By: Robert Bisewski and Dounya Hamdan

It’s no secret that financial institutions are mining “Big Data” to gather useful insights about their clients. The process consists of storing consumer data internally in order for it to be re-used by other internal departments. Here are a few key purposes:

- Find new customers

- Enhance customer experience

- Preventing fraud

- Assist in lending decisions

- Better understand the lifestyle of the client

When opening an account, customers typically hand over basic information such as their name, address, and social security number. Financial institutions can learn more about their clients through their transaction histories and the sites they frequent online.

In the past, unfortunately, banks who have ignored the captured data have created a less pleasant experience for their customers. This can also lead to a situation where they’re unable to capitalize on potential opportunities.

With recent developments in technology, shared data can be used to create customized products for their customers while also providing a richer experience for those with more specific expectations.

So, what exactly is open banking and how can it revolutionize the way consumers benefit from their financial data?

Open Banking is Opening Doors

When discussing the concept of open banking, you will find those who are proponents of it and others who are wary of their personal financial information being shared between institutions and third party vendors.

To put it simply, open banking allows the networking of accounts and data across institutions for use by financial agencies, third party service providers and customers.

A third party provider’s API can take advantage of the customers’ financial information by developing software integrations that can aggregate data from a given banking platform to one or more companies.

The introduction of open banking has created competition for big banks by giving smaller banks and tech startups an opportunity to create innovative products and services customizable to the consumer.

For those of us in the Fintech industry, this has created a number of new possibilities, in particular, the following:

- enhanced digital services: account information service provider (AISP) and payment initiation service provider (PISP)

- faster, easier and transparent transactions

- lending risks and credit scores insights

- simple-to-use APIs to access the large internal datasets of financial institutions

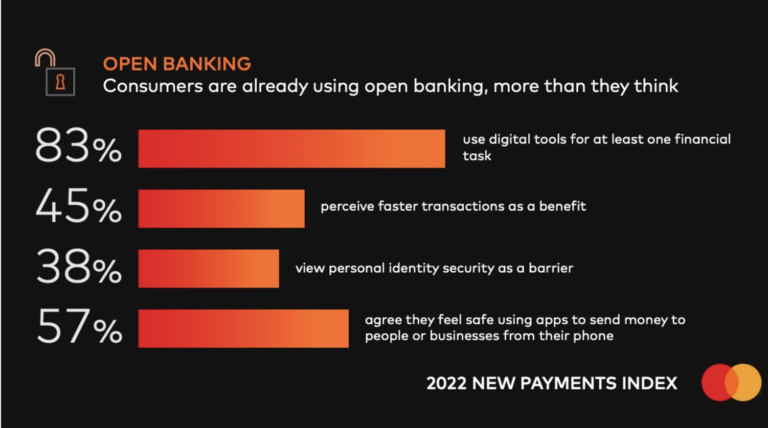

Interestingly enough, consumers may not be fully aware of how open banking impacts their day to day tasks, especially in a society that demands convenience and rapid solutions with a click of a button.

According to Mastercard’s 2022 New Payments Index, only about half of the respondents know about open banking, but about two-thirds are actually using it to pay their bills, do their banking and make ‘buy now, pay later’ payments.

World Wide Web of Convenience

Many consumers hold the belief that large financial institutions have chosen to operate with their own financial interests in mind rather than the interests of their customers.

Open banking has placed consumers in the driver’s seat of their own personal information while giving Fintech the data it needs to simplify the banking ecosystem.

It has redefined the way customers interact and build relationships with the financial industry, including financial products and services. From smartphones to online banking and shopping, consumers have relied upon a lifestyle that revolves around mobile ease and convenience.

With this understanding, fintech companies have created apps that improve the overall user experience when it comes to saving, lending and investing. For example, an open banking API can easily help identify a new savings account that would provide a higher return by simply looking at a consumer’s transaction data.

This innovation extends to finding credit cards with lower interest rates to calculating future mortgage payments for consumers who are in the market to buy a new home. Currently, there are apps that can aggregate all of your banking accounts into one dashboard, providing you with a better understanding of your overall financial health.

The future of open banking and fintech is making way for increased financial literacy and financial inclusion. They are providing consumers with a range of digital financial tools and more access to small loans and credit for those who may have a higher chance of being rejected by big banks.

Ranking the Future of Open Banking

Globally, the open banking phenomena continues to grow and current trends suggest that by 2026 the revenue of small-medium businesses is predicted to rise to 43 billion dollars.

A number of European institutions have jumped onboard with this concept, and at this time, the United Kingdom is the country with the most open banking fintech startups, with roughly 300 distinct firms that operate in the field.

In the future, this will continue to evolve, so expect new innovations to arise from open banking sooner rather than later.

Enjoy reading this article? Other content you may find interesting:

- Getting paid…in Bitcoin?

- Cryptocurrency and the Rise of Custodied Assets

- The Future is Here: How Thematics is Disrupting Investing

- ETFs and Volatile Markets

- What Investors Should Do as Year-End Approaches

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

To connect about media inquiries or to discuss the article, please email Robert Bisewski at: robert.bisewski@thinklogicly.com , and Dounya Hamdan at: dounya.hamdan@thinklogicly.com