By: Stephen Sullivan and Brian Fechter

The Digital Elephant in the Room

In October 2022, LOGICLY’s Brian Fechter wrote an article on Cryptocurrency and the Rise of Custodied Assets. In the article, Fechter discussed how cryptocurrency has become a household discussion and that the increase in retail investors dedicating capital to the digital asset markets is something that cannot be ignored.

Since then we have seen what is arguably the largest black swan event in the crypto ecosystem with the sudden implosion of the popular centralized exchange, FTX.

You are probably hard-pressed to have not seen some coverage of this incident over the past few weeks, but for those who are not following this developing saga, let us give you the TLDR (too long, didn’t read):

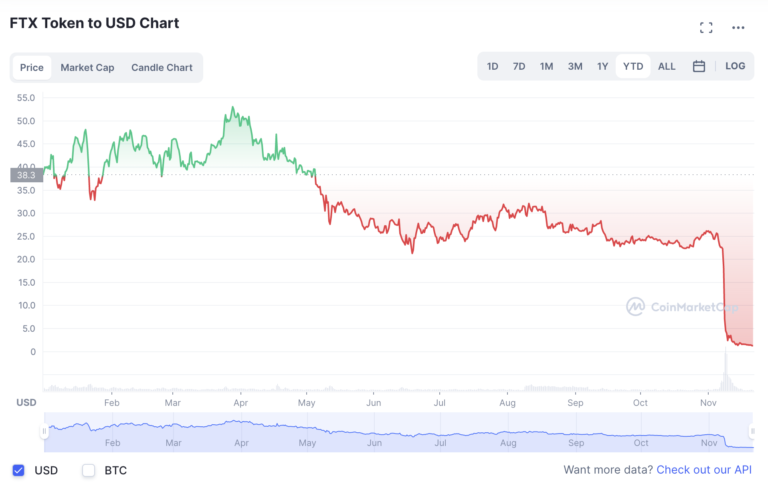

On November 2nd, CoinDesk revealed a balance sheet meant for FTX investors that showed the majority of the company’s assets being held in FTT (FTX’s proprietary token which they control the supply of) and Solana.

Both of these tokens are considered ‘alternative investments’ in the digital asset space, lending to the idea of their instability and constant fluctuation in value.

Typically, a firm the size of FTX would allocate a majority of its assets in coins like Ethereum, Bitcoin, or Stablecoins (an asset pegged to the value of the US Dollar).

Upon the unveiling of this balance sheet, Changpeng Zhao (or CZ), co-founder and CEO of Binance, the world’s largest cryptocurrency exchange by volume, announced that the exchange was going to offload its sizable holdings of FTT. These holdings were obtained through an investment into and the subsequent divestment from FTX.

This news spurred panic in the markets at large and sent FTT plummeting.

Sam Bankman-Fried (or SBF), CEO of FTX, assured its users and investors that their assets are ‘fine’ and that the leaked balance sheet was not a complete picture of the firm’s financial position.

It was, in fact, not fine.

Soon, after the initial shockwave, discussions began to take place between SBF and CZ surrounding the purchase of FTX and its assets by Binance, pending the results of due diligence on FTX by CZ and his associates.

Upon further investigation and the news surrounding internal corruption and mishandling of client funds coming to light, Binance announced that they will no longer pursue the acquisition of FTX.

What came next was the true collapse of FTX as an exchange and an organization.

FTX proceeded to pause withdrawals from their platform, while the crypto markets at large began to plummet, and we soon saw FTX and all affiliated entities file for bankruptcy.

The cherry on top came on November 11th, when over $600 million was drained from the wallets of FTX and FTX.US in what is being described as a hacking event. This event solidified the already catastrophic loss of funds for FTX users.

As of the time this article is published, the alleged hacker has already begun selling those stolen assets to the tune of nearly $200M by swapping Ethereum for Bitcoin. This creates a situation where one individual, the hacker, can create immense sell pressure in a market that is already strapped for liquidity as is.

Why This Matters for Advisors

It is estimated that over 1 million institutional and retail investors have lost funds as a result of the events we have seen this past fortnight.

With crypto investing becoming more popular by the day among the everyday investor, the odds that an advisor’s clients have some form of digital assets have increased in a correlated fashion. We have also seen financial professionals who are personally apt to web3 and invest in digital assets outside of work who have been impacted by the FTX scenario.

As adoption continues to grow, advisors are tasked with having an evolving set of knowledge on digital assets and what their clients have in their crypto wallets.

We have previously discussed the many differences between current, tenured investors vs. the next generation of wealth management clients and the impending necessity to target the next-gen investors as one of the largest generational transfers of wealth takes place in the coming decades.

Gen Z, Millennials More Bullish on Crypto

A survey conducted by Bank of America’s Private Banking division reported that 75% of investors between the ages of 21 and 42 believe the traditional Stocks and Bonds portfolio is not enough to achieve above-average returns.

These young investors believe strongly in alternative investment strategies, which is apparent when seeing that they allocate 3x more of their investment portfolios to alternative strategies vs investors older than this group.

Of the available alternative investments, this group is sure that the largest growth potential is located within the digital asset realm. So, it is not surprising to see that 47% of that demographic have current exposure to cryptocurrency.

The knowledge needed for advisors to navigate the crypto ecosystem cannot just be a topical, slight understanding of the names of coins and their current price.

It will become increasingly imperative for financial professionals to be well-versed in blockchain technology, web3 security practices, and the interpersonal ecosystem that ties the digital asset markets together.

Without a solid foundation on the underlying technologies and the purpose of organizations that clients are investing in, advisors cannot be true fiduciaries in advising on what is best for the client or not.

That would be akin to advising clients on fixed-income investing without understanding the bond market!

Greed, then and now

“Greed, for lack of a better word, is good.” – Gordon Gecko

In a scene in “Wall Street”, Oliver Stone’s movie about the churn-and-burn brokerage houses of the 80s, Gecko speaks to shareholders at a hostile meeting about why the shareholders should vote to accept his proposal. It’s one of the more famous lines from the movie.

Today, 35 years later, the sentiment is every bit as pervasive in the industry.

In the wake of the spectacular FTX collapse, the crypto industry will likely face white-hot scrutiny from lawmakers and other regulators as it tries to steady a ship that lists more and more with each new piece on information.

Only part of the onion has been peeled uncovering stories of shockingly deficient compliance processes, with concern growing that the extent of the fallout has yet to be determined. As each new story drops, so does investor (and more broadly, mainstream) confidence.

The financial services industry is no stranger to crises. The Global Financial Crisis of 2008 that led to the implosion of Lehman Brothers (from outsized risk and a confluence of “unforeseen” events) was rooted in a lack of due diligence and greed, much like the FTX debacle.

Just as the shock of Lehman Brothers began to fade, new staggering cases of fraud emerged. Bernie Madoff and Allen Stanford became the latest set of fraudsters to pilfer the investment industry. Calls for tighter regulation splashed across all forms of media.

“We must do better” was a common refrain as the investment industry reeled from the GFC and Ponzi-schemers, like Madoff and Stanford, and suffered in the court of public opinion. Little did investors and firms have any idea of what was to come.

Leveling the playing field

Suitability. Full disclosure of fees, costs, potential conflicts. These were steps taken by the financial industry to restore investor faith. Without investors handing over billions in assets for firms to manage, the advice industry will shrivel up.

While it seems like a basic, bare minimum type of effort – that is, acting in a client’s best interests – the presence of high profit products is often just too attractive to pass up. No longer willing to sit on the sidelines, investors took things into their own hands.

Demands included greater transparency, immediate access to portfolio data, and perhaps most importantly, a seat at the table for investment decisions. Firms that discarded these investor requests found themselves on the wrong end of a tsunami of ACAT transfers to firms that accepted them.

A more sophisticated investor challenges the advisory community in ways that upend the long-standing advisory business model. To meet investor demands, the wealth management industry has had to evolve. Firms offered more services and products to support both advisors and investors.

For their part, advisors adapted to the new service model. It’s one thing to have to change your business in response to regulation; it’s another entirely to adapt to meet client demands.

As the heavy smoke from the GFC and Madoff-Stanford frauds still hung across wealth management, in January 2009, a new open-source software quietly emerged. Bitcoin was created by pseudonymous developer Satoshi Nakamoto. It would take Bitcoin two years to crack the $1 price level. And another three months to move from $1 to $8.

Sitting behind Bitcoin is blockchain technology that records and validates transactions on a publicly distributed ledger. This airtight transparency facilitated the broadening and widespread interest in Bitcoin and other crypto assets. Bitcoin and other coins (like Litecoin, Ethereum, and others) are seen as offering crypto proponents access to institutional-level services like sending currency across the globe.

Evolution or extinction

With the FTX collapse still smoldering, investor faith in the investment industry is once again at a crossroads. Sure, there is vast institutional exposure to FTX (the top 50 of the millions of creditors hold ~$3b in exposure), but retail exposure is more painful. Savings accounts have been wiped out, likely to never be recouped.

For an industry that continues to struggle with the perception that the “game is rigged”, the FTX debacle is red meat for those calling for regulation of crypto.

Financial advisors hold an interesting position with respect to crypto. On the one hand, the traditional role an advisor plays is counseling clients on financial plans, goals, and objectives, and which investment strategies are most suitable. On the other hand, advisors are trusted confidants, to whom clients will turn to get a clear-headed perspective on new products like crypto.

Educating clients, acting as a behavioral coach to avoid self-inflicted decisions, and in many cases, being a sounding board for life decisions is just as important to clients as the financial components.

It’s with this in mind that advisors like Tyrone Ross, Jr. are reimagining the role of the financial advisor. Tyrone built 401 Financial with the idea that anyone, anywhere should have access to an advisor’s expertise and acumen if they want it. Part of that advice is educating clients about the full range of plans and investment products available to clients, and this includes crypto assets.

Whether a client chooses, or wants, to invest in crypto, they’ll know what they’re getting into and have full disclosure about the unique risks involved.

Two new regulations are coming into shape that will affect advisors and the services they provide. First, the SEC is proposing to tighten restrictions on how RIAs use TAMPS (Third-Party Asset Managers). Second, FINRA is proposing an exam targeting crypto asset communications.

When enough (or maybe better put, the “right”) people get hurt, expect new regulations. And with respect to crypto assets, Tyrone notes that legitimacy doesn’t come with scrutiny and now the entire space is under a microscope. Rules and regulations legitimize and validate, not constrain.

For many advisors, evolving the way they interact with clients is all about survival. For others, it’s a welcome change and part of getting closer to clients. Either way, change is afoot.

It’s especially important for advisors with primarily retiree and pre-retiree clients in attracting the younger generation in the family as they are far more likely to have an eye for crypto, whether they actually invest in it or not. Whether an advisor adapts is up to them.

But when the train leaves the station, either you’re on it or you get left behind.

Enjoy reading this article? Other content you may find interesting:

- Getting paid…in Bitcoin?

- Cryptocurrency and the Rise of Custodied Assets

- The Future is Here: How Thematics is Disrupting Investing

- ETFs and Volatile Markets

- What Investors Should Do as Year-End Approaches

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

To connect about media inquiries or to discuss the article, please email our Head of Marketing, Stephen Sullivan, at steve.sullivan@thinklogicly.com , and our Client Success Associate, Brian Fechter, at: brian.fechter@thinklogicly.com