By: Andrew Unthank

andrew.unthank@thinklogicly.com

“Deflation and secular stagnation are the risk of our time.” – Lawrence Summers

Over the past 12 months, countless headlines bark about inflation and its effect on economies around the world, not just the United States, which has seen inflation rise the most in the last forty years (since the late 1970’s and early 80’s).

According to Google Trends the word ‘inflation’ has been on a consistent uptrend throughout the year. It can be defined as “the rate of increase in prices over a given period of time.” It is a broad measure of overall price increases or the increase in the cost of living in a country.

Since the start of the pandemic, in March of 2020, central banks around the world have increased global money supply to levels never seen before. Balance sheets are loaded with trillions in liabilities, prompting the inflation felt worldwide.

Now that the inflation genie is out of its lamp, getting it back in appears to be a much harder task than initially anticipated. To tame inflation, central banks around the world have embarked on a synchronized tightening cycle that was kicked off by the Federal Reserve in March of 2022.

The Fed has since raised the federal funds rate to 3-3.25% as of the September 2022 meeting. With rates across the world rising rapidly in the last five months, volatility has surged as investors adjust to tighter monetary policy. Fears of inflation and tighter monetary policies have consumed the headlines and the lives of everyday people.

A Canary in the Coal Mine

Deflation is when the general price levels in a country are falling, in contrast to inflation, when prices rise. Deflation can be caused by the following:

- An increase in productivity

- Decrease in overall demand

- Increase in supply (goes hand in hand with demand falling)

- Decrease in the volume of credit in the economy

Deflation compounds and builds up out of sight and usually springs into action when least expected. With central banks aggressively fighting inflation at all costs with their tools of restrictive monetary policy, concern is growing that it may lead to deflation.

An article shared by Seeking Alpha mentioned that due to rapidly rising interest rates, mortgage rates have soared. At the time the article was published (Sept 1st), the 30-year fixed rate mortgages was 5.6%. One year prior, 30-year fixed rate mortgages were at 2.87%. This rapid increase in price has dramatically slowed the pace of new home sales.

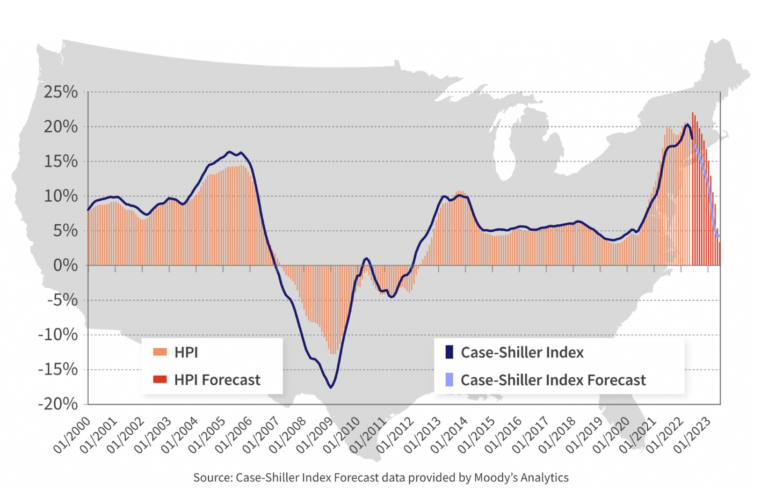

The article continues to cite CoreLogic’s U.S. Home Price Insights August 2022 report, forecasting that, on a year-over-year basis, the housing market would still see appreciation. CoreLogic is a financial services company that provides data analytics and business intelligence information on property and consumer information using proprietary methodologies. With a target of 4.3% by June of 2023, CoreLogic’s estimate tracks with the Case-Shiller Index forecast referenced in the below chart.

Lawrence Fuller writes in the Seeking Alpha article that he doesn’t agree with CoreLogic’s assessment of predicting a return of 4%+. He believes the housing market will experience much less than a 4% growth, with the potential of an outright deflationary decline. He goes on to state that this will have a major impact on the rate of inflation moving forward, as housing costs carry a large weighting in the overall calculation of both the CPI (Consumer Price Index) and personal consumption expenditures price index.

Next Stop: Deflation Destruction

The last time home prices began to decline at a rapid rate was at the beginning of the “Global Financial Crisis” in 2008. Many analysts are calling into question the current forecasts from policy makers. Fuller isn’t the only one who thinks the current path is setting the stage for a major disaster.

Wharton School Professor Jeremy Siegel gave a scathing critique of the Fed and its actions, stating that the Fed Reserve Chairman is getting too much praise. Siegel mentions that the last two years showcase some of the biggest policy mistakes in the 110-year history of the Federal Reserve by keeping the party going when everything was booming. While Professor Siegel doesn’t directly mention deflation, such an outcome on the road toward economic recovery wouldn’t be all that surprising.

The current trajectory will spark a breakdown somewhere in the economy. Both Lawrence Fuller and Professor Siegel believe that inflation has peaked and it has begun to come down across all major market indicators. Housing and commodities prices are coming down and continue to do so.

At What Cost?

With four months left in 2022, many hope the Fed can tame inflation without destroying the economy. The Fed has made it clear that there will be pain involved in getting inflation under control, but the question is: at what cost?

Advisors, regardless of concerns about inflation or deflation, have to answer challenging questions from clients about how best to navigate the current market landscape. Moving closer to year end, asset allocation will take on even greater importance as the markets trust central bankers around the world, led by the Federal Reserve, to guide global economies away from inflation, while also avoiding a deflationary abyss.

Enjoy reading this article? Other content worth your time:

- Getting paid…in Bitcoin?

- The Future of Machine Learning in FinTech

- The Future is Here: How Thematics is Disrupting Investing

- Beach Bum or Desk Jockey

- Harley Davidson, Sustainability, and ESG

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

- The Appeal of Thematic Investing

To connect about media inquiries or to discuss the article, please email Andrew at: andrew.unthank@thinklogicly.com