2045.

The industry at large has been on a broken record for the past few years in identifying this impending shift, but little seems to be done across the board to take the necessary steps in getting ahead of this monumental event.

Unsurprisingly, investors under the age of 40 have a massively different viewpoint than their parents and prior generations regarding their financial expectations of their wealth management service providers.

Yet, firms of all sizes continue to apply these same strategies to target younger investors, which have historically been used for older, tenured investors.

With an impending Great Wealth Transfer, will we collectively witness a ‘great shift’ in the way advisors approach younger investors in the long term?

A Piece of the $84T Pie

Outside of finance and wealth management conversations, it is evident that Gen Y (Millennials) and Gen Z folks have vastly different views and habits from older generations purely based on the world they were brought up in.

Many under the age of 30 have experienced multiple economic crashes or downturns at a young age, alongside the rise of social media and internet use that brings us all of the good, the bad, and the ugly of the world in real-time, and right at our fingertips.

Younger generations have been raised with the technological advancements of the past 30 years and haven’t lived a life void of technology. It is embedded into their daily habits and interactions with the world.

This is opposed to those who fall under the Gen X and Baby Boomer categories, who have experienced a generous amount of their life without having supercomputers in their back pockets, while also living through some of the most prosperous economic conditions in recent American history.

It has become increasingly imperative for those in the wealth management industry to include these findings when strategizing on how to tap into the younger generation’s piece of the $84T pie.

The key to wealth managers positioning themselves for success in the coming decades and capturing the trust of younger generations lies in a few concepts:

- Speak about your services and capabilities in verbiage that they can understand

- Understand that the viewpoint of wealth and overall values have shifted massively from Gen X and Baby Boomers

- Offer technology that is catered to the lifestyle and interests of younger investors

Now You’re Speaking My Language

Many young professionals prioritize their focus on their professional careers while trying to maximize where and how they can accumulate multiple streams of income.

This leads to the concept that financial planning and wealth management is very important from their perspective, but if you are not engaging them on their playing field, it will be a steep uphill battle in that regard.

Historically, the mindset behind demonstrating value as an advisor (beyond securing impressive returns) is to show a level of technical understanding and prowess relative to the financial markets.

Instead of the typical language regarding mortality tables, understanding compounding interest, and the very blunt connotations around retirement planning, aim for a simple, easy-to-understand terminology and questioning for a more productive baseline when communicating with young investors.

“How much do you have? How much can you save? How much risk can you take? How long can you wait?” These are the types of questions utilized by Chip Castille, CEO, and founder of GoalBased Investors.

To take an adage from the older generation: “Keep it simple, stupid.”

The biggest mistake you can make is to ask younger investors to speak and understand terms that take financial professionals many years to become privy to.

ESG for Gen Z

A key point to keep in mind here is the generational mindset around wealth. For younger investors, it’s not all about maximizing returns.

The impact of their investments in the real world means just as much as the percentage gain in the year. Hence, the rise in popularity of custom values, interest-based investment solutions, and ESG investing amongst that crowd.

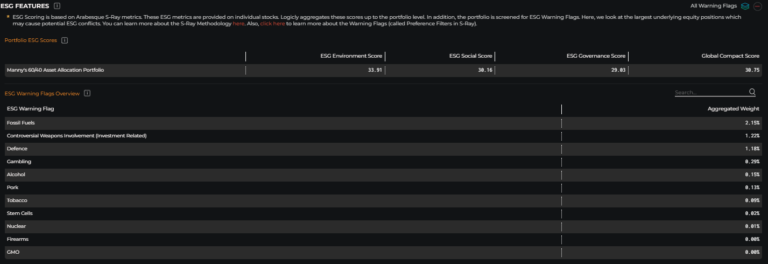

LOGICLY’s Portfolio Analysis tool equips advisors with an ESG screening and scoring system that can shed light on exposures to ESG Warning Flags such as Fossil Fuels, Tobacco, Defense Industries, and more.

When dealing with ETFs and Mutual Funds that contain exposures across multiple individual stocks and other funds, it is often difficult to truly know what you are invested in and what parts of society those investments are ultimately tied to.

Technology for the Technological Generation

It is paramount to understand that the younger generation has been raised on and with technology as a core component of their life.

In the age where teens and young adults average between 8 and 9 hours a day utilizing technology on their phones or computers, why aren’t more firms investing in bringing technological additions to their firm’s services and marketing?

To get ahead of the curve in forming and building strong relationships in the advisory space with younger investors, it’s quintessential to implement client-facing technologies that meet the age group on their turf. This same ideology also applies to the marketing and outreach front.

With that being said, firm technology additions need to add a level of gamification.

Ready Player One?

According to a Deloitte article, “Gamification is a trend across different industries that aims to increase customer loyalty and satisfaction as well as utilization rates. It does so by rewarding positive behavior and providing educational features in an easily understandable and motivational way.”

In relation to wealth management, gamification increases client engagement, enhances the understanding of the process, and brings the idea of the importance and impact of the investment management and financial planning process to light in ways previously not conveyed in the industry.

This can be implemented with items, such as client interfaces that display investment information and scenario forecasting visually and graphically which is much easier to grasp than a sheet of YTD data on each of your holdings.

Marketing outreach towards younger investors seems to be another gap that needs to be bridged by advisors. With the rise of streaming services, commercial advertising does not reach the intended audience.

A Friend Request from Your Advisor

Outside of streaming Netflix and Hulu, where does the young investor have their eyes at all times of the day? Social media; specifically platforms like TikTok and Twitter.

LOGICLY’s Dounya Hamdan touched on this in a previous article titled ‘A Friend Request From Your Advisor’.

Financial institutions have typically been weary of developing a social media presence as many users of those platforms are not in their current target demographic.

But, to the point of this article, they need to begin thinking about their positioning and implementation of their social media strategy if they wish to have the same market share with the next generation that they have with the current holders of wealth.

It’s all about understanding that in the next 20 years, the rules and strategy of the game of financial advisory will change rapidly, along with many of the players within it.

Those that take the time to lean into this shift will come out on top of the leaderboards with the next generation of wealth management clientele.

Enjoy reading this article? Other content you may find interesting:

- Getting paid…in Bitcoin?

- Cryptocurrency and the Rise of Custodied Assets

- The Future is Here: How Thematics is Disrupting Investing

- ETFs and Volatile Markets

- What Investors Should Do as Year-End Approaches

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

To connect about media inquiries or to discuss the article, please email our Client Success Associate, Brian Fechter, at: brian.fechter@thinklogicly.com