By: Robert Bisewski

The People’s Republic of China showcased its state capacity in a noteworthy manner by effectively controlling the COVID-19 outbreak, not just once but multiple times, including several serious outbreaks in 2021.

Fast forward to November 2022, ongoing protests by Chinese dissidents were witnessed. These protests, which started as a response to a fire in a crowded Uyghur apartment and later spread to Foxconn workers and eventually the general population, placed a strain on the central authorities’ ability to maintain their COVID-19 protocols.

As a result of the protests and the difficulties in enforcing the protocols, the previous policy was abandoned abruptly. This sudden shift in policy highlights the difficulties that governments may face in maintaining stability and controlling outbreaks during times of social unrest or political turmoil.

From Red Finances to Skyrocketing Stocks

On the surface, the aim of controlling the spread of disease appeared to be the primary concern, but the effort to contain COVID-19 also had significant negative impacts on China’s economy.

Many industries experienced a substantial decrease in demand, leading to financial difficulties and resulting in red finances. The global reliance on these products and the supply chain impacted by this demand reduction contributed to the existing bear market and further worsened the negative economic indicators.

It’s possible that these protests were driven not only by political grievances but also by economic concerns.

The relaxation of COVID-19 restrictions appears to have had a positive impact. Investments in China have seen an increase since November 2022, with a solid bounce-back that has prompted some economists to recommend Chinese investments as a way to make a decent recovery in the near future.

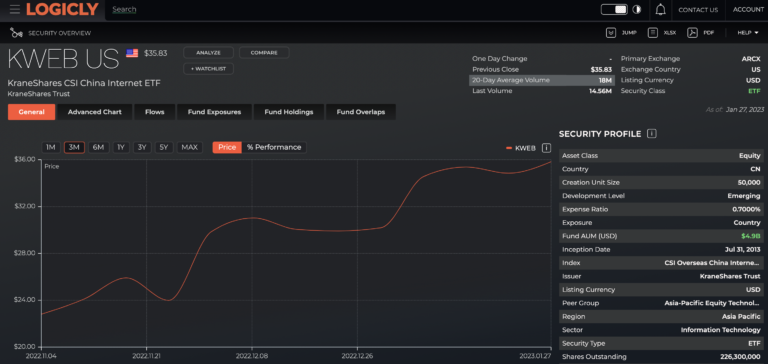

This is highlighted by the performance of KWEB, an internet-based ETF from KraneShares Trust, whose trading price has skyrocketed since the lifting of COVID-19 restrictions. A similar trend can be observed in various Chinese stocks and funds.

Balancing Caution and Opportunity

While some view the easing of restrictions in China as a positive sign for the economy, others are more cautious in their outlook. These experts acknowledge the deep interconnectivity of China with the global economy, which makes it susceptible to the same market forces as the USA and Eurozone. This is especially relevant given the recent surge in ETFs in China.

Goldman Sachs analysts offer a contrasting perspective. They argue that the impact of reduced restrictions on the market is unlikely to completely reverse the 2022 losses. They caution potential investors who may be overly optimistic about investing in Chinese equities and funds, as there may be significant challenges along the way. These experts advise a more measured approach to investment in the Chinese market.

Recently, there has been a shift in monetary policies in China as seen in December. The People’s Bank of China, which was previously hesitant to adjust rates or address financial challenges, has taken surprising actions:

- The interest rate on seven-day reverse repurchase agreements was lowered by 20 basis points to 2.2%

- The central bank had injected 50 billion Yuan into the banking system to improve liquidity

- Offered made available additional medium-term facility loans, as well as reducing the amount of reserve cash that banks must hold, providing an additional 550 billion Yuan of liquidity.

This is admittedly not too large a shift in policy, but it could represent a new trend in how the PBOC reacts to market forces.

Steering Through Uncertainty

As we continue to navigate market uncertainties, it will be an interesting couple of years for investors who are considering adding Chinese investments to their portfolio. The recent lifting of COVID-19 restrictions could lead to a more favorable outlook for growth in 2023, but this will depend on a number of factors, including the stabilization of global markets and improvements in the supply chain.

Investors who are interested in reducing risk and increasing stability in their portfolios may consider investing in sectors that are more resilient to inflation and supply chain issues. Examples of these sectors include utilities, telecommunications, and digital services.

These industries are expected to fare better during this economic uncertainty compared to those that rely on physical products.

Enjoy reading this article? Other content you may find interesting:

- Getting paid…in Bitcoin?

- Cryptocurrency and the Rise of Custodied Assets

- The Future is Here: How Thematics is Disrupting Investing

- ETFs and Volatile Markets

- What Investors Should Do as Year-End Approaches

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

To connect about media inquiries or to discuss the article, please email Robert Bisewski at: robert.bisewski@thinklogicly.com